In a report published Monday, Canaccord Genuity analysts reiterated a ‘Buy’ rating on shares of Apple Inc. (AAPL), and raised the price target from $135.00 to $145.00.

In the report, CG noted that further high-end smartphone market share gains for the larger screen iPhone 6 devices, together with growing iPhone user base should drive steady long-term iPhone sales and strong cash flows.

Apple shares recently gained $0.60 to $119.53. In the past 52 weeks, shares of Cupertino, Calif.-based tech giant have traded between a low of $73.05 and a high of $120.51. Shares are up 65.53% year-over-year, and 8.17% year-to-date.

Apple closed on Monday at $51.86. The company currently has a total market cap of $685 billion.

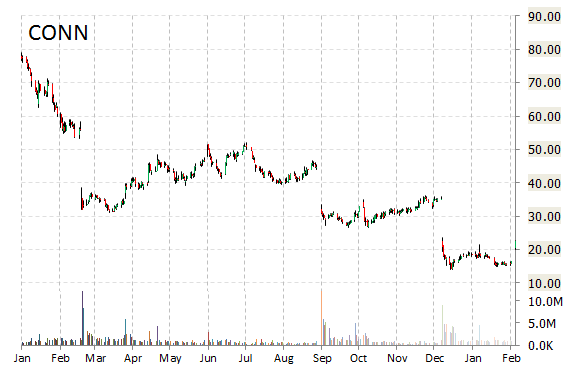

On Monday, Stifel analysts upgraded to ‘Buy’ from ‘Hold’ and set a $33 price target on shares of Conns Inc. (CONN). Within the report, the firm notes that they believe the company’s current price-per-share assumes significant further deterioration in credit performance from here forward when there are numerous data points that retailer’s credit is getting “less bad”.

Conns shares recently gained $2.10 to $24.59. The stock is down more than 59% year-over-year and has gained roughly 21% year-to-date. In the past 52 weeks, shares of The Woodlands, Texas-based durable consumer goods retailer have traded between a low of $14.02 and a high of $58.99.

Conns Inc. closed Friday at $22.49. The name has a total market cap of $892.62 million.

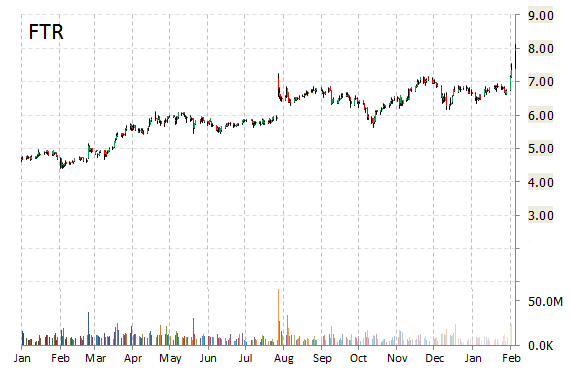

Shares of Frontier Communications Corp. (FTR) are up 1.40% to $8.03 in midday trading after being raised by Citigroup (C) to ‘Neutral’ from ‘Sell’. The investment firm also raised its price target on the stock to $8.50 from $4.50.

From a sentiment standpoint, Frontier has 2 ‘Buys’, 8 ‘Holds’, 3 ‘Underperforms’ and one ‘Sell’. Ticker is up more than 86% year-over-year and has gained roughly 19% year-to-date.

Frontier plans to release its full Q4 and FY14 results on February 19th.

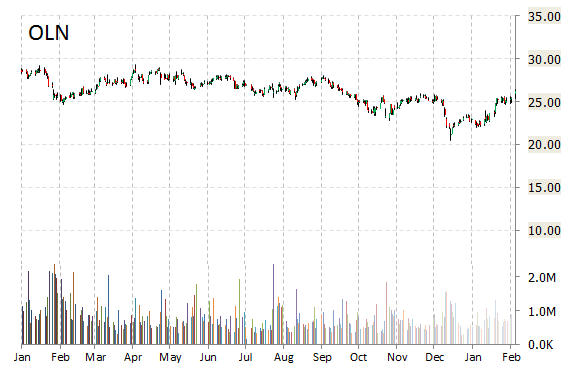

Olin Corp. (OLN) shares jumped nearly 4% Monday, after the manufacturer of chlor alkali products was upgraded by analysts at Longbow to a ‘Neutral’ rating.

On valuation measures, Olin Corp. shares are currently priced at 20.41x this year’s forecasted earnings compared to the industry’s 27.59x earnings multiple. Ticker has a PEG and forward P/E ratio of 3.12 and 13.79, respectively. Price/Sales for the same period is 0.91 while EPS is $1.33. Currently there are 3 analysts that rate OLN a ‘Buy’, 4 rate it a ‘Hold’. 1 analyst rates it a ‘Sell’. OLN has a median Wall Street price target of $26.00 with a high target of $32.00.

In the past 52 weeks, shares of Clayton, Missouri-based company have traded between a low of $20.43 and a high of $29.28 and are now at $27.13. Shares are up 6.76% year-over-year, and 16.02% year-to-date.

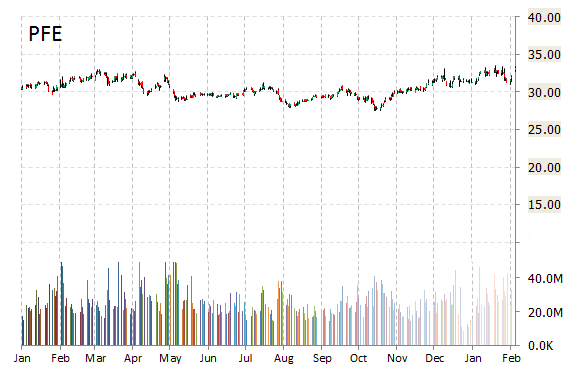

Analysts at BMO Capital upgraded their Pfizer Inc. (PFE) rating to ‘Outperform’ from ‘Market Perform’ and set a price target to $36 from $33 in a research report issued to clients on Monday.

Pfizer Inc. (PFE) gained 0.08 to $33.24 in mid-day trading today. Approximately 16.09M shares have already changed hands, compared to the stock’s average daily volume of 26.50M shares.

On valuation-measures, shares of Pfizer Inc. (PFE) have a trailing-12 and forward P/E of 23.46 and 14.99, respectively. P/E to growth ratio is 7.31, while t-12 profit margin is 18.42%. EPS registers at 1.42. The company has a market cap of $209.47B and a median Wall Street price target of $35.00 with a high target of $40.00.

On trading-measure, PFE has a beta of 0.75 and a short float of 1.12%. In the past 52 weeks, shares of healthcare products maker have traded between a low of $27.51 and a high of $33.50 with its 50-day MA and 200-day MA located at $32.11 and $30.29 levels, respectively.

PFE currently prints a one year return of about 11.50%, and a year-to-date return of 7.42%.

Leave a Reply