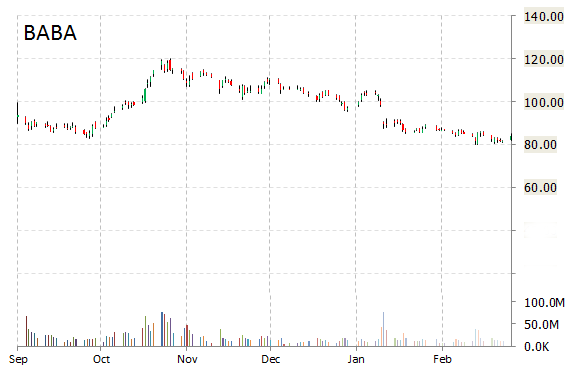

Analysts at Stifel are out with a report this morning upgrading shares of Alibaba Group Holding Limited (BABA) with a ‘Buy‘ from ‘Hold‘ rating. The firm set its price target for the company to $99.

Alibaba Group Holding Ltd. ADS shares are currently priced at 47.86x this year’s forecasted earnings, which makes them relatively expensive compared to the industry’s 34.57x earnings multiple. Ticker has a forward P/E of 29.67 and t-12 price-to-sales ratio of 18.49. EPS for the same period is $1.76.

In the past 52 weeks, shares of Hangzhou Zhejiang, China-based company have traded between a low of $80.03 and a high of $120.00 and are now at $84.38. Shares are down 19.18% year-to-date.

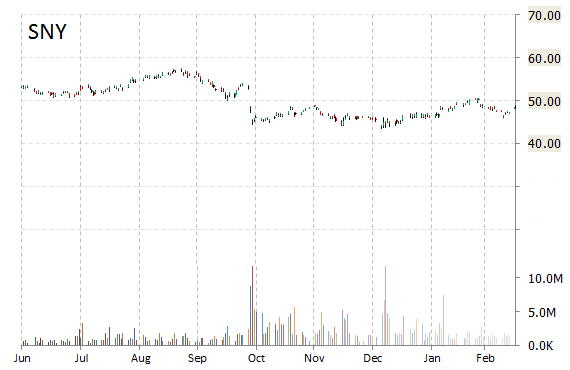

Analysts at Leerink Partners upgraded their rating on the shares of Sanofi (SNY). In a research note published on Tuesday, the firm lifted the name with an ‘Outperform‘ from ‘Market Perform‘ rating.

On valuation measures, Sanofi ADS shares are currently priced at 27.95x this year’s forecasted earnings. Ticker has a PEG and forward P/E ratio of 2.69 and 15.31, respectively. Price/Sales for the same period is 3.51 while EPS is $1.75. Currently there are 9 analysts that rate SNY a ‘Buy’, 17 rate it a ‘Hold’. 1 analyst rates it a ‘Sell’. SNY has a median Wall Street price target of $49.35 with a high target of $55.52.

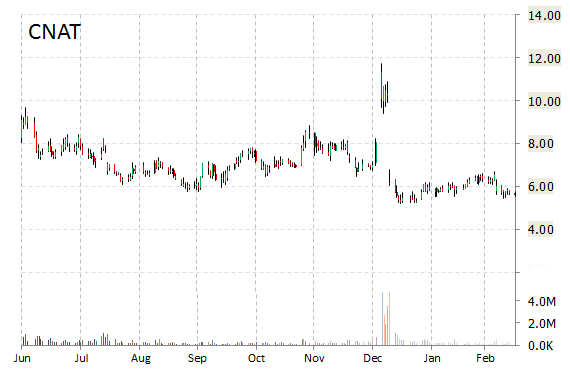

Conatus Pharmaceuticals Inc. (CNAT) coverage was resumed on Wednesday by ROTH Capital with a ‘Buy’ rating and a valuation price of $15, implying 144% upside to the $15 price target.

In the past 52 weeks, shares of San Diego, California-based biotechnology company have traded between a low of $5.06 and a high of $11.74 and are now at $6.15. Shares are down 49.28% year-over-year and 20% year-to-date.

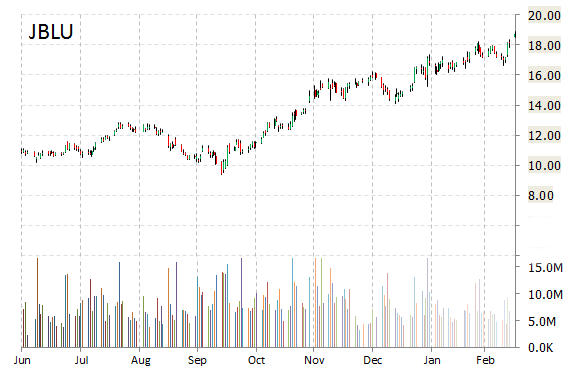

JetBlue Airways Corporation (JBLU) was reiterated a ‘Buy’ by Argus analysts on Tuesday. The broker also raised its price target on the stock to $23 from $18.

JetBlue shares are currently priced at 16.16x this year’s forecasted earnings compared to the industry’s 53.89x earnings multiple. Ticker has a PEG and forward P/E ratio of 0.26 and 10.65, respectively. Price/Sales for the same period is 1.00 while EPS is $1.19. Currently there are 7 analysts that rate JBLU a ‘Buy’, 8 rate it a ‘Hold’. 1 analyst rates it a ‘Sell’. JBLU has a median Wall Street price target of $20.00 with a high target of $24.00.

In the past 52 weeks, shares of Long Island City, New York-based airliner have traded between a low of $7.61 and a high of $19.24 and are now at $19.20. Shares are up 115.44% year-over-year and 17.91% year-to-date.

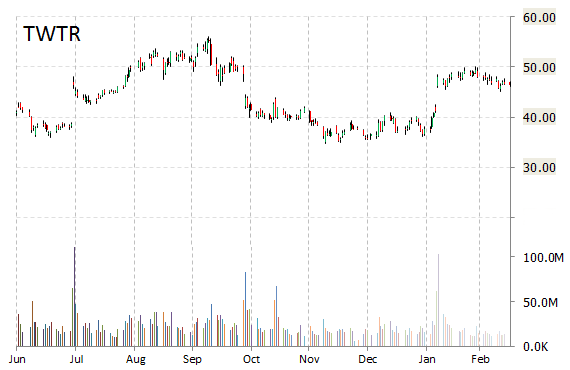

Brean Capital initiated coverage of Twitter, Inc. (TWTR) with a ‘Buy’ rating and a $61 price target, which represents expected upside of about 30% to the stock’s current price.

TWTR shares recently gained $0.62 to $47.05. In the past 52 weeks, shares of San Francisco, Calif.-based company have traded between a low of $29.51 and a high of $55.99. Shares are down 10.57% year-over-year ; up 29.44% year-to-date.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply