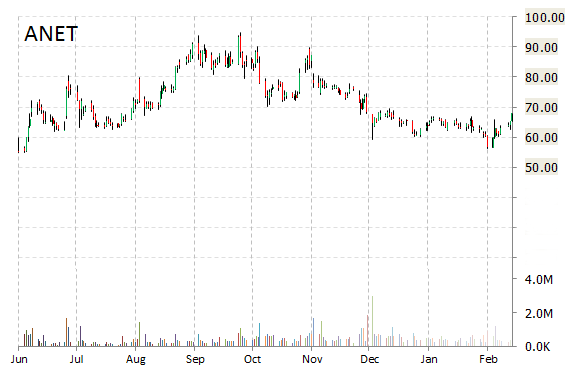

Arista Networks (ANET) was reiterated a ‘Outperform’ by Imperial Capital analysts on Friday. The broker also increased its price target on the stock to $80 from $75.

Arista Networks, Inc., currently valued at $4.54B, has a median Wall Street price target of $80.50 with a high target of $100.00. Approximately 2.94 million shares have already changed hands, compared to the stock’s average daily volume of 581.76K.

In the past 52 weeks, shares of Santa Clara, California-based cloud networking solutions provider have traded between a low of $55.00 and a high of $94.84 with the 50-day MA and 200-day MA located at $63.57 and $73.56 levels, respectively. Additionally, shares of ANET trade at a P/E ratio of 1.45 and have a Relative Strength Index (RSI) and MACD indicator of 65.48 and +5.00, respectively.

ANET currently prints a year-to-date return of around 12%.

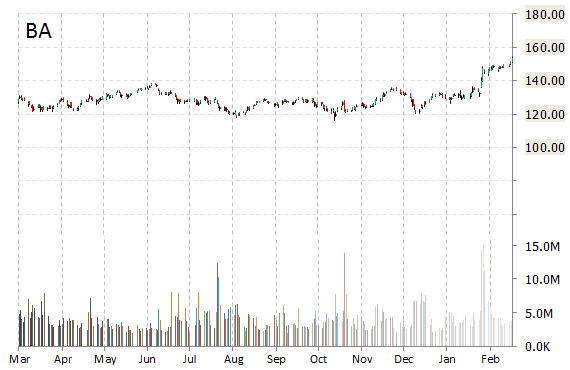

The Boeing Company (BA) was reiterated as ‘Buy’ with a $196 from $164 price target on Friday by Sterne Agee.

The Boeing Company shares are currently priced at 21.43x this year’s forecasted earnings compared to the industry’s (12.85)x earnings multiple. Ticker has a PEG and forward P/E ratio of 1.42 and 17.22, respectively. Price/sales for the same period is 1.19 while EPS is $7.38. Currently there are 13 analysts that rate BA a ‘Buy’, 8 rate it a ‘Hold’. 1 analyst rates it a ‘Sell’. BA has a median Wall Street price target of $157.50 with a high target of $185.00.

In the past 52 weeks, shares of Chicago, Illinois-based company have traded between a low of $116.32 and a high of $158.58 and are now at $158.17. Shares are up 22.62% year-over-year, and 19.02% year-to-date.

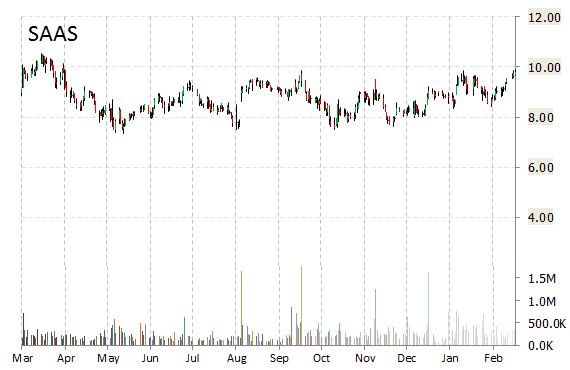

inContact, Inc.’s (SAAS) rating of ‘Overweight’ was reiterated today at Piper Jaffray with a price target increase of $13 from $12 (versus a $9.81 previous close).

inContact shares have surged 26.63% over the past 52 weeks, while the S&P 500 index has gained 14.22% in the same period.

SAAS recently traded at $11.25, up 14.68 percent.

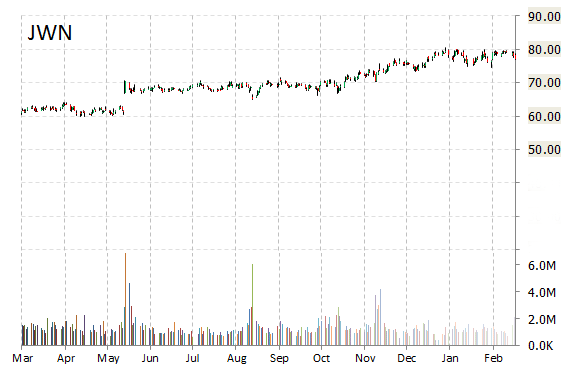

Shares of Nordstrom Inc. (JWN) are up 5.24% in midday trading after Telsey Advisory Group reiterated its ‘Market Perform’ rating and decreased its 12-month base case estimate on the name by five points to $79 a share.

Nordstrom Inc shares recently gained $3.80 to $80.94. In the past 52 weeks, shares of Seattle, Washington-based fashion specialty retailer have traded between a low of $58.26 and a high of $81.23. Shares are up 33.58% year-over-year ; down 2.83% year-to-date.

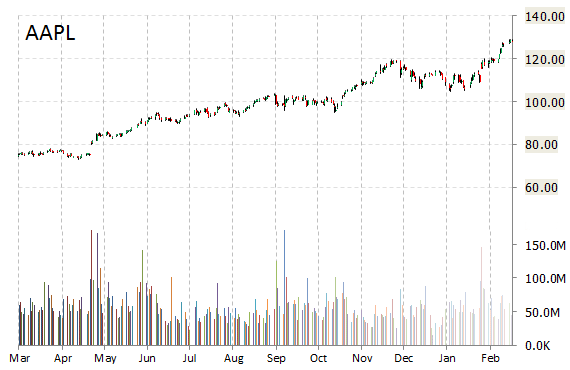

Apple Inc. (AAPL) was reiterated as ‘Buy’ and the price target was raised to $145 from $130 at Goldman Sachs (GS).

AAPL shares recently gained $0.52 to $128.97. The stock is up more than 70.49% year-over-year and has gained roughly 16.83% year-to-date. In the past 52 weeks, shares of the iPhone maker have traded between a low of $73.05 and a high of $129.03.

Apple closed Thursday at $128.45. The name has a total market cap of $751.22 billion.

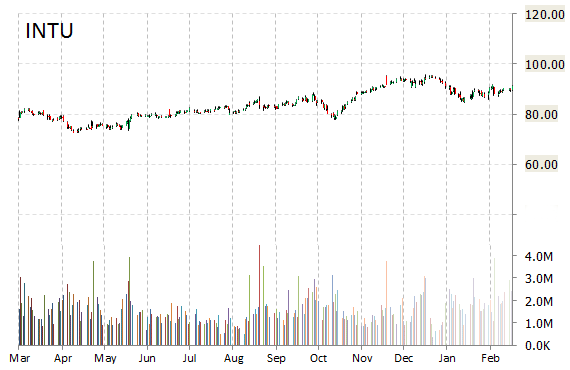

Shares of Intuit Inc. (INTU) are up $5.43, or 6%, at $96.46, after Oppenheimer this morning raised its price target on the shares to $100 from $98, and reiterated an ‘Outperform’ rating.

Intuit Inc shares are currently priced at 33.54x this year’s forecasted earnings, which makes them expensive compared to the industry’s 27.65x earnings multiple. Ticker has a forward P/E of 25.96 and t-12 price-to-sales ratio of 5.71. EPS for the same period is $2.88.

In the past 52 weeks, shares of Mountain View, California-based firm have traded between a low of $72.44 and a high of $96.89. Shares are up 25.44% year-over-year ; down 0.89% year-to-date.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply