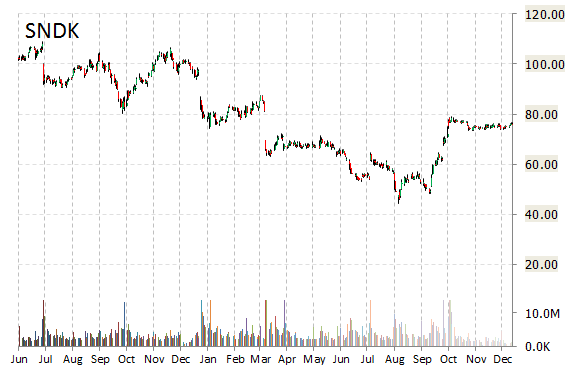

Analysts at Needham are out with a report this morning upgrading shares of SanDisk Corp. (SNDK) with a ‘Buy’ from ‘Hold’ rating. The firm set price price target for the company at $78.

SNDK was up $3.49 at $70.74 in midday trade, moving within a 52-week range of $44.28 to $87.43. The name, valued at $14.20 billion, opened at $68.28.

On valuation measures, SanDisk Corp. shares are currently priced at 34.19x this year’s forecasted earnings. Ticker has a t-12 price/sales ratio of 2.43. EPS for the same period registers at $2.07.

As for passive income investors, the firm pays stockholders $1.20 per share annually in dividends, yielding 1.87%.

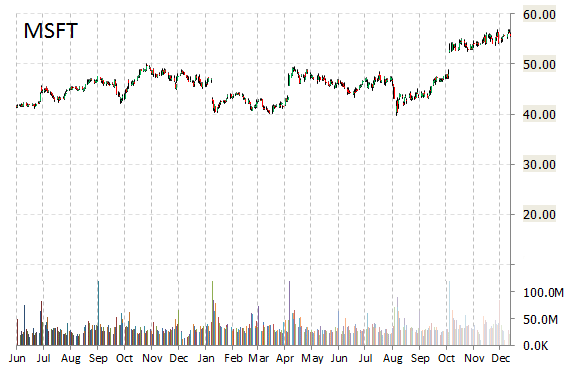

Microsoft Corporation (MSFT) was reiterated a ‘Buy’ by UBS analysts on Friday. The broker also raised its price target on the stock to $60 from $58. Microsoft was also raised to $55 from $50 at Wunderlich following earnings. The firm believes the software giant’s mobile/cloud strategy world makes sense.

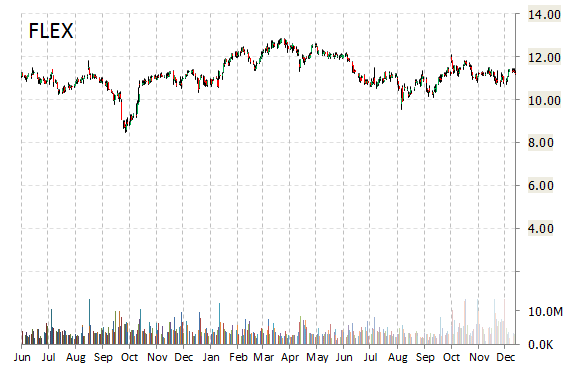

Flextronics International Ltd. (FLEX) was raised to ‘Buy’ from ‘Hold’ and it was given a $13 price target at Stifel on Friday.

FLEX is up $0.93 at $10.46 on heavy volume. Midway through trading Friday, 7.17 million shares of Flextronics International Ltd. have exchanged hands as compared to its average daily volume of 6.85 million shares. The stock has ranged in a price between $10.15-$10.88 after having opened the day at $10.88.

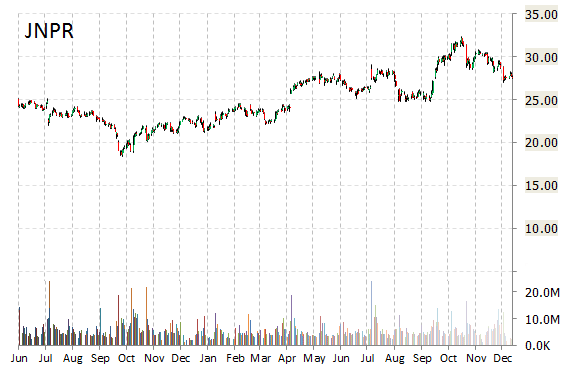

Juniper Networks, Inc. (JNPR) was upgraded to ‘Outperform’ from ‘Market Perform’ by Bernstein analysts on Friday.

JNPR is currently printing a higher than average trading volume with the issue trading 8.33 million shares, compared to the average volume of 6.64 million. The stock began trading this morning at $22.95 to currently trade 4.10% higher from the prior days close of $22.46. On an intraday basis it has gotten as low as $22.80 and as high as $23.57.

JNPR shares have declined 18.95% in the last 4 weeks and declined 28.55% in the past three months. Over the past 5 trading sessions the stock has lost 12.40%. The $9.03 billion Sunnyvale, California-based company has a median Wall Street price target of $30.00 with a high target of $41.00.

Juniper Networks is up 0.65% year-over-year, compared with a 5.09% loss in the S&P 500.

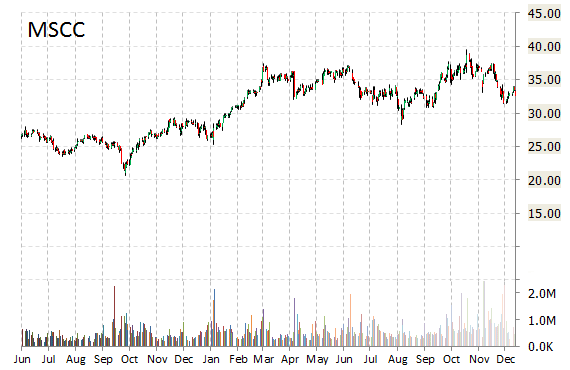

Microsemi Corporation (MSCC) had its rating hiked to ‘Outperform’ from ‘Market Perform’ by Wells Fargo (WFC) today.

MSCC recently gained $1.67 to $32.08. The stock is up 7.95% year-over-year and has lost roughly 6.69% year-to-date. In the past 52 weeks, shares of Aliso Viejo, California-based company have traded between a low of $27.44 and a high of $39.56.

Microsemi Corp. closed Thursday at $30.41. The name has a total market cap of $3.57 billion.

Leave a Reply