SunEdison, Inc. (SUNE) reported fourth quarter non-GAAP EPS of ($0.16) after the bell Wednesday. The company said revenues decreased 34.9% from last year to $625.5 million. Analysts were expecting EPS of ($0.32) on revenues of $682.8 million. GAAP revenue and GAAP EPS came in at $610.5 million and ($0.89), respectively. The stock is now down 3.04% to $21.32.

The St. Peters, Missouri-based company said it will provide Q1’15 and full year outlook on February 24, 2015.

On valuation measures, SunEdison Inc. shares, which currently have an average 3-month trading volume of 11,413,600 shares, trade at a P/E to growth ratio of -12.34. The median Wall Street price target on the name is $28.00 with a high target of $40.00. Currently ticker boasts just 12 ‘Buy’ endorsements, compared to 1 ’Holds’ and no ‘Sell’.

Profitability-wise, SUNE has a t-12 profit and operating margin of (50.50%) and (16.69%), respectively. The $5.97B market cap company reported $846.70M in cash vs. $6.41B in debt in its most recent quarter.

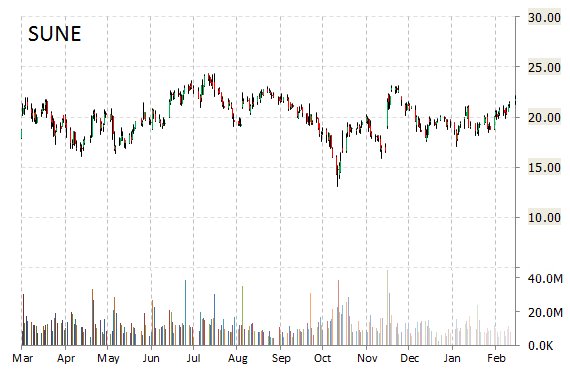

SUNE currently prints a one year return of about 53.45% and a year-to-date return of around 11.84%.

The chart below shows where the equity has traded over the last 52 weeks.

SunEdison Inc. develops and manufactures silicon wafers to the semiconductor industry. The company was founded in 1984 and is headquartered in St. Peters, Missouri.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply