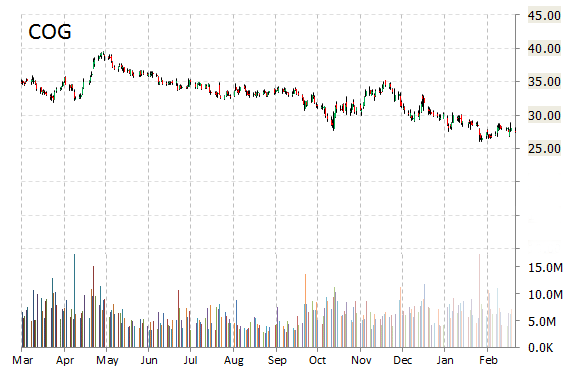

Cabot Oil & Gas Corporation (COG) gained 0.70% Tuesday, boosted by Tudor Pickering analysts who upgraded the name with an ‘Accumulate’ from ‘Hold’.

Cabot Oil & Gas Corp. shares are currently priced at 28.95x this year’s forecasted earnings compared to the industry’s 15.72x earnings multiple. Ticker has a PEG and forward P/E ratio of 3.30 and 27.96, respectively. Price/sales for the same period is 5.77 while EPS is $0.96. Currently there are 16 analysts that rate COG a ‘Buy’, 18 rate it a ‘Hold’. No analysts rate it a ‘Sell’. COG has a median Wall Street price target of $34.00 with a high target of $44.00.

In the past 52 weeks, shares of Houston, Texas-based company have traded between a low of $26.01 and a high of $39.46 and are now at $27.79. Shares are down 23.35% year-over-year, and 6.79% year-to-date.

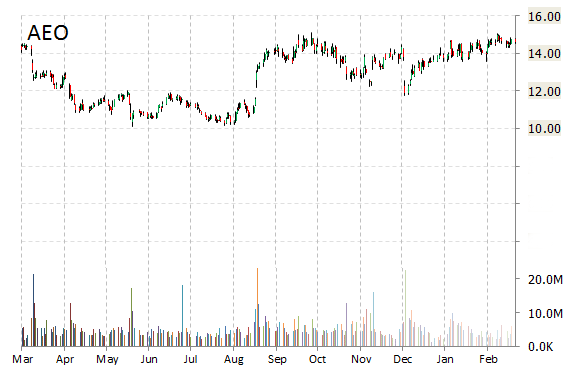

Analysts at Telsey Advisory Group upgraded their American Eagle Outfitters, Inc. (AEO) rating to ‘Outperform’ from ‘Market Perform’ and set a price target of $17 from $15 per share in a research report issued to clients on Tuesday.

American Eagle Outfitters, Inc., currently valued at $2.89B, has a median Wall Street price target of $15.00 with a high target of $20.00. Approximately 2.78M shares have already changed hands, compared to the stock’s average daily volume of 4.90M.

In the past 52 weeks, shares of specialty retailer of clothing, accessories and personal care products have traded between a low of $10.12 and a high of $15.16 with the 50-day MA and 200-day MA located at $14.36 and $13.71 levels, respectively. Additionally, shares of AEO trade at a P/E ratio of 6.93 and have a Relative Strength Index (RSI) and MACD indicator of 60.54 and -0.02, respectively.

AEO currently prints a one year return of about 9.30%, and a year-to-date return of 5.40%.

American Eagle Outfitters recently traded at $14.89, up 1.78 percent.

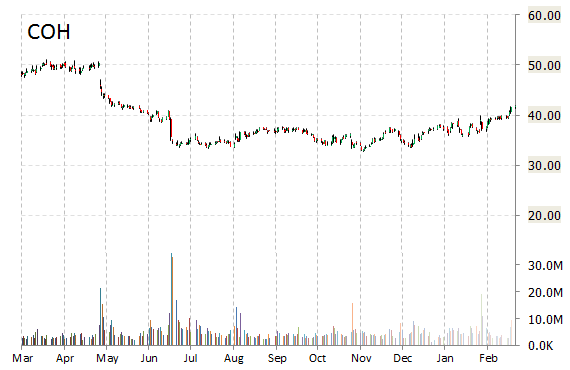

Analysts at Oppenheimer upgraded shares of Coach, Inc. (COH) to ‘Outperform’ from ‘Perform’ and set their price target to $50 in a research report issued to clients on Tuesday. The firm’s new PT points to a potential upside of 16.30% from the stock’s current price-per-share. The firm said it raised its 12-month base case estimate on the name based on higher traffic seen in the company’s outlet unit and a new designer that is helping to stabilize the business.

Coach, Inc., currently valued at $11.85B, recently gained $1.20 to $42.91. In the past 52 weeks, shares of New York-based luxury accessories and lifestyle collections designer have traded between a low of $32.72 and a high of $51.00.

Shares are down 9.42% year-over-year ; up 11.05% year-to-date.

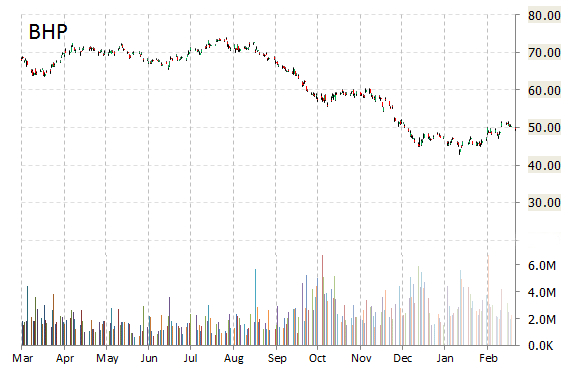

Shares of BHP Billiton Limited (BHP) are up nearly 6% after Macquarie analysts today upgraded the name, giving it an ‘Outperform’ from ‘Neutral’ rating.

BHP shares recently gained $2.79 to $52.34. The stock is down more than 27.30% year-over-year and has gained roughly 4.71% year-to-date. In the past 52 weeks, shares of Melbourne, Australia-based company have traded between a low of $42.92 and a high of $73.91.

BHP Billiton Limited closed Monday at $49.55. The name has a total market cap of $139.25 billion.

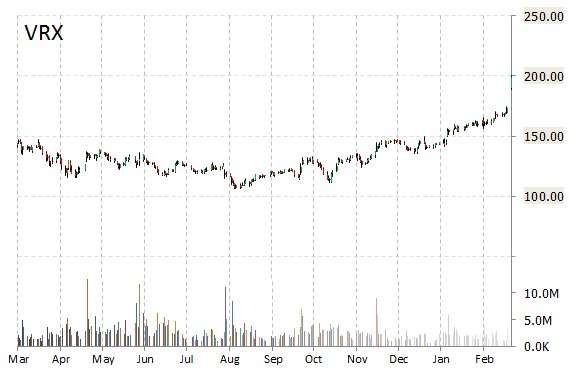

Valeant Pharmaceuticals Int’l, Inc. (VRX) was reiterated a ‘Buy’ by UBS analysts on Tuesday. The broker also raised its price target on the stock to $222 from $165.

VRX shares are currently priced at 136.64x this year’s forecasted earnings, which makes them quite expensive compared to the industry’s 28.02x earnings multiple. Ticker has a price/book of 12.95 and t-12 price-to-sales ratio of 8.29. EPS for the same period is $1.48.

In the past 52 weeks, shares of Laval, Canada-based firm have traded between a low of $106.00 and a high of $204.66 and are now at $202.36. Shares are up 35.89% year-over-year, and 38.88% year-to-date.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply