Comcast Corporation (CMCSA) shares are up $1.59, or 2.72%, to $60.00 in pre-market trading Monday after the company reported its first quarter earnings results.

The cable provider posted non-GAAP earnings of $0.79 per share on revenues of $17.85 billion, up 2.6% from $17.40 billion a year ago. Analysts were expecting EPS of $0.74 on revenues of $17.42 billion. Net income attributable to Comcast Corp. came in at $2.06 billion, or $0.81 per share, from $1.88 billion, or $0.71 per share, a year earlier.

Comcast said high-speed Internet customers rose by 407,000 in the quarter. High-speed Internet revenue saw growth of 10.7%, the strongest rate of growth in more than four years.

Revenue from theme parks jumped 33.7 %. The company also said its stock buyback program will increase by $2.5 Billion, with $6.75 billion to be repurchased in 2015.

On valuation measures, Comcast Corp. Cl A shares, which currently have an average 3-month trading volume of 19.24 million shares, trade at a trailing-12 P/E of 18.25, a forward P/E of 15.87 and a P/E to growth ratio of 1.06. The median Wall Street price target on the name is $66.00 with a high target of $84.00. Currently ticker boasts 22 ‘Buy’ endorsements, compared to 5 ‘Holds’ and no ‘Sell’.

Liquidity: The $148.42 billion market cap company reported $3.9 billion in cash vs. $18.5 billion in total current liabilities in its most recent quarter. Q1/15 free cash flow increased nearly 13% to $3.2 billion compared to $2.8 billion in Q1/14.

Brian L. Roberts, Chairman and CEO of Comcast Corporation, stated, “We are off to a great start in 2015, with 7.6% operating cash flow growth and record quarterly free cash flow. Cable had a terrific quarter, once again reflecting strong results in high-speed Internet and business services…We begin 2015 with great momentum and remain confident that we are well positioned with an impressive portfolio of complementary businesses to continue our strong performance and drive shareholder value.”

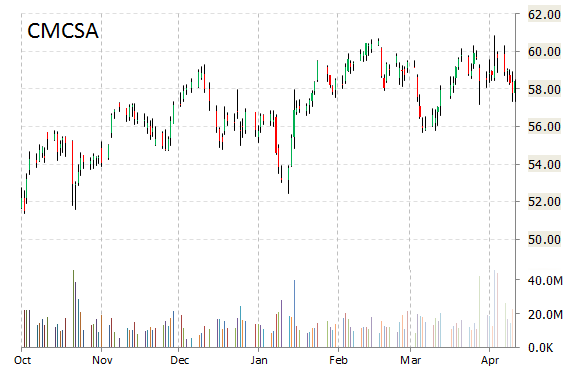

CMCSA currently prints a one year return of about 14% and a year-to-date return of less than 2 percent.

The chart below shows where the equity has traded over the last 52 weeks.

Cognizant Technology Solutions Corporation (CTSH) reported first quarter EPS of $0.71 before the opening bell Monday, compared to the consensus estimate of $0.70. Revenues increased 23.5% from last year to $2.99 billion. Analysts expected revenues of $2.90 billion. GAAP net income was $382.9 million, or $0.62 per diluted share in Q1/15, compared with a net income of $348.9 million, or $0.57 per diluted share, in the first quarter of 2014.

For Q2/15, Cognizant provided EPS guidance $0.72 versus consensus of $0.73 per share. The information technology consulting and outsourcing firm also issued revenue projection of at least $3.01 billion, compared to the consensus revenue estimate of $3.01 billion.

Profitability-wise, CTSH has a t-12 profit and operating margin of 14.02% and 18.37%, respectively. The $36.05 billion market cap company reported $1.27 billion in cash vs. $925 million in debt in its most recent quarter.

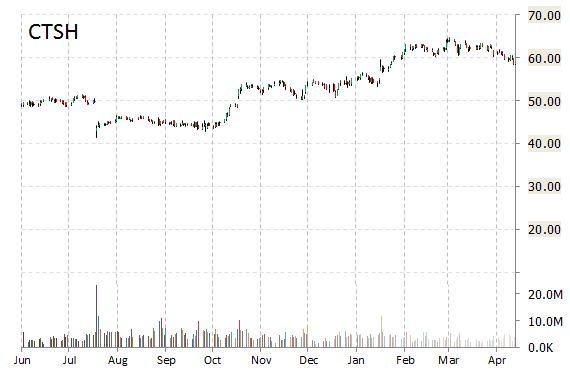

CTSH currently prints a yoy return of about 22% and a year-to-date return of 12.31%.

The stock is up nearly 6% premarket to $62.50 on more than 12.500 shares.

Shares of Cyan, Inc. (CYNI) rallied $1.05, or 28.77%, to $4.70 after the company released its earnings results on Monday. The firm reported Q1’15 EPS of ($0.14) per share vs. ($0.15) consensus on $36 million in revenue, up 89.5% from $19 million a year ago. Net loss was $52.9 million, or $1.11 per share, in the first quarter ended March 31, 2015, compared with a net income loss of $17.8 million, $0.38 per share, in the first quarter of 2014.

Cyan today also announced an agreement to be acquired by Ciena (CIEN) for approximately $400 million (or approximately $335 million net of cash).

Under terms of the agreement, the per-share bid of $4.75 for Cyan represents a 30% premium to Friday’s closing price. The deal is expected to close in the fiscal fourth quarter, ending October.

Profitability-wise, CYNI has a t-12 profit and operating margin of (58.94%) and (52.83%), respectively. The $176.28 million market cap company reported $53.87 million in cash vs. $130 million in total liabilities in its most recent quarter.

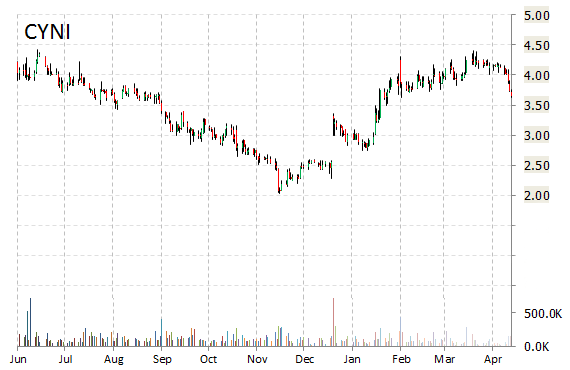

CYNI currently prints a one year loss of 12.89% and a year-to-date return of around 46%.

Array BioPharma, Inc. (ARRY) surged $0.98, or 15%, to $7.30 in pre-market trading after it reported fiscal-third quarter earnings. The drug developer handed in earnings of $0.37 per share on revenue of $6.6 million, beating Wall Street EPS estimates of ($0.19) per share on revenue of $6 million. Net income came in at $58.3 million, or $0.37 per share (diluted), compared to a net loss of $24.9 million, or ($0.20) per share (diluted), for the same period in fiscal 2014.

For the nine months ended March 31, 2015, revenue was $39.6 million, compared to $36.1 million year-over-year.

On valuation measures, Array BioPharma Inc. shares have a P/E to growth ratio of (8.93). The median Wall Street price target on the name is $10.00 with a high target of $15.00. Currently ticker boasts 7 ‘Buy’ endorsements, compared to 1 ‘Holds’ and no ‘Sell’.

Liquidity: The $882.89 million market cap company reported $190.61 million in cash vs. $108. million in net debt in its most recent quarter.

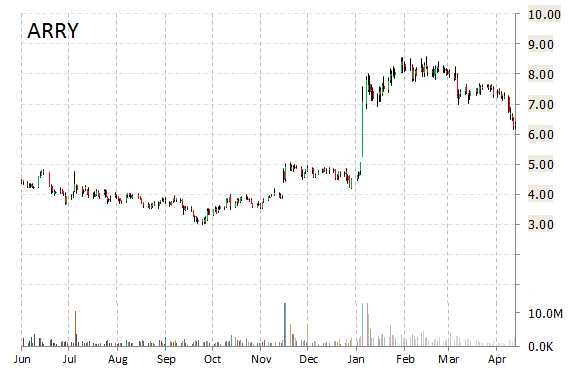

ARRY currently prints a one year return of about 48%.

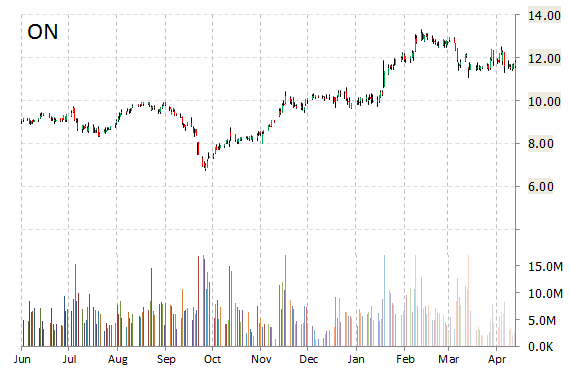

Shares of ON Semiconductor Corp. (ON) are up $0.55 to $12.35 in pre-market trading after it reported fiscal results for the first quarter.

In its quarterly report, the manufacturer of semiconductor components said it earned $0.20 per share, well above the $0.17 per share analysts were expecting. Revenue rose 23.3% to $870.8 million from $706.5 million a year earlier, and above views for $860.82 million. Q1 GAAP and non-GAAP gross margin in the period was 34.5%. The company’s net income came in at 55.1 million from $55.7 million, year-over-year.

For Q2/15, ON provided revenue guidance of $876 – $916 million, compared to the consensus revenue estimate of $896.35 million.

“We continue to make strong progress in our focused end-markets, as evident from our results for the first quarter and outlook for the second quarter,” said in a statement Keith Jackson, president and CEO of ON Semiconductor. “Our order momentum is accelerating and visibility into near to mid-term outlook has improved significantly, driven by strong customer interest in our product offerings. Along with solid revenue growth, our margins continue to expand and we remain on track to deliver strong growth in earnings and free cash flow.

Profitability-wise, ON has a t-12 profit and operating margin of 6.00% and 9.48%, respectively. The $5.08 billion market cap company reported $428.1 million in cash vs. $950 million in debt in its most recent quarter.

ON currently prints a one year return of 25.91% and a year-to-date return of 16.58%.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply