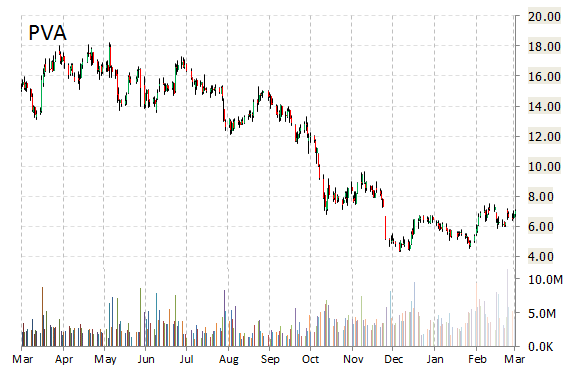

Analysts at Scotia Howard Weil are out with a report this morning upgrading shares of Penn Virginia Corporation (PVA) with a ‘Focus Stock‘ from ‘Sector Outperform‘ rating.

Penn Virginia Corp. shares have a t-12 price-to-sales ratio of 0.97. EPS for the same period is ($6.26).

In the past 52 weeks, shares of Radnor, Pennsylvania-based oil company have traded between a low of $4.32 and a high of $18.20 and are now at $7.26. Shares are down 54.91% year-over-year ; up 5.24% year-to-date.

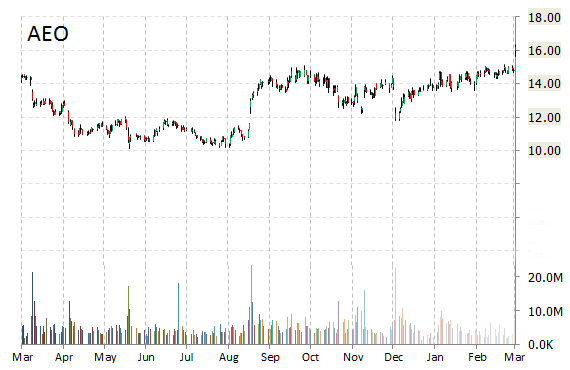

Analysts at Stifel upgraded their rating on the shares of American Eagle Outfitters, Inc. (AEO). In a research note published on Thursday, the firm lifted the name with a ‘Buy‘ from ‘Hold‘ rating and set a 12-month base case estimate of $20 per share.

On valuation measures, American Eagle Outfitters Inc. shares are currently priced at 107.62x this year’s forecasted earnings compared to the industry’s 23.23x earnings multiple. Ticker has a PEG and forward P/E ratio of 3.37 and 17.33, respectively. Price/Sales for the same period is 0.95 while EPS is $0.15. Currently there are 5 analysts that rate AEO a ‘Buy’, 17 rate it a ‘Hold’. 3 analyst rates it a ‘Sell’. AEO has a median Wall Street price target of $15.00 with a high target of $20.00.

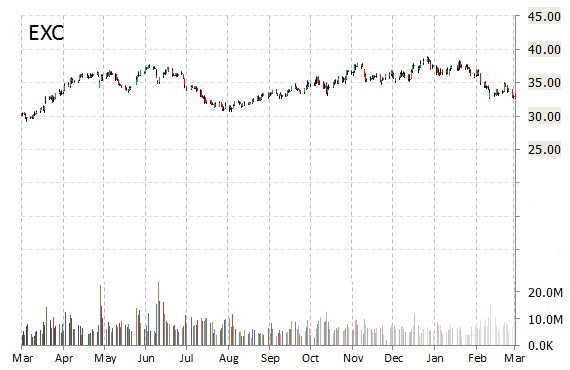

Exelon Corporation (EXC) was raised to ‘Overweight‘ from ‘Neutral‘ and it was given a $38 from $36 price target at JP Morgan (JPM) on Thursday.

EXC is up $0.25 at $32.87 on heavy volume. Midway through trading Thursday, 3.74 million shares of Exelon Corp. have exchanged hands as compared to its average daily volume of 7.18 million shares. The stock has been ranging intraday between $32.80-$33.29 after having opened the day at $33.29 as compared to the previous trading day’s close of $32.62.

In the past 52 weeks, shares of Chicago, Illinois-based utility services holding company have traded between a low of $29.14 and a high of $38.93. Shares are up 11.22% year-over-year ; down 11.24% year-to-date.

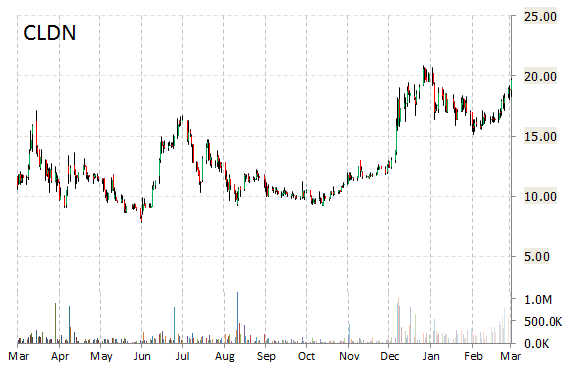

Roth Capital initiated coverage on Celladon Corporation (CLDN) with a ‘Buy’ rating and 12-month target price of $70/share. RC’s price target would suggest a potential upside of 229% from the stock’s current pps.

CLDN shares recently gained $1.73 to $21.36. In the past 52 weeks, shares of clinical-stage biotechnology company have traded between a low of $7.82 and a high of $22.90. Shares are up 66.02% year-over-year and 0.56% year-to-date.

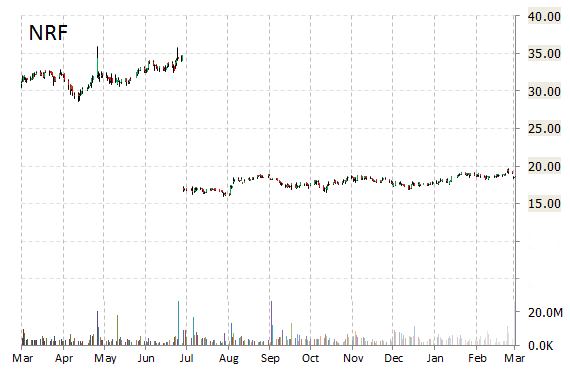

NorthStar Realty Finance Corp. (NRF) was upgraded to ‘Outperform’ from ‘Market Perform‘ by Keefe Bruyette analysts on Thursday.

NRF is currently printing a higher than average trading volume with the issue trading 10.24 million shares, compared to the average volume of 6.42 million. The stock began trading this morning at $18.26 to currently trade 1.54% higher from the prior days close of $18.17. On an intraday basis it has gotten as low as $18.25 and as high as $18.61.

On valuation measures, Northstar Realty Finance Corp. shares have a t-12 price/sales ratio of 6.25. EPS for the same period registers at ($1.64).

NRF has declined 1.12% in the last 4 weeks while advancing 3.28% in the past three months. Over the past 5 trading sessions the stock has lost 1.64%.

The New York-based company, which is currently valued at $4.12 billion, has a median Wall Street price target of $22.25 with a high target of $23.50. Northstar Realty Finance Corp. is up 28.51% year-over-year, compared with a 11.80% gain in the S&P 500.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply