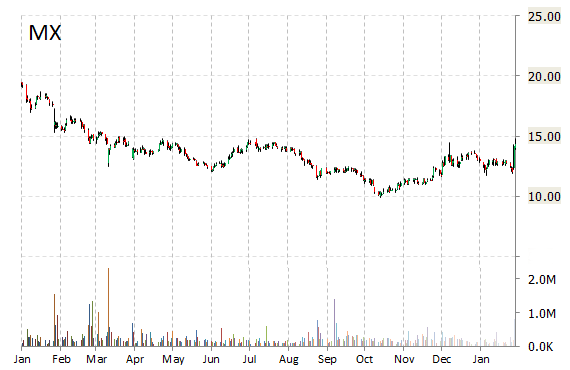

Shares of MagnaChip Semiconductor (MX) are down 50% to $7.51 in midday trading, after Topeka Capital Markets downgraded its rating on the name to ‘Hold’ from ‘Buy’, noting the company has brought its revised financials up to 3Q’14. The move comes on a big volume too with the issue currently trading more than 13.5 million shares, well ahead of its three month daily average of 222K shares.

The brokerage firm lowered its 12-month MX base case estimate to $9 from $14, implying 35.70% expected downside.

MagnaChip Semiconductor is a Luxembourg-based manufacturer of analog and mixed-signal semiconductor products for high-volume consumer apps. Its stock has a median consensus analyst price target of $16 with a high target of $18.00, and a 52-week trading range of $6.40 to $16.48. The T-12 profit margin at MagnaChip is 17.93%. MX revenue for the same period is $856.49 million.

MagnaChip Semiconductor has a current market capitalization of $262 million.

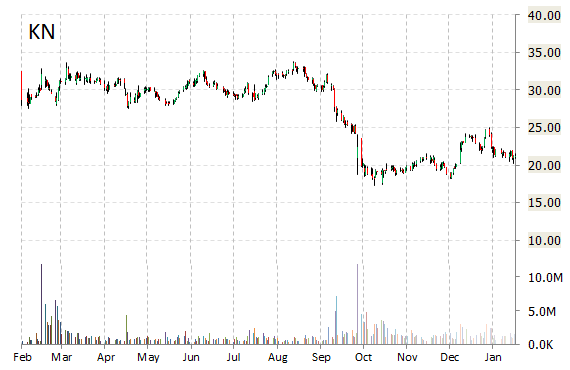

FBR Capital reported on Friday that they have lowered their rating for Knowles Corporation (KN). The firm has downgraded KN from a ‘Market Perform’ to ‘Underperform’ and reduced its price target to $16 from $23.

Shares of Knowles Corporation plummeted nearly 14% in midday trading today. The plunge comes one day after the company reported Q4 EPS of $0.14 on revenue of $286.1 million, missing Wall Street estimates of $0.34 in earnings and $290.71 million revenue. For Q1’15 the company guided EPS and revs below consensus.

KN shares recently lost $2.98 to $18.66. In the past 52 weeks, shares of Itasca, Illinois-based firm have traded between a low of $17.23 and a high of $33.82. Shares are down 8.11% in the year-to-date, while the S&P 500 has gained 13.59%.

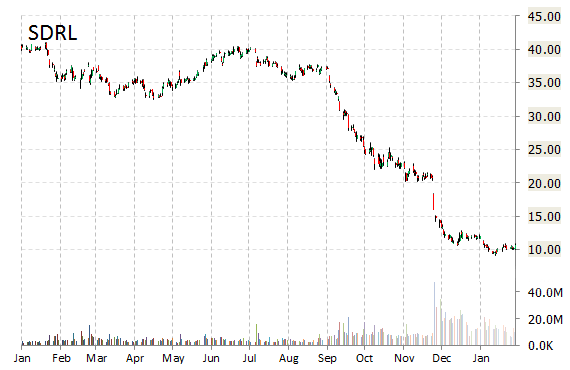

Analysts at Cowen downgraded this morning their rating on the shares of SeaDrill Limited (SDRL) to ‘Market Perform’ and lowered their price target to $10 from $12, noting the company was removing $1.1 billion worth of Petrobras (PBR) orders from its backlog due to the ongoing corruption scandal at the Brazilian state-run oil company. Petrobras produces over 90% of Brazil’s oil.

SDRL shares recently lost $0.74 to $12.28. Cowen’s 12-month base case estimate suggests a potential downside of about 19% from the company’s current stock price.

In the past 52 weeks, shares of Hamilton, Bermuda-based offshore drilling contractor have traded between a low of $9.18 and a high of $40.44. Shares are down 60.50% year-over-year ; up 9.05% year-to-date.

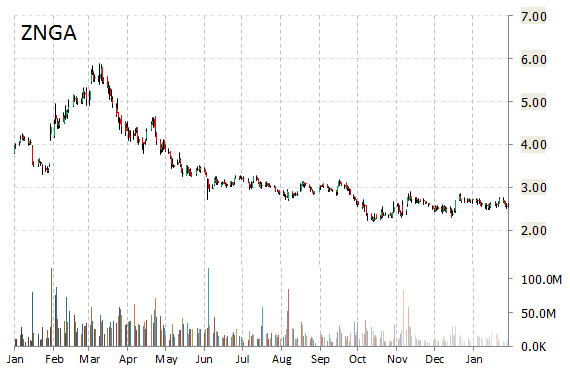

Shares of Zynga, Inc. (ZNGA) were lowered to $2.50 from $4.00 with a ‘Hold’ rating by Canaccord Genuity on Friday.

Zynga, Inc., currently valued at $2.01B, has a median Wall Street price target of $3.00 with a high target of $6.00. Approximately 65.97M shares have already changed hands, compared to the stock’s average daily volume of 12.49M.

In the past 52 weeks, shares of San Francisco, Calif.-based company have traded between a low of $2.20 and a high of $5.89 with the 50-day MA and 200-day MA located at $2.65 and $2.69 levels, respectively. Additionally, shares of ZNGA trade at a P/E ratio of 2.96 and have a Relative Strength Index (RSI) and MACD indicator of 31.41 and -0.06, respectively.

ZNGA currently prints a one year loss of about 45%. The ticker was last trading at $2.22, down 16.54%.

Leave a Reply