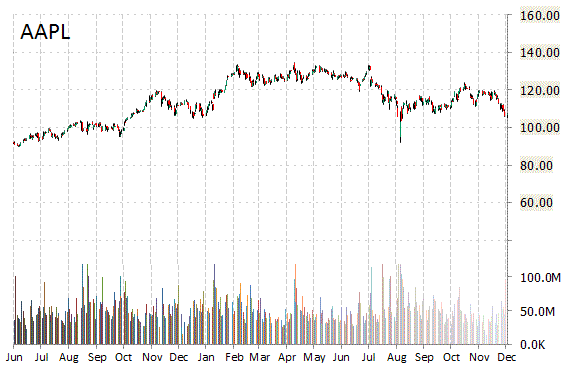

Apple Inc. (AAPL) was reiterated a ‘Buy’ by Stifel analysts on Wednesday. The broker however, cut its price target on the stock to $140 from $150 noting that while it is positive on Cupertino’s competitive positioning to harvest company’s installed base expansion, there has clearly been a deceleration occurring over the past 8 weeks.

On valuation measures, Apple Inc. stock it’s trading at a forward P/E multiple of 10.11x, and at a multiple of 11.74x this year’s estimated earnings. The t-12-month revenue at Apple is $233.72 billion. AAPL’s ROE for the same period is 46.25%.

Shares of the $603.53 billion market cap company are down 3.44% year-over-year and 1.20% year-to-date.

AAPL rose $1.02 to $108.26 in recent trading.

The chart below shows where the equity has traded over the past 52-weeks.

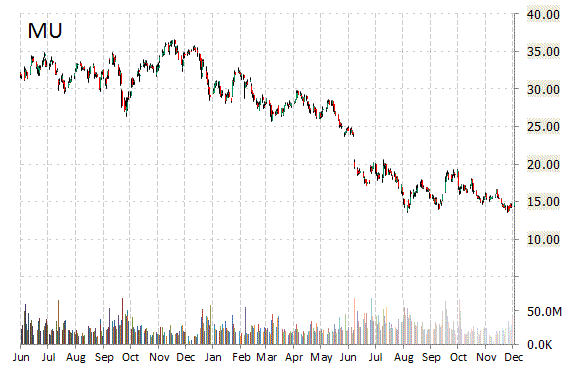

Micron Technology, Inc. (MU) was downgraded from ‘Strong Buy’ to ‘Outperform’ at Raymond James.

Shares have traded today between $13.55 and $14.25 with the price of the stock fluctuating between $13.50 to $35.74 over the last 52 weeks.

Micron Technology Inc. shares are currently changing hands at 5.67x this year’s forecasted earnings, compared to the industry’s 10.18x earnings multiple. Ticker has a t-12 price/sales ratio of 0.94. EPS for the same period registers at $2.48.

Shares of Micron have lost $0.59 to $14.02 in midday trading on Wednesday, giving it a market cap of roughly $14.52 billion. The stock traded as high as $35.74 in December 30, 2014.

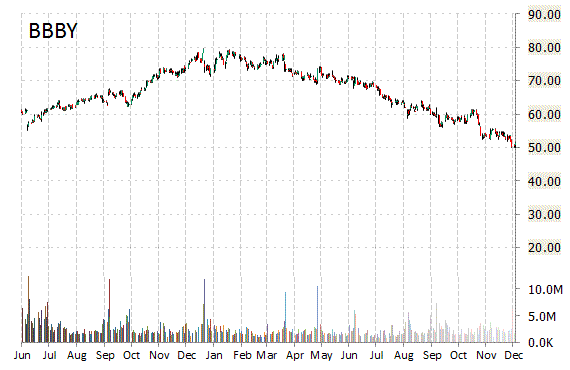

Sun Trust Rbsn Humphrey reported on Wednesday that they have lowered their rating for Bed Bath & Beyond Inc. (BBBY). The firm has downgraded BBBY from ‘Buy’ to ‘Neutral’.

Bed Bath & Beyond Inc. recently traded at $48.97, a loss of $2.35 over Tuesday’s closing price. The name has a current market capitalization of $8.17 billion.

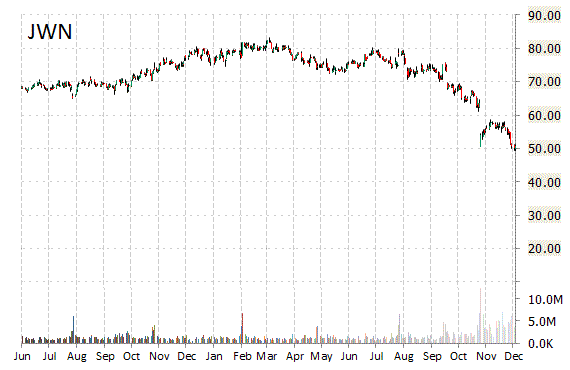

Nordstrom Inc. (JWN) was reiterated as ‘Buy’ with a $60 from $70 price target on Wednesday by Stifel.

JWN was up $0.84 at $51.65 in midday trade, moving within a 52-week range of $49.34 to $83.16. The name, valued at $9.49 billion, opened at $51.27.

As for passive income investors, the co. pays stockholders $1.48 per share annually in dividends, yielding 2.93%.

Leave a Reply