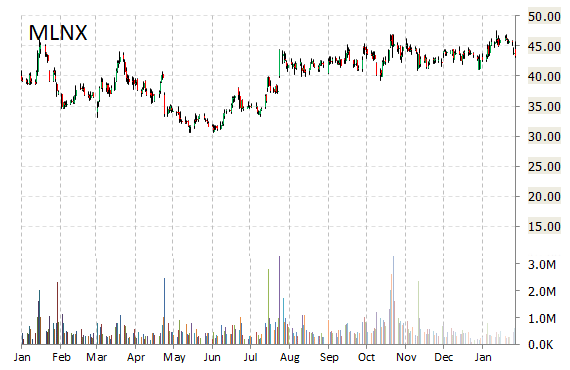

Mellanox Technologies, Ltd. (MLNX) gained $1.54 to $44.92 in mid-day trading today after the company reported stronger than expected Q4 results. Approximately 1.99M shares have already changed hands, compared to the stock’s average daily volume of 474.60K shares. MLNX had its price target raised to $63 from $53 at Stifel. The firm currently has a ‘Buy’ rating on the stock.

Mellanox currently prints a one year return of about 7%, and a year-to-date return of 1.52%.

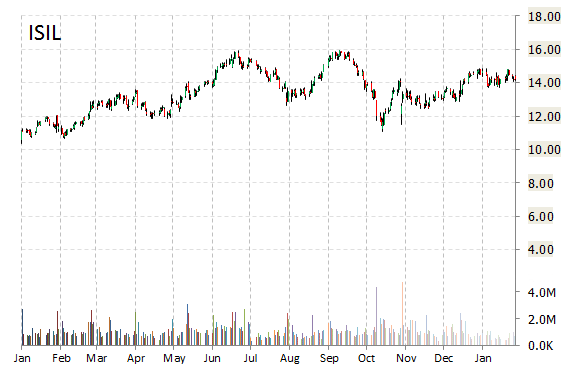

Analysts at Craig Hallum are out with a report this morning upgrading shares of Intersil Corporation (ISIL) with a ‘Buy’ from ‘Hold’ rating. Separately, Northland Capital came out with an upgrade, raising the price target on the shares to $19 from $17, maintaining an ‘Outperform’ rating on the shares.

ISIL shares are currently priced at 39.89x this year’s forecasted earnings, which makes them expensive compared to the industry’s 11.91x earnings multiple. Ticker has a forward P/E of 17.92 and t-12 price-to-sales ratio of 3.20. EPS for the same period is $0.35.

In the past 52 weeks, shares of the Milpitas, California-based firm have traded between a low of $10.66 and a high of $15.95 and are now at $13.88. Shares are up 29.23% year-over-year ; down 1.94% year-to-date.

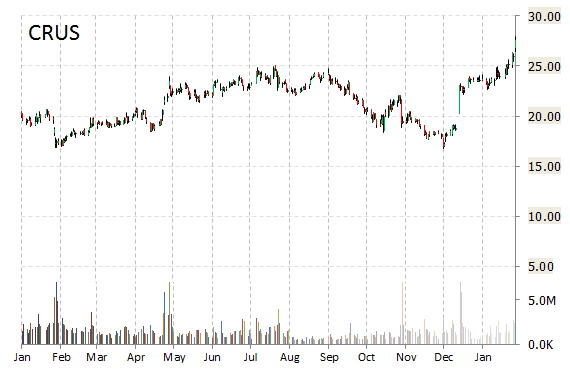

Shares of Cirrus Logic Inc. (CRUS) were upgraded to a ‘Buy’ rating from ‘Neutral’ by Sidoti on Thursday. CRUS was also upgraded at Northland Capital. Price target was raised to $35 from $30. The firm currently has an ‘Outperform’ rating on the stock.

In the past 52 weeks, shares of the semiconductor company have traded between a low of $16.80 and a high of $27.95 with the 50-day MA and 200-day MA located at $23.48 and $21.89 levels, respectively. Additionally, shares of CRUS trade at a P/E ratio of 1.86 and have a Relative Strength Index (RSI) and MACD indicator of 65.84 and +1.92, respectively.

CRUS currently prints a one year return of about 47%, and a year-to-date return of around 17%.

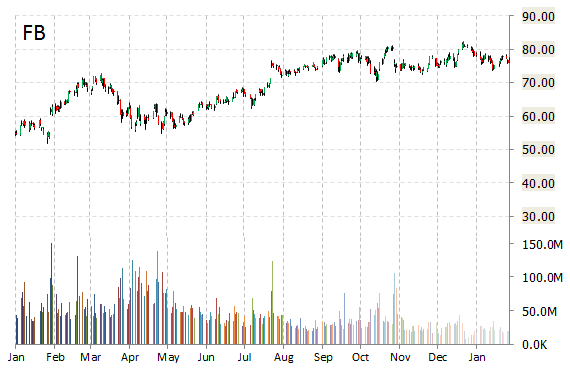

Facebook, Inc. (FB) gained $0.37 to $76.61 in mid-day trading today, after a flurry of upgrades from the buy-side following the company’s fourth quarter. FB results were solid but analysts expressed concerns about an increase in the firm’s operating expenses (up 50% yoy).

Following the results, Cantor raised the price target for Facebook shares to $90 from $80 with a ‘Buy’ rating. Separately, Goldman, Jefferies, Credit Suisse, Canaccord Genuity and Janney came out with upgrades this morning, raising the price target on the shares to $90 from $85, $105 from $100, $104 from $102, $90 from $88 and to $80 from $78, respectively.

On valuation-measures, Facebook shares have a trailing-12 and forward P/E of 71.23 and 29.97, respectively. P/E to growth ratio is 1.11, while t-12 profit margin is 24.66%. EPS registers at $1.08. The company has a market cap of $213.86B and a median Wall Street price target of $90.00 with a high target of $105.00.

On trading-measure, FB has a beta of 0.77 and a short float of 1.43%. In the past 52 weeks, shares of the social networking giant have traded between a low of $54.66 and a high of $82.17 with its 50-day MA and 200-day MA located at $77.55 and $75.67 levels, respectively.

FB currently prints a one year return of about 38.27%, and a year-to-date loss of around 2.28%.

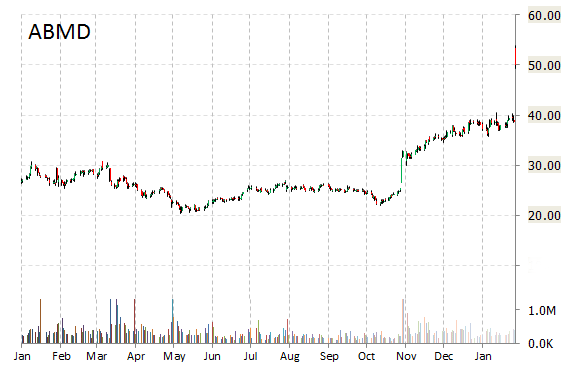

Shares of Abiomed, Inc. (ABMD) are up $1.01 to $50.95 in mid-day trading today after analysts at Leerink Partners issued an upgrade on the name. LP raised the price target for ABMD shares to $60 from $43 with an ‘Outperform’ rating.

Abiomed shares are currently priced at 222.62x this year’s forecasted earnings compared to the industry’s 22.72x earnings multiple. Ticker has a PEG and forward P/E ratio of 15.49 and 85.29, respectively. Price/Sales for the same period is 9.62 while EPS is $0.24. Currently there are 4 analysts that rate ABMD a ‘Buy’, 5 rate it a ‘Hold’. No analyst rates it a ‘Sell’. ABMD has a median Wall Street price target of $43.00 with a high target of $60.00.

Leave a Reply