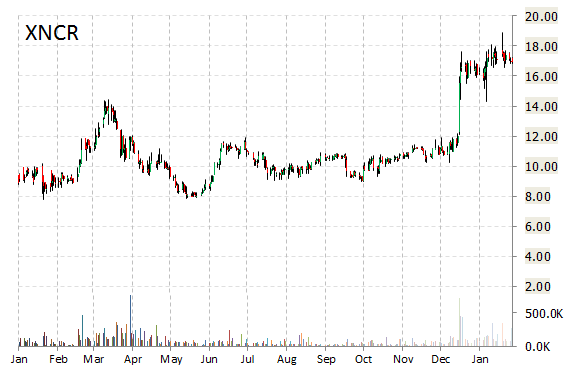

Xencor, Inc. (XNCR) is trading at unusually high volume Thursday with 1.26 million shares changing hands. It is currently at more than 10x its average daily volume and trading down $1.19, or 7%, at $15.73 as of 3:30 p.m. ET. Xencor today reported top-line interim results from a Phase 1a study for XmAb 7195. The company said the study showed rapid reduction of Serum IgE in healthy volunteers.

“These results demonstrate for the first time that XmAb7195’s first-in-class mechanism of action which targets IgE and FcγRIIb can be effective at reducing both free and total IgE from the circulation in humans,” said Paul Foster, M.D., chief medical officer of Xencor.

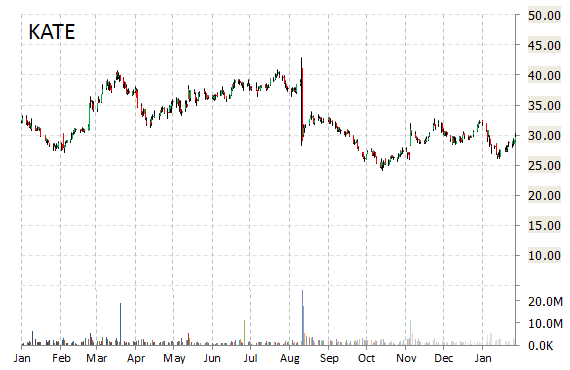

Kate Spade & Co. (KATE) soared more than 12% to an intraday high of $33.40, after the luxury retailer said its full-year sales jumped 40%. The move comes on a big volume too with the issue currently trading more than 8.3 million shares, compared to the average volume of 2.24 million shares.

On valuation measures, Kate Spade & Company, currently valued at $4.06B, has a median Wall Street price target of $35.00 with a high target of $41.00.

In the past 52 weeks, shares of the New York-based company have traded between a low of $24.07 and a high of $42.87 with the 50-day MA and 200-day MA located at $29.26 and $30.67 levels, respectively. Additionally, shares of KATE trade at a P/E ratio of 2.64 and have a Relative Strength Index (RSI) and MACD indicator of 63.92 and +1.99, respectively.

KATE currently prints a one year return of 5.43%, and a year-to-date loss of 7.12%.,

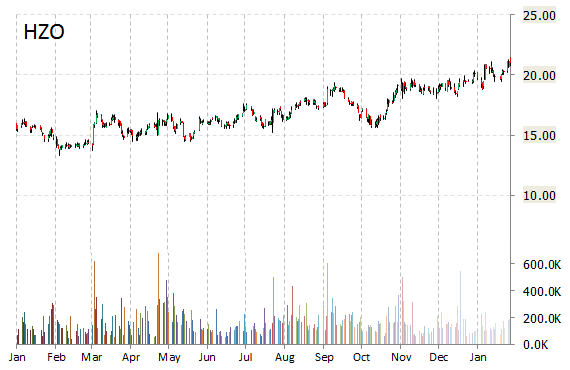

Shares of Marinemax Inc.(HZO) are higher by 19% to $24.99 in late trading on Thursday, as the stock continues to see gains following the company’s first quarter results that topped Wall Street estimates. HZO reported 1Q net income of $214,000, after reporting a loss on a year-over-year basis. Ticker is trading at unusually high volume with 1.45 million shares changing hands, 7x its average daily volume.

Marinemax Inc. shares are currently priced at 54.11x this year’s forecasted earnings compared to the industry’s 14.74x earnings multiple. Ticker has a PEG and forward P/E ratio of 1.19 and 19.59, respectively. Price/Sales for the same period is 0.81 while EPS is $0.46. Currently there are 5 analysts that rate HZO a ‘Buy’, 2 rate it a ‘Hold’. No analyst rates it a ‘Sell’. HZO has a median Wall Street price target of $22.00 with a high target of $23.00.

In the past 52 weeks, shares of Clearwater, Florida-based company have traded between a low of $13.33 and a high of $25.45. Shares are up 37.64% year-over-year, and 4.69% year-to-date.

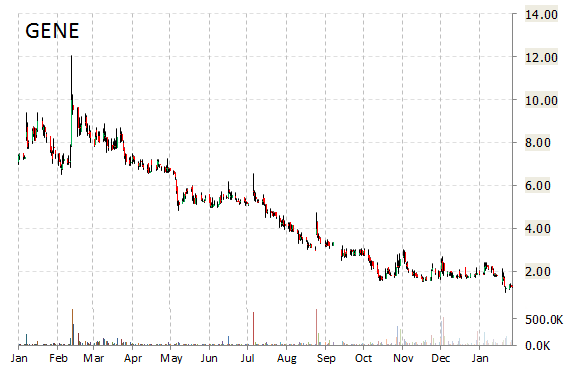

Genetic Technologies Limited (GENE) gained ‘only’ 187% this session. The company reported that up to 6 new breast diagnosis/treatment centres are expected to begin offering BREVAGenplus to their at-risk patients in a systematic broad fashion in the January to March timeframe, with a growing number of additional new breast and imaging centre customers expected to follow later in calendar year 2015. As a result, the Genetic Tech expects sales growth to accelerate in the second half 2015 and beyond.

In the past 52 weeks, shares of Fitzroy, Australia-based company have traded between a low of $1.04 and a high of $12.05 and are now at $2.02. Shares are down 49.66% year-over-year ; up 89.56% since the beginning of the year.

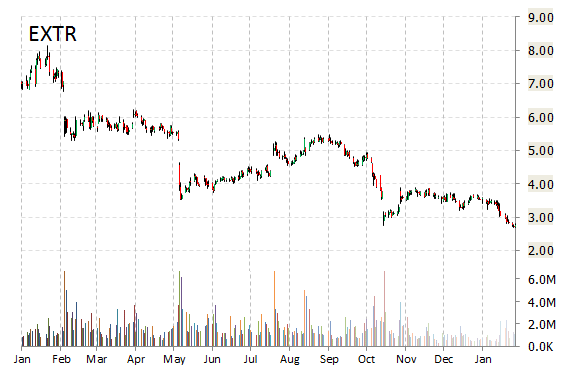

Extreme Networks‘ (EXTR) stock popped more than 9% Thursday, after the company’s second quarter results exceeded Wall Street expectations. On an EPS basis, the San Jose, California-based company beat by $0.01. The average estimate of analysts was for earnings of $0.04.

In other EXTR news, SignalShare and Extreme Networks announced that the National Hockey League’s Detroit Red Wings have selected and deployed the companies’ high density Wi-Fi solution at Hockeytown’s Joe Louis Arena in Detroit, Michigan.

In the past 52 weeks, shares of the Sunnyvale, California-based company have traded between a low of $2.68 and a high of $7.49. In the final minutes of trading on Thursday, the company’s shares printed the tape at $3.04. Shares are down 61.66% year-over-year, and 21.25% year-to-date.

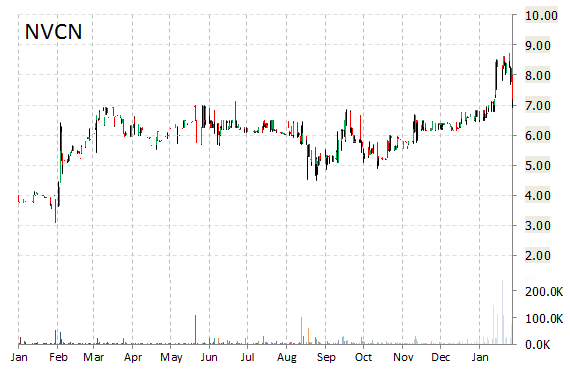

Neovasc Inc. (NVCN) today announced that due to market interest has increased the size of its underwritten public offering from 8 million common shares to 10.5 million common share. The company also announced that it has priced the offering at $7.19 per share.

Neovasc Inc. said it is offering 8,840,000 of the 10,500,000 common shares in the offering. The company anticipates aggregate gross proceeds of $63,559,600 and $11,935,400 for the Selling Securityholders.

NVCN shares gained 25.17% intraday to $9.00. In the past 52 weeks, shares of Richmond, Canada-based specialty medical device company have traded between a low of $3.08 and a high of $9.35. Shares are up 128% year-over-year, and 32% year-to-date.

Leave a Reply