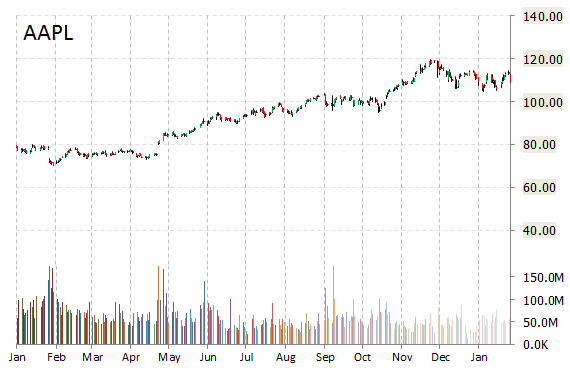

Shares of Apple Inc. (AAPL) hit a new 52-week high Friday, trading above $120. It’s previous high had been $119. That’s a 68.23% rise, or $48.67 per share from the 52-week low of $71.33 set on February 3, 2014.

The stock closed at $117.30 at the end of Friday’s trading session, printing a solid one-year return of about 50.19% and year-to-date return of around 6%, outperforming the S&P 500 by more than 35% on a yoy basis. The average volume of shares traded over the last three months was roughly 52.3 million.

On Tuesday Apple posted the biggest quarterly profit in corporate history, earning $3.06 per share, $0.46 above estimates, on revenue of $74.6 billion. The mega quarter was led by record sales of iPhone 6 and iPhone 6 Plus models during the holiday season.

Apple CEO Tim Cook said consumer demand for new iPhones has been “staggering” and “hard to comprehend.” Customers snapped up a record 74.5 million iPhones, up 46% from last year. Analysts were expecting 67 million to 70 million.

Apple currently has a market cap of $682.43 billion and a 5-year expected growth of 64%. The trailing-twelve-month revenue at Apple is $199.80 billion. AAPL’s EPS for the same period is $7.39. Even after the rally on Friday, the stock only trades at 12.87x next year’s earnings estimate, making it cheaper than the average stock on the S&P 500 based on FY’16 numbers.

The chart below shows where the equity has traded over the past year.

Leave a Reply