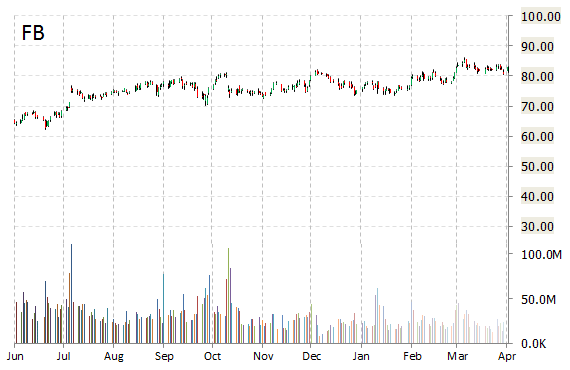

Facebook (FB) gapped up after the market opened on Tuesday to challenge its April highs around $84. Some continuation today could set it up for a test of next resistance level at $85.36. The social networking giant is expected to report first-quarter earnings tomorrow after the close. Thomson Reuters consensus calls for EPS of $0.40 on revenue of $3.56 billion.

Fundamentally, FB shows the following financial data:

- $11.20 billion in cash in most recent quarter

- $40.18 billion t-12 total assets

- $36.1 billion total equity

- $12.47 billion t-12 revenue

- $2.93 billion annual net income

- $3.63 billion free cash flow

On valuation measures, Facebook Inc. shares have a T-12 price/sales ratio of 18.66 and a price/book for the same period of 6.39. EPS is $1.07. The name has a market cap of $235.70 billion and a median Wall Street price target of $92.00 with a high target of $107.00. Currently there are 39 analysts that rate FB a ‘Buy’, 6 rate it a ‘Hold’. 1 analyst rates it a ‘Sell’.

Facebook shares recently gained $1.13 to $84.22. The stock is up more than 40% year-over-year and has gained about 9% since it reported its fourth quarter results on January 28.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply