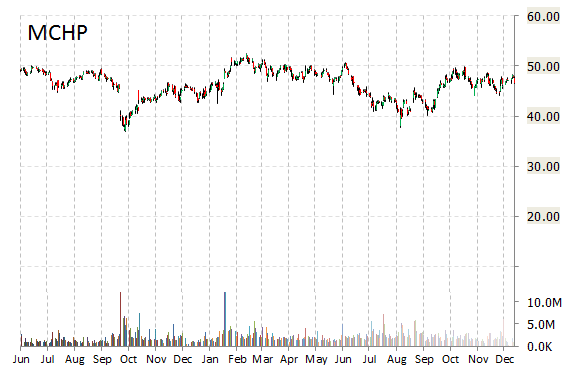

Analysts at Morgan Stanley (MS) are out with a report this morning upgrading shares of Microchip Technology Inc. (MCHP) with an ‘Overweight’ from ‘Equal-Weight’ rating.

Microchip Technology Inc. shares are currently priced at 23.83x this year’s forecasted earnings, compared to the industry’s 8.77x earnings multiple. Ticker has a forward P/E of 14.04 and a t-12 price-to-sales ratio of 3.83. EPS for the same period is $1.73.

In the past 52 weeks, shares of Chandler, Arizona-based company have traded between a low of $37.77 and a high of $52.44 and are now at $41.21.

Shares are down 6.06% year-over-year.

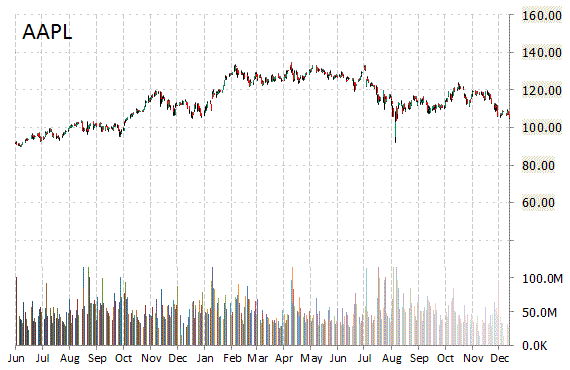

Apple Inc. (AAPL) – In a research note published on Tuesday, Goldman Sachs (GS) analyst Simona Jankowski tells clients that a miss in iPhone sales may already be priced in. The analyst reiterated Goldman’s AAPL “Conviction Buy List” rating and price target of $155.

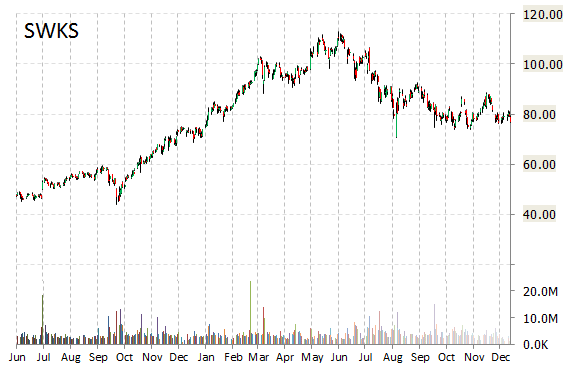

Skyworks Solutions Inc. (SWKS) was raised to ‘Buy’ from ‘Hold’ and it was given a $73 price target at Needham on Tuesday.

SWKS is up $0.40 at $61.07 on normal volume. Midway through trading Tuesday, 2.53 million shares of Skyworks Solutions have exchanged hands as compared to its average daily volume of 4.08 million shares. The stock has ranged in a price between $60.91 to $63.34 after having opened the day at $61.07.

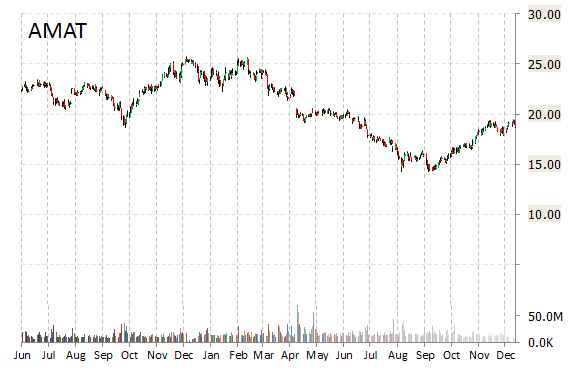

Applied Materials, Inc. (AMAT) was upgraded to ‘Buy’ from ‘Outperform’ by Credit Agricole analysts on Tuesday.

The stock began trading this morning at $16.54 to currently trade 2.86% higher from the prior days close of $16.08. On an intraday basis it has gotten as low as $16.36 and as high as $16.76.

On valuation measures, Applied Materials Inc. shares are priced at 14.77x this year’s forecasted earnings, compared to the industry’s 13.40x earnings multiple. The company’s current year and next year EPS growth estimates stand at 1.70% and 26.40%, compared to the industry growth rates of 10.70% and 19.30%, respectively. AMAT has a t-12 price-to-sales ratio of 1.91. EPS for the same period registers at $1.12.

AMAT shares have declined 12.89% in the last 4 weeks while advancing 2.87% in the past three months. Over the past 5 trading sessions the stock has lost 4.23%. The Santa Clara, Calif.-based company, currently valued at $19.01 billion, has a median Street price target of $21.75 with a high target of $30.00.

Applied Materials Inc. is down 29.64% year-over-year, compared with a 7.03% loss in the S&P 500.

Leave a Reply