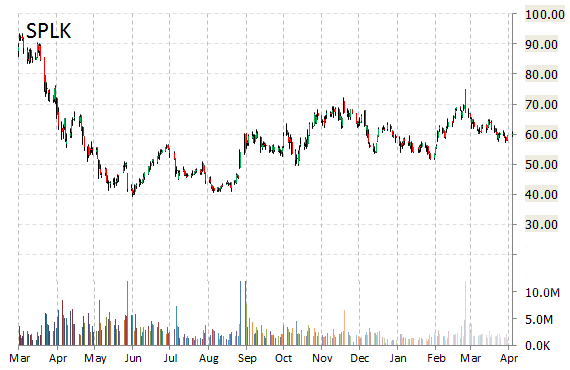

Analysts at Piper Jaffray are out with a report this morning upgrading shares of Splunk, Inc. (SPLK) with an ‘Overweight‘ from ‘Neutral‘ rating. The firm set its price target at $77.

Splunk Inc. shares have a forward P/E of 218.27 and t-12 price-to-sales ratio of 16.69. EPS for the same period is ($1.81).

In the past 52 weeks, shares of San Francisco California-based company have traded between a low of $39.35 and a high of $74.88 and are now at $63.00. Shares are down 9.31% year-over-year ; up 2.09% year-to-date.

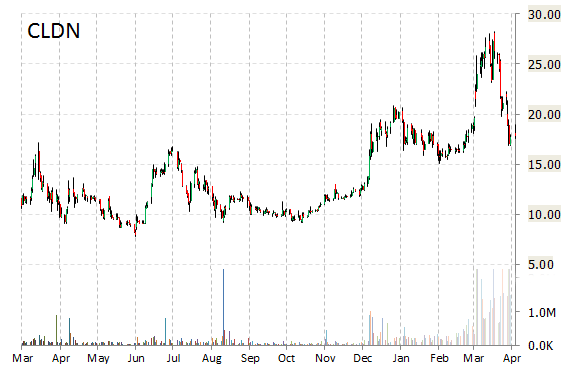

In a report published Tuesday, Piper Jaffray analysts initiated coverage on Celladon Corporation (CLDN) with an ‘Overweight’ rating and $77.00 price target.

Celladon Corporation, currently valued at $432.70 million, has a median Wall Street price target of $28.50 with a high target of $70.00. Approximately 920K shares have already changed hands, compared to the stock’s average daily volume of 758K.

In the past 52 weeks, shares of San Diego, California-based biopharmaceutical company have traded between a low of $7.82 and a high of $28.25 with the 50-day MA and 200-day MA located at $21.17 and $15.76 levels, respectively. Additionally, shares of CLDN trade with a Relative Strength Index (RSI) and MACD indicator of 40.56 and 3.62, respectively.

CLDN currently prints a one year return of about 83.40% and a year-to-date loss of around 9%.

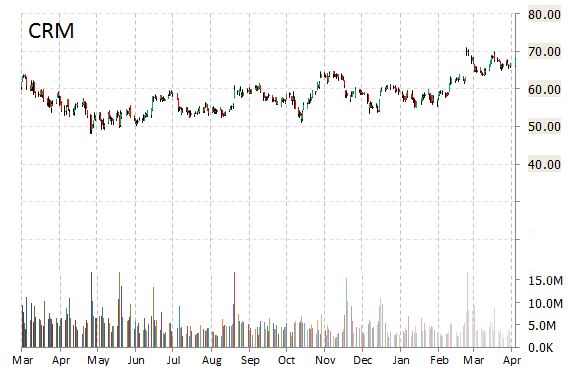

salesforce.com, inc. (CRM) was reiterated an ‘Outperform’ by Oppenheimer analysts on Tuesday. The broker also raised its price target on the stock to $80 from $75.

CRM shares recently gained $0.75 to $68.69. In the past 52 weeks, shares of San Francisco, California-based cloud computing solution provider have traded between a low of $48.18 and a high of $71.00. Shares are up 21.89% year-over-year and 14.55% year-to-date.

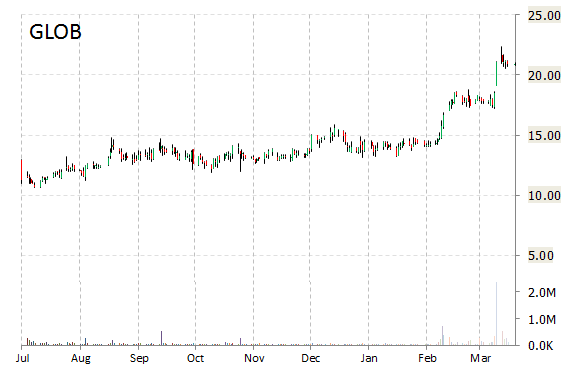

Globant S.A. (GLOB) was reiterated as ‘Buy’ with a $24.50 from $18 price target on Tuesday by Citigroup (C).

Globant S.A. shares are currently priced at 28.66x this year’s forecasted earnings, compared to the industry’s 34.78x earnings multiple. Ticker has a PEG and forward P/E ratio of 1.19 and 21.60, respectively. Price/Sales for the same period is 3.56 while EPS is $0.79. Currently there are 4 analysts that rate GLOB a ‘Buy’. No analyst rates it a ‘Hold’ or a ‘Sell’. GLOB has a median Wall Street price target of $17.50 with a high target of $18.00.

In the past 52 weeks, shares of Luxembourg-based software solutions developer have traded between a low of $10.65 and a high of $23.20 and are now at $22.64. Shares are up 34.06% year-to-date.

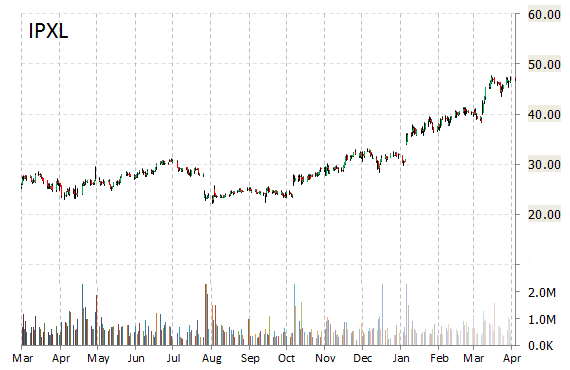

Impax Laboratories Inc. (IPXL) rating of ‘Overweight’ was reiterated today at Piper Jaffray with a price target increase of $58 from $49 (versus a $47.07 previous close).

IPXL shares recently gained $2.19 to $49.26. The stock is up more than 85.75% year-over-year and has gained roughly 48.60% year-to-date. In the past 52 weeks, shares of the Charlotte, North Carolina-based company have traded between a low of $22.12 and a high of $49.54.

Impax Laboratories Inc. closed Monday at $47.07. The name has a total market cap of $3.39 billion.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply