Shares of DirecTV (DTV) are fractionally higher to $87.38 in morning trading Thursday following the company’s fourth quarter financial results.

The provider of satellite TV services reported earnings of $1.53 per share on revenues of $8.92 billion, up 3.8% from a year ago. Analysts were expecting EPS of $1.41 on revenues of $8.91 billion. The company said it added 149,000 net subscribers during the quarter.

“Our fourth quarter results, although marked by challenging macroeconomic conditions in Latin America and a conscious decision to reinvest in our U.S. business, capped off another strong year of operations for DirecTV”, said Mike White , President and CEO of DirecTV.

On valuation measures, DirecTV shares, which currently have an average 3-month trading volume of 2.53 million shares, trade at a trailing-12 P/E of 16.09, a forward P/E of 14.12 and a P/E to growth ratio of 2.52. The median Wall Street price target on the name is $95.00 with a high target of $95.00. Currently ticker boasts 2 ‘Buy’ endorsements, compared to 18 ’Holds’ and no ‘Sell’.

Profitability-wise, DTV has a t-12 profit and operating margin of 8.47 and 16.77, respectively. The $43.79B market cap company reported $2.90B in cash vs. $19.76B in debt in its most recent quarter.

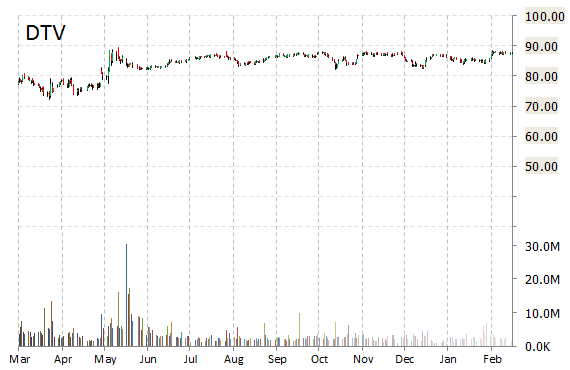

DTV currently prints a one year return of about 20%, and a year-to-date return of 0.75%.

The chart below shows where the equity has traded over the last 52 weeks.

DirecT provides digital TV entertainment services in the United States and Latin America. The company was founded in 1977 and is headquartered in El Segundo, California.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply