In a post in August 2014, I examined the importance of narratives in valuation and how shifts or changes in those narratives can affect value, using Apple, Twitter and Facebook to illustrate my point. Since all of these companies have reported earnings in the last few weeks, I revisited my valuations of these companies, with the specific intent of seeing whether there is a need to update the narratives (and values) for these companies and whether, as an investor, I need to act.

Apple Inc. (AAPL)

I have been valuing Apple every quarter on my blog for the last four years. While I admitted in my very first posted valuation of the company that I liked the company and its products too much to ever be unbiased in my valuations, I did reluctantly sell my Apple shares when they hit $600 in early April 2012, arguing that the traders were driving the stock in ways that I could not comprehend. That turned out to be a lucky break, because the momentum shifted (as it does in pricing games), causing the stock to go into a tailspin. In January 2013, I reentered the Apple investor sweepstakes, when the stock hit $440, using this post to explain my rationale and in April 2014, I looked at the sometimes divergent paths taken by price and value at the company.

My August 2014 narrative

My last blog post valuation of Apple was in August 2014, after the stock had a 7 for 1 stock split, and the value per share that I obtained was $96. Starting in 2011, my narrative for Apple has been that it is a mature company, with limited growth potential (revenue growth rates< 5%) and sustained profitability, albeit with downward pressure on margins, as its core businesses becomes more competitive, and only a small probability that the company would introduce another disruptive product to follow up its trifecta from the prior decade (the iPod, the iPhone and the iPad). I saw no reason to change this narrative significantly, and as the stock was hovering around $100 at the time of the analysis, I considered it fully priced.

What’s happened since

The biggest news announcements from Apple came in September 2014, where they announced two new products, the Apple iWatch and Apple Pay. While I don’t see much in Apple iWatch to change my narrative in significant ways, Apple Pay offers the potential to provide a breakthrough, because the financial services business is a huge one and ripe for disruption. It is that shift that led me to hold Apple through the rest of 2014 and into 2015. In addition, Apple’s introduction of the iPhone 6 has allowed it to protect its margins much better than I had anticipated that they would. In a valuation that I did as part of my valuation class in March 2015, I revalued Apple at close to $118/share, about 10% below the stock price of $128 at that point in time, leading to a decision to sell the stock and count my blessings.

The August 2015 narrative

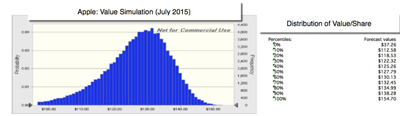

The last earnings report from Apple, which came out in late July, contains few surprises or twists, with perhaps the only surprising feature being the unexpectedly large jump in the cash balance to over $200 billion. That fact, while Apple continues to buy back billions in stock and pay large dividends, is a testimonial to the cash machine that Apple has created with its iPhones and iPads. In fact, just incorporating the higher cash balance and the lower share count into the valuation yields a value per share of close to $130. While you can download the valuation by clicking here, I also ran a simulation, where I allowed my assumptions on revenue growth, margins and cost of capital to vary to generate these numbers:

(click to enlarge)

At the time of this post, the mood around Apple has darkened and the stock has dropped to less than $110. The purported reason for the stock price drop is the slow down in Apple sales in China, but that sounds to me like an attempt to fit a “good” reason to an old-fashioned sell off. Even allowing for a Chinese economic slowdown, Apple is starting to look like a bargain to me again but given the ebbs and flows in momentum in this stock, I would not be surprised if this round of selling leads the stock even lower, before good sense prevails. I think I will wait a few weeks before putting my buy order in but it looks like I will once more be an Apple stockholder.

Facebook Inc. (FB)

When Facebook filed for its initial public offering in February 2012, I described it as the most pre-priced IPO in history, as it had been actively traded in private markets before that offering. In my initial narrative for Facebook, I foresaw a company that would tread in Google’s path in terms of generating advertising revenues, while posting substantial profit margins. That “Google wannabe” narrative yielded a value of $71 billion for the company and a value per share of $28. Needless to say, I was not tempted to buy the stock at the offering price of $38 per share, but a few months later, I was extraordinarily lucky to get the stock at $18, as investors dumped the stock after its first earnings report. Since my narrative changed relatively little in the year following, my value changed little, but the stock price recovered to $45, leading to a decision on my part to sell.. The subsequent rise of the stock to $95/share meant that I left significant profits on the table by selling too early, but better than bailing on an investment philosophy that has worked for me.

My August 2014 narrative

In my August 2014 post on Facebook, following another blockbuster earnings report, where they reported more success in their mobile advertising efforts, I admitted that my original narrative was too cramped and that Facebook was perhaps on its way to outstripping Google not only in advertising but also in generating other ways of making money of its monstrously large (and involved) user base. The expanded narrative yielded a value per share of close to $63, still lower than the price at the time ($72) and I concluded that much as I liked the company, it looked over priced to me.

What’s happened since

In its earnings reports in October 2014, January 2015 and April 2015 in Facebook continued to impress markets with its capacity to scale up revenues, while maintaining huge operating margins. In addition, other evidence accumulated that Facebook was moving forward briskly in its business model. In May 2015, Buzzfeed and the New York Times announced that they would be posting articles directly on Facebook, cementing its status as a news source. Facebook has also turned Instagram into a powerful tool for mobile advertising, with revenues of $600 million in 2015 and expected to rise to almost $3 billion in the next few years.

The August 2015 narrative

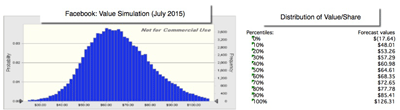

The last earnings report on July 29, 2015, continued this trend but it also included a note of caution from Mark Zuckerberg that investors should take to heart. He was explicit in his view, just as he was in the quarters before, that growth was getting more expensive and that investors should expect larger capital investments (and acquisitions) in the future. Looking at my August 2014 narrative, I see little need to make major changes to it, since I am already building in large reinvestment needs in the future. My updated valuation yields a value of $69/share and at its current price of $95, it is still too richly priced for my taste. Again, you can download the valuation by clicking here, but the simulation yields the following results:

(click to enlarge)

At its current stock price of $94, I am not tempted yet, but I am all aware that this may be more a reflection of my narrative failure than a market mistake. In my August 2014 post, I described Facebook as a company where my valuations may chase the price for a long time and that is certainly turning out to be true.

Twitter Inc. (TWTR)

I valued Twitter for the first time in early October 2013, when the company filed its prospectus as a precursor to its initial public offering. My initial valuation of $18/share of the company is contained in this post from late October was based on the promise of advertising revenues that its large user base provided. While the initial offer price for the stock was set at $22, it was moved up to $26 and the stock itself opened for trading at $46 on the offering date. In the months after, the stock moved above $70 per share, before investors started noticing its flaws.

My August 2014 narrative

In my post on Twitter in August 2014, I stuck with my narrative of it becoming a successful but not-dominant online advertising companies, capable of commanding healthy margins, but added the concern that its management did not seem to have any control of this narrative or act in a way to make it happen. I contrasted how Twitter’s business model was a static one, relative to Facebook’s, and my estimate of value was $22.53, higher than the IPO number, but not by much.

What’s happened since

It has been a tumultuous year at Twitter. In the aftermath of their stock price drop last year, they held an analyst meet in San Francisco in December 2014, where the CFO, Anthony Noto, tried to lay out the vision that the company had for its future. I must admit that I was underwhelmed by both how cramped that vision was and how little thought had been given to making it happen, and I posted my reaction in this post, where I likened it a bar mitzvah moment. If what has happened at the company in the months since are any indication, it looks like Twitter has a lot of growing up to do. After another bad earnings report, Twitter’s CEO, Dick Costolo, lost his job. That might have qualified as good news, but he was replaced by Jack Dorsey, who heads another company (Square). Twitter needs more than a part-time CEO and one who will represent a clean break from the status quo.

The August 2015 narrative

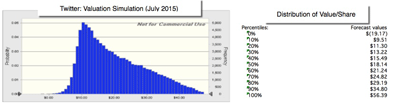

The last earnings report confirmed the chaos at Twitter. While the news in the report was not bad, investors latched on to the slowing growth in users as an excuse for selling off the stock. While I was disappointed in Twitter’s inability to extend its user presence especially overseas, Twitter’s bigger problem is not being able to convert its existing user base into revenues. There must be a way to monetize a social media presence that causes governments to quake, politicians to fall and breaks news ahead of established news services. My narrative for Twitter therefore is very similar to what it was in 2014. I believe that it will eventually get a management team that finds a way to convert potential to profits, stops catering to equity research analysts and expands its international presence. My valuation reflects this narrative and yields a value per share close to $26/share, and you can download it by clicking here. The simulation delivers the following numbers:

(click to enlarge)

Note that the distribution of values for Twitter is much less symmetric that the distributions for Facebook and Apple, and is skewed towards larger values. IThis is not uncommon for small, high growth companies and is part of the “option” story, where you buy these companies to take advantage of the potential for breakout values. While the stock is, at best, fairly valued (at least based on my value), the optionality tilts the scale for me, and my (limit) buy orders were executed on Friday at $27/share. I am now a Twitter shareholder, and needless to say, I will keep you posted on how this investment evolves.

The End Game

Apple, Facebook and Twitter are three companies that I will continue to value at regular intervals and I will use them to remind myself of three fundamental propositions about value-based investing.

- Never say never: I do not want to tar all value investing with the same brush, but a substantial proportion of “value” investors draw lines in the sand. You should never invest in stocks that operate in technology businesses, they tell you, and definitely not in social media companies. Not only do these rules make no sense, but they take larger and larger proportions of companies out of your investing universe. Much as I have taken issue with Twitter’s management in the past, at its current price, it looks like a good value to me. Put more generally, at the right price, I would buy almost any company, even a risky one with bad corporate governance, and at the wrong price, I would not buy even the very best company.

- Don’t just buy and hold: The other piece of advice you get from value investors is buy great companies and hold them forever. This advice does not hold up either, since the essence of investing for value is that you buy an asset for a price that is less than its value. A consistent version of value investing would push for you to buy a a stock when the price is below value (with perhaps a margin of safety built in) but you should sell the stock when the price exceeds value (perhaps, using the same margin of safety in the other direction), even if you have held it for only a short period. If Apple continues its drop below $100, I will be buying Apple for the third time in four years and if Facebook sees a dramatic drop off in price to $60 per share or lower, I will buy it for the second time.

- PE Ratios are blunt instruments: Generations of investors have been brought up on the notion that you should screen stocks, using multiples of earnings (PE or EV/EBITDA) or book (price to book), and pick companies that trade at low multiples. Even if Twitter dropped to $20/share, it will not trade at a low PE, even if with forward earnings, but I think it will be a good value.

Leave a Reply