Dollar Tree, Inc. (DLTR) is set to report its fiscal second-quarter earnings Tuesday before the markets open. Checking in on the numbers, the Street’s estimates for the quarter reflect an expected profit of $0.68 per share, up from $0.61 in the same quarter last year. Revenue is projected to post a 63% year-over-year (yoy) increase to $3.31 billion from $2.03 billion a year earlier. Meanwhile, EarningsWhisper.com reports a whisper number of $0.69 per share.

As a quick reminder, DLTR reported 1Q/15 EPS of $0.71, $0.04 worst than the Street’s consensus estimate of $0.75. Revs increased 9% yoy to $2.18 billion versus the $2.20 billion consensus.

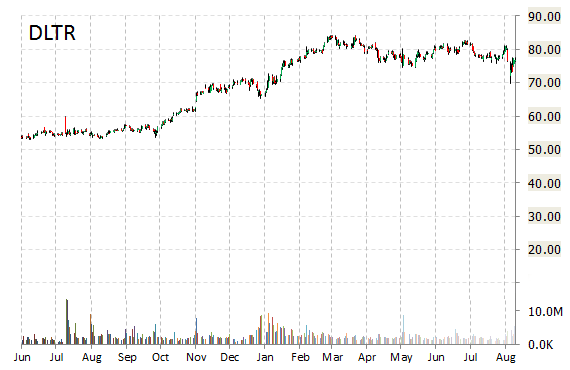

Dollar Tree, Inc., currently valued at $17.84 billion, has a median Wall Street price target of $88.00 with a high target of $98.00. In the past 52 weeks, shares of Chesapeake, Virginia-based operator of discount variety stores in the U.S. and Canada have traded between a low of $53.70 and a high of $84.22 with the 50-day MA and 200-day MA located at $78.54 and $79.16 levels, respectively. Additionally, shares of DLTR trade at a P/E ratio of 1.31 and have a Relative Strength Index (RSI) and MACD indicator of 44.34 and -0.59, respectively.

DLTR currently prints a one year return of 42.22% and a year-to-date return of around 9%.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply