Netflix, Inc. (NFLX) was reiterated a ‘Buy’ by Pivotal Research Group analysts on Friday. The broker also cut its price target on the stock to $165 from $175.

On valuation measures, Netflix Inc. stock it’s trading at a forward P/E multiple of 431.79x, and at a multiple of 298.72x this year’s estimated earnings. The t-12-month revenue at Netflix is $6.44 billion. NFLX ‘s ROE for the same period is 8.37%.

Shares of the $48.00 billion market cap company are up 145.09% year-over-year.

Netflix Inc., currently with a median Wall Street price target of $125 and a high target of $175, dropped $2.24 to $112.38 in recent trading.

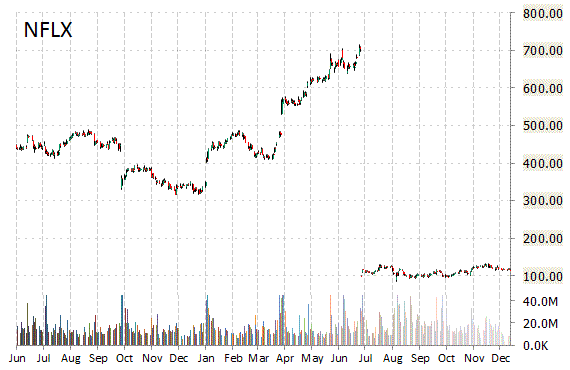

The chart below shows where the equity has traded over the past 52-weeks.

Apple Inc. (AAPL) was reiterated as ‘Buy’ with a $146 from $160 price target on Friday by Canaccord Genuity. The firm anticipates softer first half/FY2016 iPhone and overall smartphone sales.

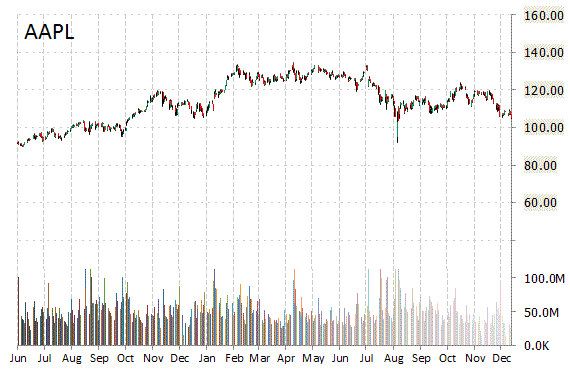

Shares have traded today between $96.79 and $99.11 with the price of the stock fluctuating between $92.00 to $134.54 over the last 52 weeks.

Apple Inc. shares are currently changing hands at 10.61x this year’s forecasted earnings, compared to the industry’s 8.37x earnings multiple. Ticker has a t-12 price/sales ratio of 2.30. EPS for the same period registers at $9.22.

Shares of AAPL have gained $1.38 to $97.83 in mid-day trading on Friday, giving it a market cap of roughly $545.21 billion. The stock traded as high as $134.54 in April 28, 2015.

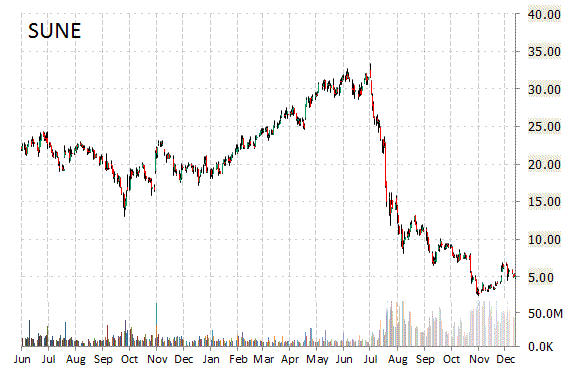

SunEdison, Inc. (SUNE) rating of ‘Outperform’ was reiterated today at Oppenheimer with a price target decrease of $7.50 from $18 (versus a $3.34 previous close). Firm believes the name will remain volatile in the near term as company tries to close the Vivint Solar (VSLR) deal unveiled July 20, 2015.

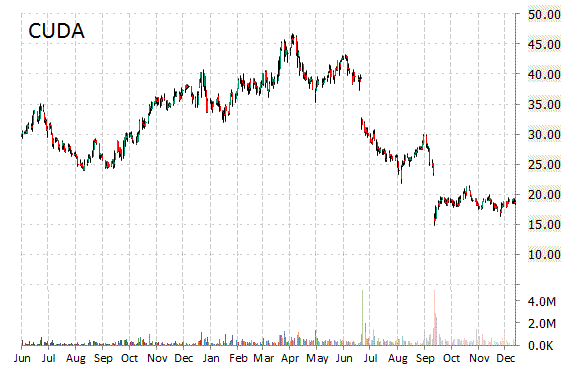

Barracuda Networks, Inc. (CUDA) had its rating lowered from ‘Overweight’ to ‘Equal-Weight’ by analysts at Morgan Stanley (MS) on Friday.

Currently there are 12 analysts that rate CUDA a ‘Buy’, no analysts rate it a ‘Sell’, and 3 rate it a ‘Hold’.

CUDA was down $5.61 at $10.82 in midday trade, moving within a 52-week range of $10.52 to $46.78. The name, valued at $577.54 million, opened at $11.13.

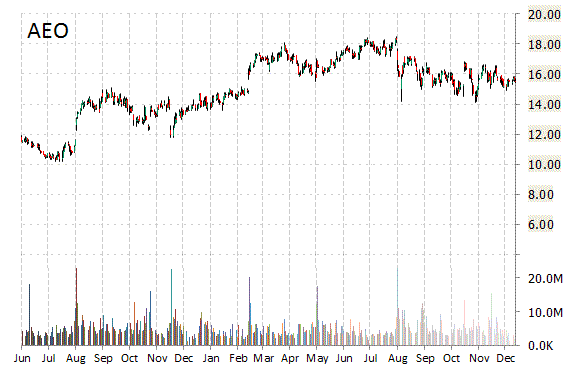

Mizuho reiterated its ‘Neutral’ rating and decreased its 12-month base case estimate on American Eagle Outfitters, Inc. (AEO) by 2 points to $16 a share. Ticker is down $2.53 to $13.35 in midday trading.

Leave a Reply