BlackBerry Limited (BBRY) shares are trading higher by 1.31% to $10.02 in late morning trading Thursday, following a 13G filing in which Canso Investment Counsel discloses a 5.4% passive stake in the company. Approximately 2.72 million BBRY shares have already changed hands, compared to the stock’s average daily volume of 9.24 million shares.

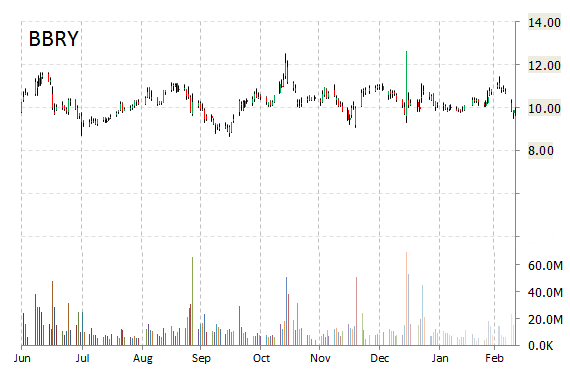

During today’s trading session, the stock opened 5 cents higher from the previous close and kept ranging for the majority of the morning, before settling into an intraday range of $9.90 to $10.05 with its 52-week range being $7.01 to $12.63.

Fundamentally, BBRY shows the following financial data:

- $2.77 billion in cash in most recent quarter

- $8.36 billion t-12 total assets

- $4.01 billion total equity

- $3.65 billion t-12 revenue

- ($6.15) billion annual net income

- ($462.53) million free cash flow

On valuation measures, BlackBerry Ltd. shares have a T-12 price/sales ratio of 1.42 and a price/book for the same period of 1.55. EPS is ($1.43). The name has a market cap of $5.31 billion and a median Wall Street price target of $10.00 with a high target of $17.00. Currently there are 2 analysts that rate BBRY a ‘Buy’, 19 rate it a ‘Hold’. 7 analyst rates it a ‘Sell’.

In terms of share statistics, BlackBerry Ltd. has a total of 528.70 million shares outstanding with 4.99% held by insiders and 56.60% held by institutions. The stock’s short interest currently stands at 18.01%, bringing the total number of shares sold short to 88.27 million.

Shares of Waterloo, Ontario-based smartphone maker are up 6.34% year-over-year ; down 9.84% year-to-date.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply