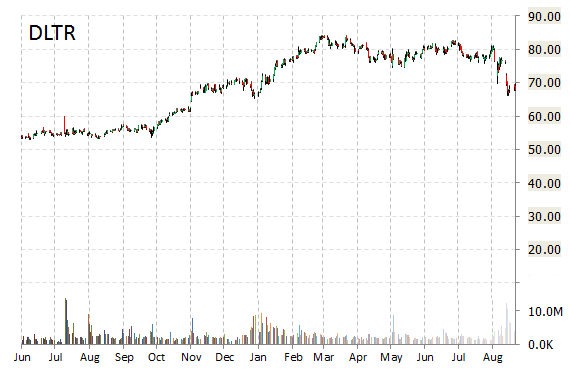

Analysts at Credit Suisse (CS) downgraded Dollar Tree, Inc. (DLTR) from ‘Neutral’ to ‘Underperform’ in a research report issued to clients on Thursday. The firm attributes the downgrade to execution risk related to the company’s recent acquisition of rival Family Dollar Stores Inc. (FDO).

On valuation measures, Dollar Tree Inc. stock it’s trading at a forward P/E multiple of 16.75x, and at a multiple of 44.02x this year’s estimated earnings. The t-12-month revenue at Dollar Tree is $9.76 billion. DLTR ‘s ROE for the same period is 11.32%.

Shares of the $15.45 billion market cap company are up 21.52% year-over-year ; down 3.47% year-to-date.

Dollar Tree Inc., currently with a median Wall Street price target of $85.50 and a high target of $98.00, dropped $2.15 to $65.81 in recent trading.

The chart below shows where the equity has traded over the past 52-weeks.

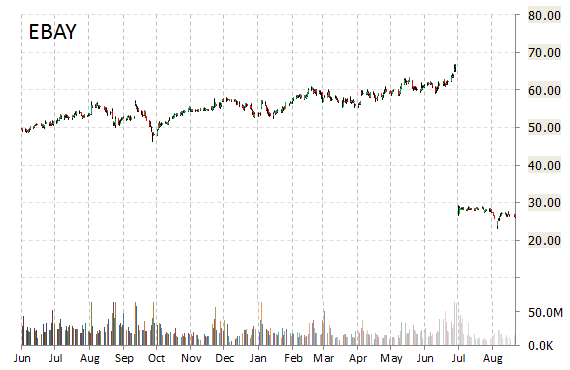

eBay Inc. (EBAY) was downgraded from ‘Buy’ to ‘Hold’ at Cantor Fitzgerald following the completion of its PayPal (PYPL) spinoff, in what the firm calls a reflection of the slower growth rate of what remains. Cantor also slashed it price target on the name by 62.50% to $27 from $72.

Shares have traded today between $25.77 and $26.23 with the price of the stock fluctuating between $19.50 to $29.35 over the last 52 weeks.

eBay Inc. shares are currently changing hands at 13.54x this year’s forecasted earnings, compared to the industry’s 2.01x earnings multiple. Ticker has a t-12 price/sales ratio of 1.74. EPS for the same period registers at $1.93.

Shares of EBAY have lost $0.02 to $26.18 in midday trading on Thursday, giving it a market cap of roughly $32 billion.

The stock traded as high as $29.35 in July 20, 2015.

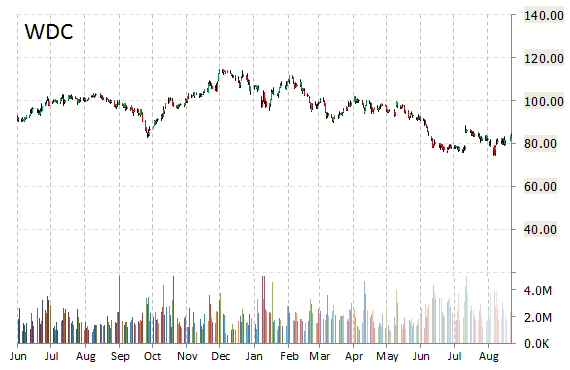

In a report published Thursday, UBS analysts initiated coverage on Western Digital Corporation (WDC) with a ‘Sell’ rating and $71 price target.

On valuation measures, Western Digital Corp. shares currently have a PEG and forward P/E ratio of 1.59 and 10.62, respectively. Price/sales for the same period is 1.30 while EPS is $6.18. Currently there are 16 analysts that rate WDC a ‘Buy’, 7 rate it a ‘Hold’. No analyst rates it a ‘Sell’. WDC has a median Wall Street price target of $100.00 with a high target of $150.00.

Over the past year, shares of Irvine, California-based company have traded between a low of $74.44 and a high of $114.69 and are now at $81.82.

Shares are down 24.71% since the beginning of the year.

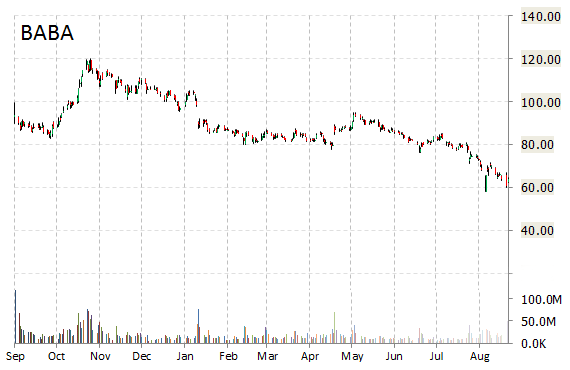

Alibaba Group Holding Limited (BABA) was reiterated a ‘Buy’ by Stifel analysts on Thursday. The broker however, cut its price target on the stock to $88 from $97 based on moderate estimate revisions.

BABA was down $0.06 at $63.98 in mid-day trade, moving within a 52-week range of $58.00 to $120.00. The name, valued at $158.48 billion, opened at $63.52.

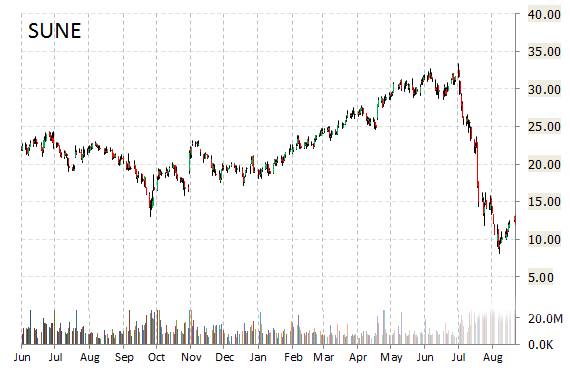

SunEdison, Inc. (SUNE) was reiterated as ‘Buy’ on Thursday by Needham. The firm however, cut its 12-month base case estimate on the name to $26 from $31.

SUNE shares recently lost $0.11 to $11.86. In the past 52 weeks, shares of Maryland Heights, Missouri-based company have traded between a low of $8.10 and a high of $33.45.

Shares are down 42.61% year-over-year and 38.70% year-to-date.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply