Smith & Wesson Holding Corporation (SWHC) rallied $1.10, or 8.43%, to $14.15 in the extended session Tuesday after it reported fiscal results for the third quarter ended January 31, 2015.

In its quarterly report, the gun maker said it earned $0.20 per share, adjusted for one-time gains and costs, well above the $0.12 per share analysts were expecting. Revenues however, fell 10.5% to $130.6 million, below views for $124.81 million.

For Q415, the company guided revenues between $162-$166 million, as compared to analysts’ expectations of $160.01 million. The management also gave its bottom line range of $0.24-$0.26 per share, against projections of $0.24 per share.

For full-year 2015, the company said it expects net sales to be between $532 million and $536 million and EPS from continuing operations to be between $0.75 and $0.77. On a non-GAAP basis, EPS is expected to be between $0.87 and $0.89.

On valuation measures, Smith & Wesson Holding Corp. shares, which currently have an average 3-month trading volume of 1.32 million shares, trade at a trailing-12 P/E of 11.21, a forward P/E of 13.18 and a P/E to growth ratio of 1.40. The median Wall Street price target on the name is $15.00 with a high target of $16.00. Currently ticker boasts 6 ‘Buy’ endorsements, compared to 1 ’Hold’ and no ‘Sell’.

Profitability-wise, SWHC has a t-12 profit and operating margin of 11.76% and 20.17%, respectively. The $700.84 million market cap company reported $59 million in cash vs. $175.00 million in debt in its most recent quarter.

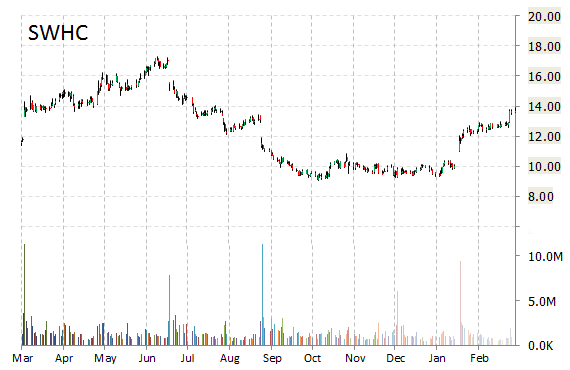

SWHC currently prints a one year return of about 18.60% and a year-to-date return of around 44%.

The chart below shows where the equity has traded over the last 52 weeks.

Smith & Wesson Holding Corp. manufactures and sells firearm products in the United States and internationally. The company was founded in 1852 and is based in Springfield, Massachusetts.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply