Stocks slumped yesterday. Crude slipped below $40, losing more than 4% on the day. Gold futures dropped a whopping $25.

Are markets on the brink once again?

Rich Dad thinks so.

Robert Kiyosaki of “Rich Dad, Poor Dad” fame says total collapse is upon us. He predicted as much in his book “Rich Dad’s Prophecy” way back in 2002.

“Fourteen years ago, the author of a series of popular personal-finance books predicted that 2016 would bring about the worst market crash in history, damaging the financial dreams of millions of baby boomers just as they started to depend on that money to fund retirement,” MarketWatch reports. “Kiyosaki is convinced: The pullback he predicted is happening.”

And as Kiyosaki told MarketWatch, we’re right on schedule.

I’m not sure about Rich Dad’s definition of a meltdown-in-action. The S&P 500’s barely in the red for the year. Sorry but that just doesn’t cut it for me. But I don’t make prophecies 14 years in advance. Maybe Rich Dad would have earned more clout if he had mentioned the housing bust and financial crisis back in 2002…

To be honest, I’m not the least bit surprised the Rich Dad meltdown prediction is gaining traction right now. It’s almost laughable how quickly sentiment has swung bearish after one crappy day.

How should we treat yesterday’s market action? You’ll see in a second…

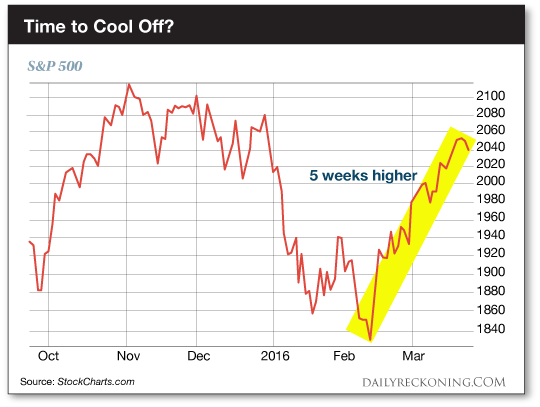

A little perspective is necessary. The S&P 500 just posted five straight weeks of gains. And it did it after the worst start to the year ever for the index. So a little red on the screen shouldn’t be unexpected.

Despite what the past five weeks might have suggested, this is not a favorable market environment. Stocks remain under pressure. And it’s obvious investors are rudderless right now.

That’s how we ended up with the most boring trading week of 2016. Low volume. And barely any movement from the major averages. All the investing class can do is drift along with the tide.

So instead of making wild predictions, let’s go with what we know…

While a majority of stocks have enjoyed short-term bounces since mid-February, most stocks remain below their respective 200-day moving averages. So we’re forced to deal with a choppy market since most stocks aren’t locked in long-term uptrends.

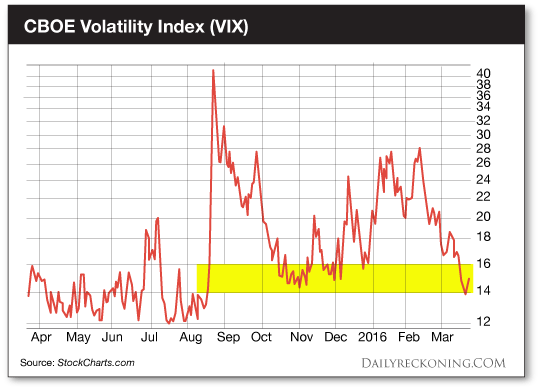

And what about volatility? Are we due for another spike?

Maybe…

The CBOE Volatility Index (VIX) steadily churned higher to start the year as the market floundered. But volatility was smacked down last month as stocks bottomed out and started climbing. Now the VIX has dropped below 15 to 2016 lows—an area that has triggered some volatility spikes ever since the market started behaving badly last year.

Of course, none of this means we’re guaranteed to see another swoon like we saw to start the year. But if this rally is indeed losing significant steam, it’s time to take some money off the table.

Leave a Reply