FMC Technologies, Inc. (FTI) is scheduled to report second-quarter/15 results after the market close today. The Street has consensus estimates of $0.61 in earnings per share and $1.70 billion in revenue. In the 2Q of the previous year, Houston, Texas-based supplier of tech solutions for the energy industry posted $0.72 in EPS and $1.99 billion in revenue. Meanwhile, ticker’s earnings whisper number calls for EPS of $0.62 on revenue of $1.71 billion.

As a quick reminder, FMC Tech reported 1Q/15 EPS of $0.63, $0.04 better than the Street’s consensus estimate of $0.59. Revs declined 5.56% yoy to $1.70 billion versus the $1.82 billion consensus.

On valuation measures, FMC Technologies, Inc. shares are currently priced at 12.16x this year’s forecasted earnings compared to the industry’s 7.96x earnings multiple. Ticker has a PEG and forward P/E ratio of 1.27 and 16.30, respectively. Price/Sales for the same period is 1.08 while EPS is 3.01. Currently there are 16 analysts that rate FTI a ‘Buy’, 16 rate it a ‘Hold’. 3 analysts rate it a ‘Sell’. FTI has a median Wall Street price target of $46.00 with a high target of $60.00.

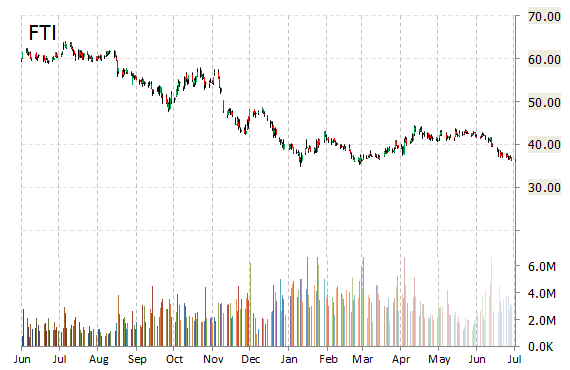

Over the past year, shares of FMC Technologies have traded between a low of $34.85 and a high of $63.92 and are now at $36.62. Shares are down 39.83% year-over-year and 22.27% year-to-date.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply