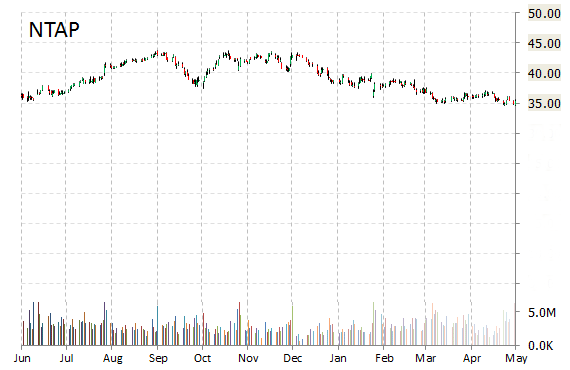

NetApp, Inc. (NTAP) shares are down $2.79 to $32.54 in after-hours trading Wednesday after the company reported its fourth quarter earnings results.

The tech firm reported earnings of $0.65 per share on revenues of $1.54 billion, down 6.6% from a year ago. Analysts were expecting EPS of $0.72 on revenues of $1.59 billion. GAAP net income for Q4/15 was $135 million, or $0.43 per share, compared to GAAP net income of $197 million, or $0.59 per share, for the comparable period of the prior year.

“We are not satisfied with our fourth quarter results and are taking concrete action to transition NetApp for the next phase of growth,” said in a statement Tom Georgens, chairman and CEO. “

For Q1/16, NTAP provided EPS guidance of $0.20 – $0.25 versus consensus of $0.60 per share. The company also issued revenue projection of $1.275 – $1.375 billion, compared to the consensus revenue estimate of $1.46 billion. GAAP loss per share is expected to be in the range of $0.11 – $0.06 per share.

Liquidity: As of April 24, 2015, NetApp had net cash and cash equivalents $5.33 billion. Separately, the company increased Q1/16 dividend by 9% to $0.18 per share. The dividend will be paid on July 23, 2015, to shareholders of record as of the close of business on July 10, 2015.

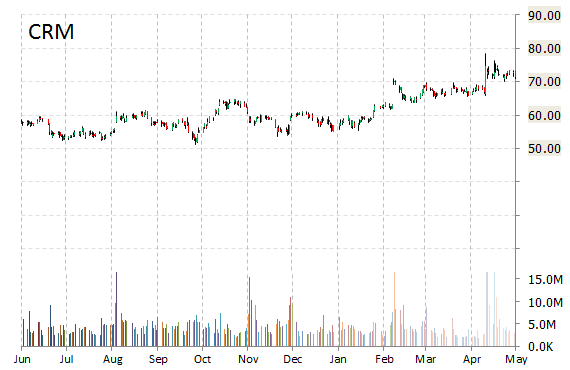

salesforce.com, inc. (CRM) reported first quarter 2016 EPS of $0.16 after the closing bell Wednesday, compared to the consensus estimate of $0.14. Revenues increased 23.2% from last year to $1.51 billion. Analysts expected revenues of $1.50 billion. Net income for the quarter ended April 30 came in at $4.1 million, or $0.01 per share, compared to a net loss of $96.9 million, or $0.16 per share for the year-ago quarter.

The cloud computing company guided Q2/16 revenues of $1.59 – $1.60 billion, as compared to analysts’ expectations of $1.59 billion. The management also gave its bottom line range of $0.17 – $0.18 per share, against projections of $0.17 per share. For full year 2016 revenue is projected to be approximately $6.52 billion to $6.55 billion, an increase of 21% – 22% yoy, which includes an FX headwind of $175 million – $200 million.

“Salesforce has surpassed the $6 billion annual revenue run rate faster than any other enterprise software company, and our current outlook puts us on track to reach a $7 billion revenue run rate later this year,” said in a statement Marc Benioff, Chairman and CEO, Salesforce. “Our goal is to be the fastest to reach $10 billion in annual revenue.”

