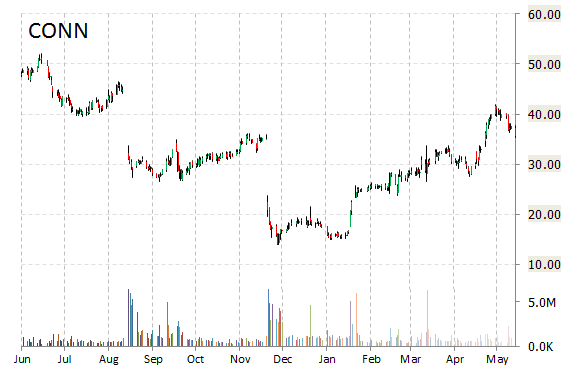

Conns Inc. (CONN) shares are up 2.30% to $36.35 in pre-market trading Tuesday after the company reported its first quarter earnings results.

The retailer reported earnings of $0.43 per share on revenues of $365.1 million, up 8.9% from $335.4 million a year ago. Analysts were expecting EPS of $0.41 on revenues of $376.5 million. The company’s net income for the three months ended April 30, 2015 came in at $15.7 million, or $0.43 per diluted share, from $28.5 million, or $0.77 per share, a year earlier.

Liquidity: As of April 30, 2015, the $1.29 billion market cap company reported $4.9 million in cash vs. $942 million in total liabilities in its most recent quarter.

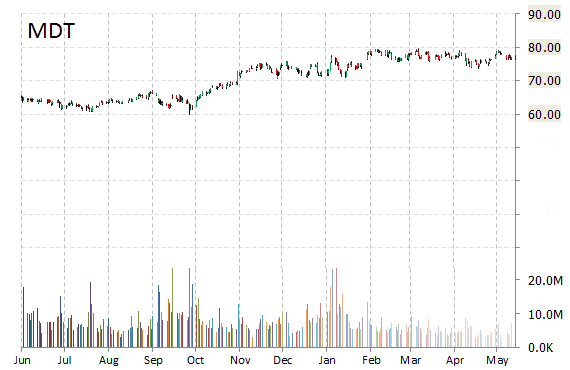

Medtronic plc (MDT) reported fourth quarter non-GAAP EPS of $1.16 before the opening bell Tuesday, compared to the consensus estimate of $1.11. Revenues increased marginally from $7.25 billion last year to $7.30 billion. Analysts expected revenues of $7.18 billion. For the period ended April 24, 2015 the medical device company reported a net income Q4 loss of $1 million and $0.00 per diluted share, compared to a profit in the same period a year earlier.

“I am encouraged by our strong fourth quarter performance, the first quarter that reflects the combined results of Medtronic and Covidien. In addition to making solid progress on our integration of Covidien, these results reflect disciplined execution across our three core strategies of therapy innovation, globalization, and economic value,” said in a statement Omar Ishrak, Medtronic chairman and CEO.

For FY/16, MDT provided EPS guidance of $4.30 – $4.40, which includes an expected $0.40 – $0.50 negative foreign currency impact based on current exchange rates, versus consensus of $4.40 per share.

The stock is currently up $0.80 to $77.50 on 14K shares.

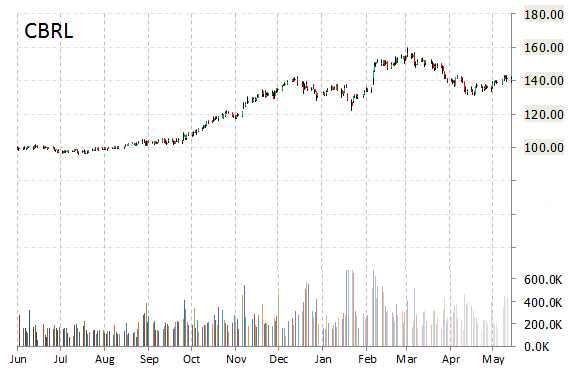

Shares of Cracker Barrel Old Country Store, Inc. (CBRL) gained $6.31 to $146.10 after the company released its earnings results on Tuesday. The restaurant operator reported Q3’15 EPS of $1.49 per share vs. $1.37 consensus on $683.7 million in revenue, up 6.3% from a year ago. Net income for the period ended May 1, 2015 was $35.3 million, or $1.47 per share on a diluted basis, as compared to $28.7 million, or $1.20 per share on a diluted basis, for the first quarter of 2014.

Commenting on the third-quarter results, Cracker Barrel President and CEO Sandra B. Cochran said, “We believe that our strong sales performance in the quarter is the result of general increases in consumer spending, our strong value positioning, and the continuing success of our marketing initiatives. Our margin improvement in the quarter reflects the continuing implementation of our cost savings initiatives and the leverage of higher sales.”

Looking ahead, Cracker Barrel expects Q4/15 EPS in the range of of $1.75 – $1.85 versus consensus of $1.78 per share.

On valuation measures, Cracker Barrel Old Country Store Inc. shares, which currently have an average 3-month trading volume of 290K shares, trade at a trailing-12 P/E of 22.51, a forward P/E of 19.66 and a P/E to growth ratio of 2.02. The median Wall Street price target on the name is $155.00 with a high target of $165.00. Currently ticker has only one ‘Buy’ endorsement, compared to 6 ‘Holds’ and no ‘Sell’.

Profitability-wise, CBRL has a t-12 profit and operating margin of 5.37% and 8.46%, respectively. The $3.34 billion market cap company reported $202 million in cash vs. $400 million in debt in its most recent quarter.

CBRL currently prints a one year return of about 44% and a year-to-date return of less than one percent.

The chart below shows where the equity has traded over the last 52 weeks.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply