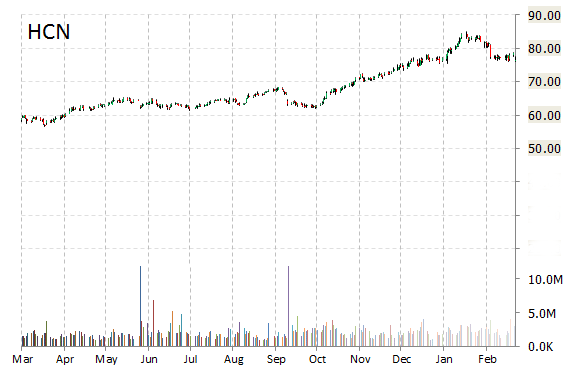

Analysts at Morgan Stanley (MS) upgraded their Health Care REIT, Inc. (HCN) rating to ‘Overweight’ from ‘Equal-Weight’ in a research report issued to clients on Wednesday. The stock is currently up 2.30% and trading more than 2.7 million shares, compared to the average volume of 2.5 million shares.

Health Care REIT, Inc. shares are priced at 86.79x this year’s forecasted earnings compared to the industry’s 10.82x earnings multiple. Ticker has a PEG and forward P/E ratio of 3.03 and 17.06, respectively. Price/sales for the same period is 7.77 while EPS is $0.90. Currently there are 5 analysts that rate HCN a ‘Buy’, 14 rate it a ‘Hold’. 1 analyst rates it a ‘Sell’. HCN has a median Wall Street price target of $77.00 with a high target of $86.00.

In the past 52 weeks, shares of the independent equity real estate investment trust have traded between a low of $56.45 and a high of $84.88 and are now at $78.20. Shares are up 38.09% year-over-year, and 2.12% year-to-date.

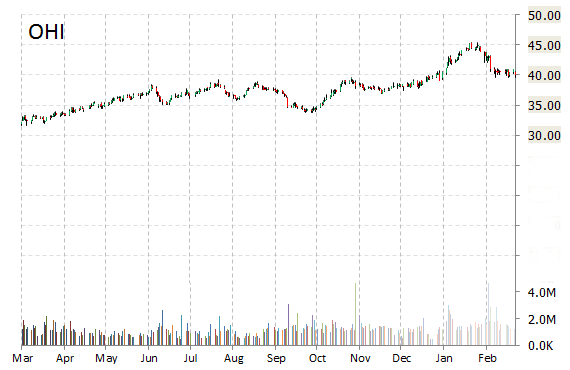

Analysts at Stifel upgraded their Omega Healthcare Investors Inc. (OHI) rating to ‘Buy’ from ‘Hold’ and set a price target of $44 per share in a research report issued to clients on Wednesday. The firm said it views yesterday’s share drop as an attractive entry point for what firm believes is a high-growth REIT.

On valuation measures, Omega Healthcare Investors Inc., currently valued at $5.27B, has a median Wall Street price target of $42.00 with a high target of $47.00. Approximately 1.29M shares have already changed hands, compared to the stock’s average daily volume of 1.52M.

In the past 52 weeks, shares of the Maryland-based real estate investment firm have traded between a low of $31.47 and a high of $45.46 with the 50-day MA and 200-day MA located at $42.50 and $38.69 levels, respectively. Additionally, shares of OHI trade at a P/E ratio of 3.25 and have a Relative Strength Index (RSI) of 50.88.

OHI currently prints a one year return of about 32.25% and a year-to-date return of around 3.80%.

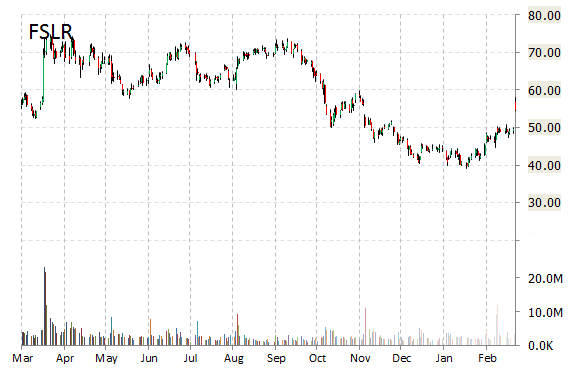

First Solar, Inc. (FSLR) was upgraded to ‘Neutral’ from ‘Underperform ‘ at Bank of America (BAC).

FSLR shares recently gained $3.85 to $58.55. In the past 52 weeks, shares of solar energy solutions provider have traded between a low of $39.18 and a high of $74.84. Shares are down 5.28% year-over-year ; up 22.65% year-to-date.

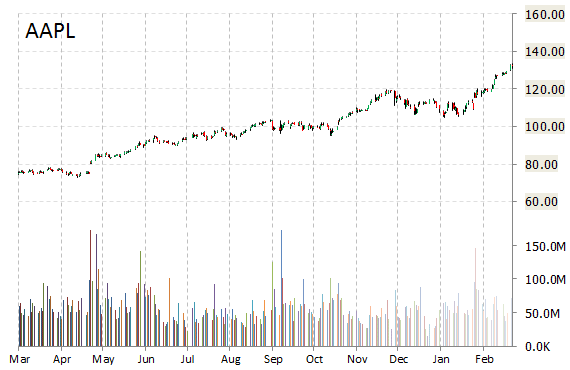

Apple Inc. (AAPL) was reiterated as ‘Buy’ at Stifel, and the price target was raised to $150 from $130.

In other Apple news this morning, the Chinese government will no longer approve state purchases from companies including Apple, Intel (INTC)’s security software firm McAfee and Citrix Systems (CTXS) amid Western cybersurveillance concerns, according to a Reuters report.

AAPL shares recently lost $1.44 to $130.73. The stock is up more than 78.70% year-over-year and has gained roughly 20.21% year-to-date. In the past 52 weeks, shares of the iPhone maker have traded between a low of $73.05 and a high of $133.60.

Apple Inc. closed Tuesday at $132.17. The tech giant has a total market cap of $761.46 billion.

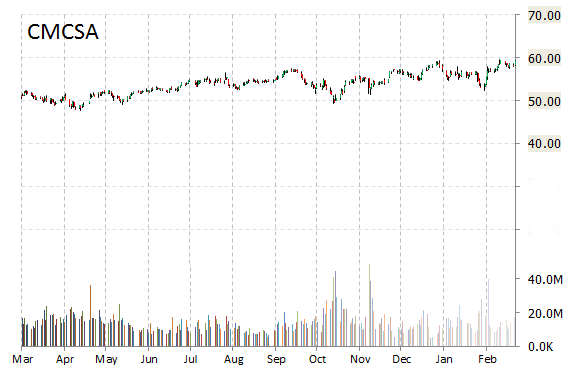

Comcast Corporation (CMCSA) was reiterated as ‘Buy’ with a $70 from $62 price target on Wednesday by Canaccord Genuity.

CMCSA shares recently gained $0.65 to $59.82. CG’s target price suggests a potential upside of about 17% from the company’s current stock price.

In the past 52 weeks, shares of the New York-based firm have traded between a low of $47.74 and a high of $59.89. Shares are up 17.63% year-over-year and 2.41% year-to-date.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply