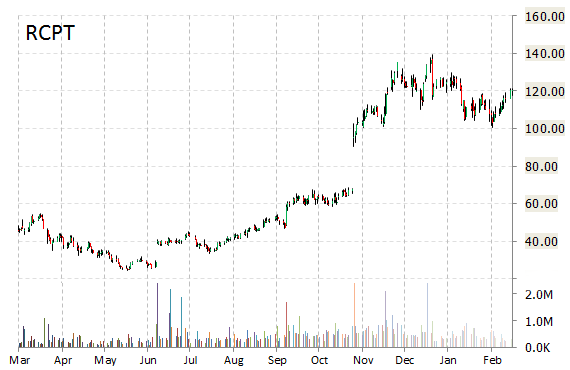

Receptos, Inc. (RCPT) was reiterated as ‘Outperform’ by Credit Suisse analysts on Thursday. The broker also increased its price target on the stock to $140 from $125.

Receptos, Inc., currently valued at $3.29B, has a median Wall Street price target of $161.50 with a high target of $186.00. Approximately 205K shares have already changed hands, compared to the stock’s average daily volume of 561.88K.

In the past 52 weeks, shares of San Diego, California-based biopharmaceutical company have traded between a low of $24.53 and a high of $139.40 with the 50-day MA and 200-day MA located at $114.59 and $89.79 levels, respectively. Additionally, shares of RCPT have a Relative Strength Index (RSI) and MACD indicator of 58.19 and +8.19, respectively.

RCPT currently prints a one year return of 167.18%, and a year-to-date loss of around 2%. Ticker is up 0.22% to $120.30.

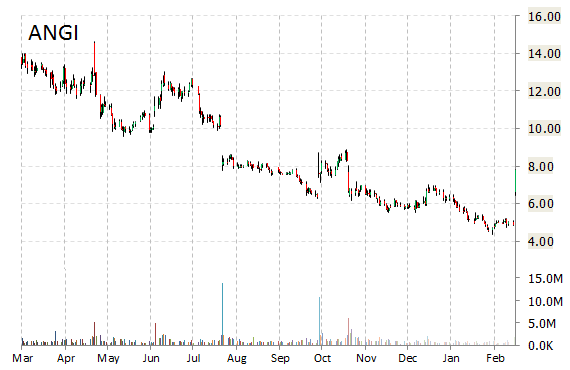

Angie’s List, Inc. (ANGI) was reiterated as ‘Sector Perform’ with a $10.00 from $9.00 price target on Thursday by RBC Capital Markets.

Angie’s List, Inc. shares have a PEG and forward P/E ratio of 4.10 and 21.52, respectively. Price/Sales for the same period is 1.51 while EPS is ($0.42). Currently there are no analysts that rate ANGI a ‘Buy’, 9 rate it a ‘Hold’. 1 analyst rates it a ‘Sell’. ANGI has a median Wall Street price target of $7.00 with a high target of $8.00.

In the past 52 weeks, shares of the Indianapolis, Indiana-based company have traded between a low of $4.36 and a high of $15.03 and are now at $7.07. Shares are down 47.90% year-over-year ; up 25.20% year-to-date.

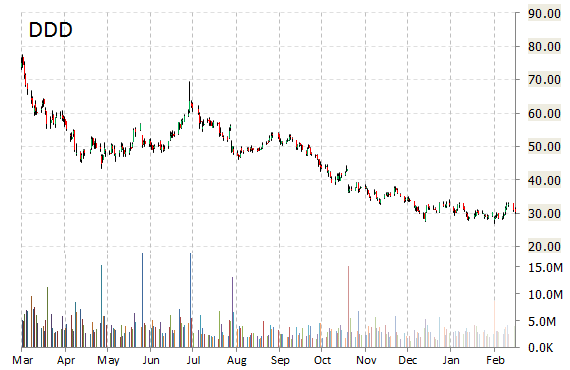

3D Systems Corporation (DDD) rating of ‘Outperform’ was reiterated today at Imperial Capital with a price target decrease of $36 from $42 (versus a $30.41 previous close).

DDD shares recently gained $0.06 to $30.47. In the past 52 weeks, shares of Rock Hill, South Carolina-based company have traded between a low of $27.00 and a high of $82.65. Shares are down 60.58% year-over-year, and 7.48% year-to-date.

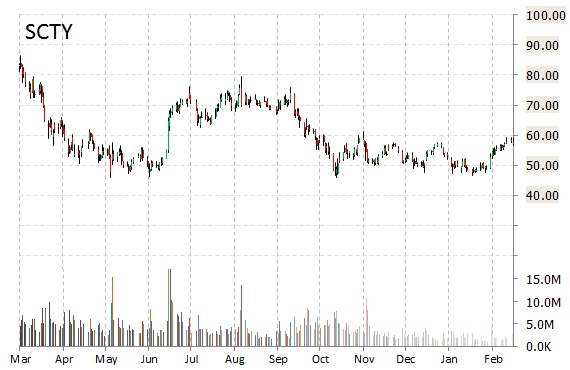

Shares of SolarCity Corporation (SCTY) are down 5.50% in midday trading after Canaccord Genuity reiterated its ‘Buy’ rating and increased its 12-month base case estimate on the name by three points to $67 a share.

SCTY shares recently lost $3.20 to $53.90. The stock is down more than 28% year-over-year and has gained roughly 6.80% year-to-date. In the past 52 weeks, shares of San Mateo, California-based company have traded between a low of $45.79 and a high of $88.35.

SolarCity Corporation closed Wednesday at $57.10. The name has a total market cap of $5.17 billion.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply