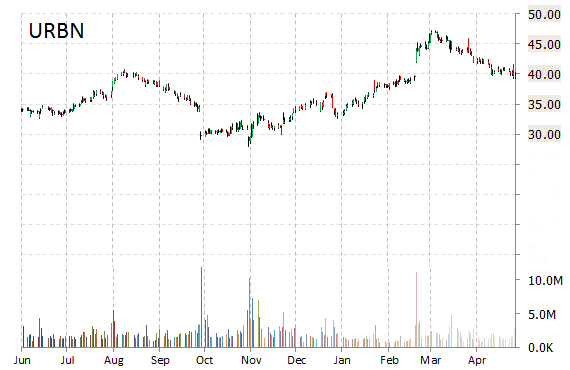

Urban Outfitters Inc. (URBN) reported first quarter EPS of $0.25 after the closing bell Monday, compared to the consensus estimate of $0.30. Revenues increased 7.7% from last year to $739 million. Analysts expected revenues of $757.7 million. Gross profit for the period ended April 30 decreased by 141 basis points versus the prior year`s comparable period. Net income came in at $32.77 million, or $0.25 per diluted share, down from $37.5 million, or $0.26 per diluted share, a year earlier. Meanwhile, same-store sales increased 4%, missing the Street’s consensus of 5.2% growth. Comparable Retail segment net sales increased 17% and 1% at Free People and Anthropologie Group, respectively. Wholesale segment net sales rose 18%.

“I am pleased to announce record first quarter sales and positive Retail segment comparable net sales at each of our brands,” said in a statement Richard A. Hayne, Chief Executive Officer. “I believe our Retail segment comparable net sales growth is being driven by the success of our omni-channel strategy,” finished Mr. Hayne.

Cash Position: As of April 30, 2015, Urban Outfitters cash and cash equivalents totaled $176.9 million, compared to $191.8 million at April 31, 2014.

The stock is currently down $4.83, or 11.35%, to $35.88 on 5.21 million shares.

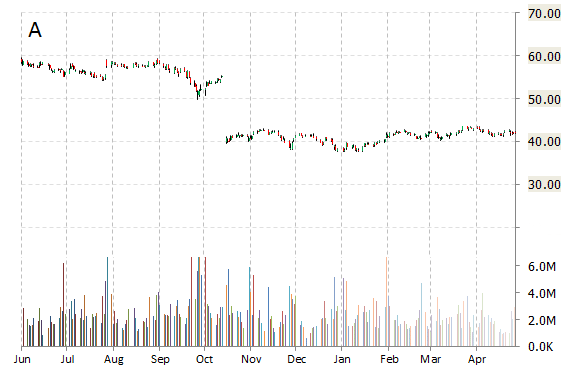

Agilent Technologies Inc. (A) shares are down $1.62 to $41.01 in after-hours trading Monday after the company reported its second quarter earnings results.

The scientific instrument maker posted earnings of $0.38 per share on revenues of $963 million, down 2.5% from a year ago. Analysts were expecting EPS of $0.39 on revenues of $990 million. GAAP net income in the quarter ended April 30, 2015 was $83 million, a decrease of 40% compared to $139 million in the same quarter of 2014.

For the current quarter ending in July, Agilent provided EPS guidance of $0.38 – $0.42 versus consensus of $0.42 per share. The company also issued revenue projection of $995 million – 1.15 billion, compared to the consensus revenue estimate of $1.00 billion. For full fiscal year 2015, Agilent sees EPS between $1.67 – $1.73 on revenue of between $4.05 billion – $4.11 billion.

“Agilent delivered solid earnings within guidance, along with excellent order momentum in the second quarter,” stated Mike McMullen, Agilent president and CEO. “Our continued focus on customers and strong market acceptance of our new products and sales structure are driving order growth.”

Liquidity: As of April 30, 2015, Agilent had net cash and cash equivalents of $2.2 billion, essentially flat compared with $2.21 in October 31, 2014.

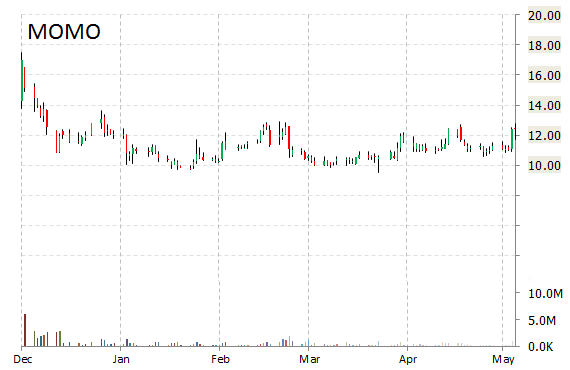

Shares of Momo Inc. (MOMO) rallied $1.17, or 9.17%, to $13.99 after the company released its earnings results on Monday. The Chinese mobile-based social networking platform operator reported Q1’15 EPS of $0.05 per share vs. $0.01 consensus on $26.32 million in revenue, up more than 383% from $5.4 million a year ago. Net income attributable to Momo Inc. was $6.7 million, compared to a net loss of $1.2 million during the same period last year.

For Q2/15, MOMO provided revenue guidance of $31 – $33 million, compared to the consensus revenue estimate of $34.20 million.

On valuation measures, Momo Inc. ADS shares, which currently have an average 3-month trading volume of 385K shares, trade at a forward P/E of 20.03. The median Wall Street price target on the name is $14.90 with a high target of $15.00. Currently ticker has 1 ‘Buy’ endorsement, compared to 1 ‘Hold’ and no ‘Sell’.

Profitability-wise, MOMO has a t-12 profit and operating margin of (56.79%) and (58.4%), respectively. The $2.05 billion market cap company reported $101.9 million in cash in its most recent quarter vs. $55.22 million during the same period last year.

MOMO currently prints a year-to-date return of around 3.25%.

The chart below shows where the equity has traded over the last six months.

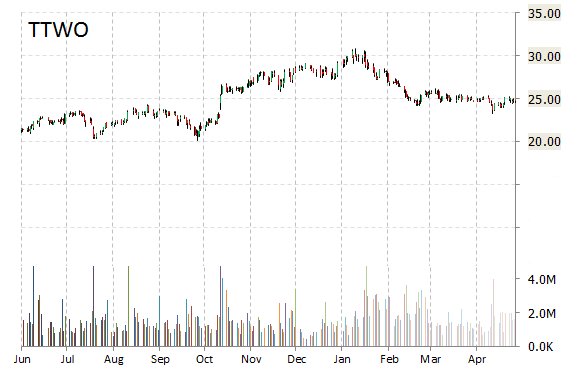

Take-Two Interactive Software Inc. (TTWO) rallied $1.49 to $25.69 in after-hours trading after it reported fiscal results for the fourth quarter.

In its quarterly report, the video game publisher said it earned $0.49 per share, well above the $0.28 per share analysts were expecting. Revenue rose 83.4% yoy to $427.7 million, below views for $468.1 million. The company’s GAAP net loss was $242.8 million, or ($2.99) per share (diluted), as compared to $30.8 million, or ($0.40) per share, for the year-ago period.

“Our strong fourth quarter revenues and better-than-expected Non-GAAP profits marked an outstanding close to one of our Company’s best years ever,” said in a press release Strauss Zelnick, Chairman and CEO of Take-Two.

For Q1/16, TTWO provided EPS guidance of $0.25 – $0.35 versus consensus of ($0.03) per share. The company also issued revenue projection of $325 – $350 million, compared to the consensus revenue estimate of $204.6 million. For the full fiscal year 2015, the company reported a loss of $279.5 million, or ($3.48) per share, swinging to a loss in the period. Revenue was reported as $1.083 billion.

Cash – As of March 31, 2015, the $2.04 billion market cap company reported $911 million in cash vs. $476 million in debt.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply