Time Warner Inc. (TWX) is marginally higher to $69.80 in pre-market trading today. Shares of the media and entertainment company have been gaining this month on continued speculation that billionaire activist investor Carl Icahn is building an equity stake in the New York-based firm. Mr. Icahn however, denied reports Monday evening that suggested he was buying shares of Time Warner. He told CNBC: “I don’t own one share of Time Warner and it annoys me that certain speculators use my name to make profits at the expense of other shareholders“.

In February 2006, Icahn took a stake in TWX and urged the company to split up, insisting the move would unlock $40 billion of extra value for shareholders. While the veteran investor later abandoned his efforts to break-up the media giant after his plans failed to move many other investors, he did reach a settlement that included a $20 billion share buyback and cost-cutting measures.

On valuation-measures, shares of Time Warner Inc. have a trailing-12 and forward P/E of 15.84 and 13.23, respectively. P/E to growth ratio is 0.97, while t-12 profit margin is 12.93%. EPS registers at 4.39. The company has a market cap of $55.65B and a median Wall Street price target of $83.00 with a high target of $105.00.

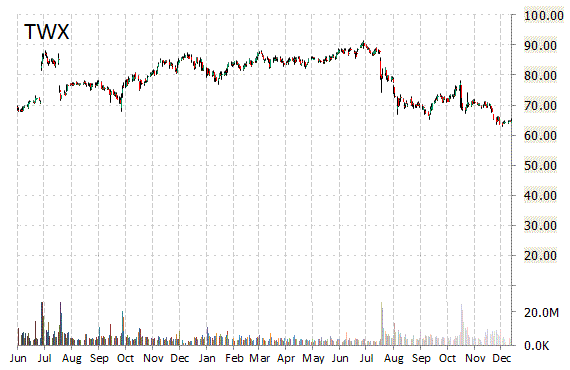

On trading-measure, TWX has a beta of 1.36 and a short float of 2.05%. In the past 52 weeks, shares have traded between a low of $62.94 and a high of $91.34 with its 50-day MA and 200-day MA located at $67.29 and $74.25 levels, respectively.

TWX currently prints a one year loss of about 16% and a year-to-date return of around 8%.

Leave a Reply