Bank of America (BAC) is set to report its fiscal third-quarter earnings Wednesday before the markets open. Wall Street analysts are on average expecting the banking giant to post $20.77 billion in sales during the quarter. This would show a 6.86% decrease from the Q215 revenue of $22.3 billion, and a decrease of 2.94% from the same period in Q314. EPS in Q315 are expected to come in at $0.33 compared to ($0.01) per share a year earlier. Meanwhile, EarningsWhisper.com reports a whisper number of $0.37 per share.

As a quick reminder, BofA reported Q215 EPS of $0.45, $0.09 better than the Street’s consensus estimate. Revs increased 1.55% yoy to $22.3 billion versus the $21.32 billion consensus.

On valuation measures, Bank of America Corp. shares are currently priced at 16.22x this year’s forecasted earnings, compared to the industry’s 20.23x earnings multiple. Ticker has a PEG and forward P/E ratio of 1.30 and 9.82, respectively. Price/Sales for the same period is 2.02 while EPS is $0.96.

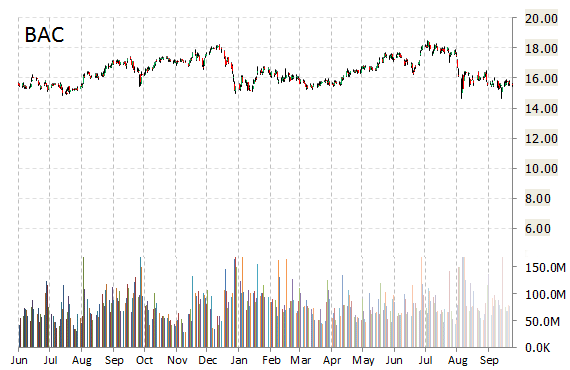

Currently there are 20 analysts that rate BAC a ‘Buy’, 6 rate it a ‘Hold’. 1 analyst rates it a ‘Sell’. BAC has a median Wall Street price target of $19.00 with a high target of $21.00.

Leave a Reply