Cash Position: Cash generated from operations for the first quarter was $731 million, an increase of 54% year-over-year. Total cash, cash equivalents and marketable securities finished the quarter at $1.92 billion.

The stock is currently up $2.93 to $73.09 on 8.94 million shares.

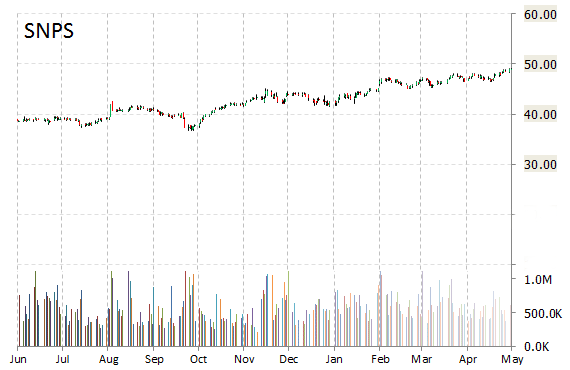

Synopsys Inc. (SNPS) dropped $0.68 to $48.56 in after-hours trading after it reported fiscal-second quarter earnings.

The maker of software used to test and develop chips handed in earnings of $0.68 per share on revenue of $557.2 million, beating Wall Street estimates of $0.63 per share on revenue of $546.51 million. GAAP net income for the second quarter ended April 30/15 was $55.6 million, or $0.35 per share, compared to $63.3 million, or $0.40 per share, for Q2/14.

“Our fiscal second quarter results were very strong, and solidify our outlook for the full year,” commented Aart de Geus, chairman and co-CEO of Synopsys. “We see clear momentum with our new implementation and verification products in the early stages of a multi-year customer upgrade cycle. Our entry into the software quality and security space has opened up an opportunity to drive incremental growth in both familiar and new market segments and build on Synopsys’ strengths.”

For the current quarter ending in July, SNPS provided EPS guidance of $0.58 – $0.60 versus consensus of $0.66 per share. The company also issued revenue projection of $550 – $560 million, compared to the consensus revenue estimate of $557.36 million.

On valuation measures, Synopsys Inc. shares trade at a trailing-12 P/E of 30.40, a forward P/E of 16.64 and a P/E to growth ratio of 1.86. The median Wall Street price target on the name is $51.50 with a high target of $55.00. Currently ticker boasts 7 ‘Buy’ endorsements, compared to 2 ‘Holds’ and no ‘Sell’.

Profitability-wise, SNPS has a t-12 profit and operating margin of 12.10% and 13.10%, respectively. The $7.57 billion market cap company reported $869 million in cash vs. $30 million in debt in its most recent quarter.

SNPS currently prints a one year return of 28.54% and a year-to-date return of around 13%.

The chart below shows where the equity has traded over the last 52 weeks.

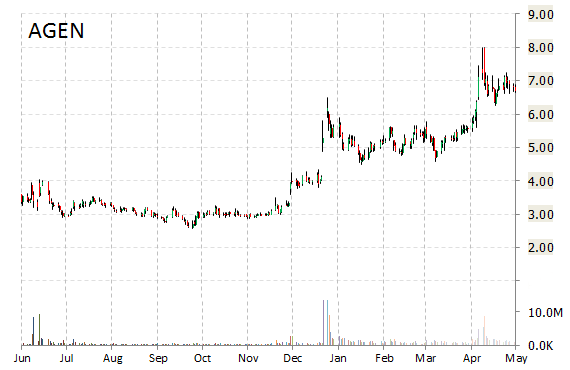

Shares of Agenus Inc. (AGEN) are lower by 4.56% to $6.30 in after-hours trading on Wednesday after the immunotherapy company announced that it intends to offer shares of its common stock in an underwritten public offering (details not disclosed). Agenus said it intends to grant the underwriters a 30-day option to purchase up to an additional 15% of the shares of its common stock offered in the offering.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply