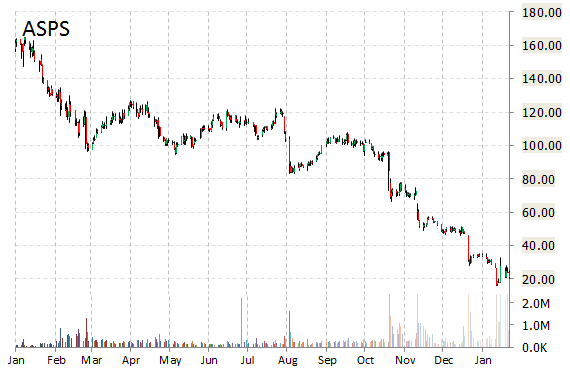

Altisource Portfolio Solutions S.A. (ASPS) shares gained 22% to $26 in Monday’s pre-market trading session following Leon Cooperman’s 5.06% passive stake in the company.

Altisource Portfolio Solutions is currently valued at $431.57 million. The company has a median Wall Street price target of $20.00 with a high target of $46.00.

In the past 52 weeks, shares of Luxembourg-based company have traded between a low of $16.00 and a high of $138.94 with the 50-day MA and 200-day MA located at $35.08 and $76.17 levels, respectively. Additionally, shares of ASPS trade at a P/E ratio of 0.21 and have a Relative Strength Index (RSI) and MACD indicator of 36.33 and -1.87, respectively.

ASPS currently prints a one year loss of about 85%, and a year-to-date loss of around 37%.

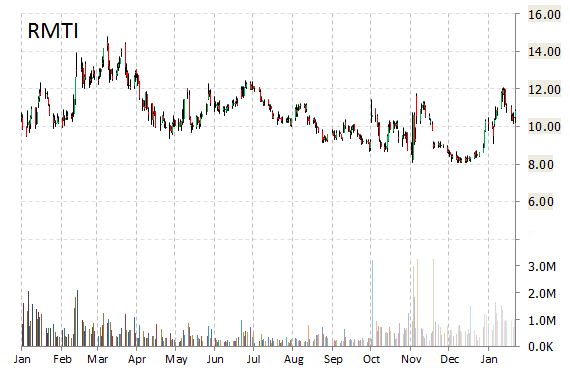

Rockwell Medical, Inc. (RMTI) – The company today announced that it receives FDA Approval for Triferic for iron replacement and maintenance of hemoglobin in hemodialysis patients.

“We are extremely pleased with the FDA approval of Triferic. It is the first drug approved to replace ongoing iron losses and to maintain hemoglobin levels in hemodialysis patients,” Robert L. Chioini, Founder, Chairman and CEO of Rockwell said in a statement.

On valuation measures, Rockwell Medical shares have a PEG and forward P/E ratio of (0.89) and 43.24, respectively. Price/Sales for the same period is 8.48 while EPS is ($0.58). Currently there are 3 analysts that rate RMTI a ‘Buy’, 1 analyst rates it a ‘Sell’. RMTI has a median Wall Street price target of $17.50 with a high target of $24.00.

In the past 52 weeks, shares of Wixom, Michigan-based biopharmaceutical company have traded between a low of $8.10 and a high of $14.80 and are now up 15.63% to $12.50. Shares are up 2.08% year-over-year, and 5.16% year-to-date.

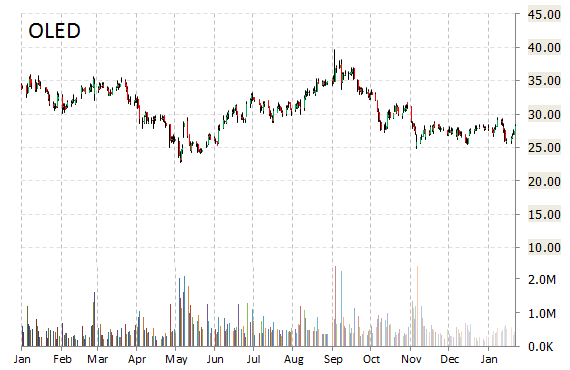

Universal Display Corp (OLED) shares jumped 21.49% in pre-market trading after the company announced the signing of a new OLED Technology License Agreement and Supplemental Material Purchase Agreement. The agreements run through December 31, 2022.

Universal Display said that under the license agreement it has granted LG Display non-exclusive license rights under various patents owned or controlled by Universal Display to manufacture and sell OLED display products. In consideration of the license grant, LG Display has agreed to pay Universal Display license fees and running royalties on its sales of these licensed products over the term of the agreement. Additionally, Universal Display will supply phosphorescent materials to LG Display for use in its licensed products.

OLED shares recently gained over six points $34.25. In the past 52 weeks, shares of Ewing, New Jersey-based developer of organic light emitting diode technologies have traded between a low of $22.69 and a high of $39.72. Ticker is down 12.75% year-over-year ; up 1.62% year-to-date.

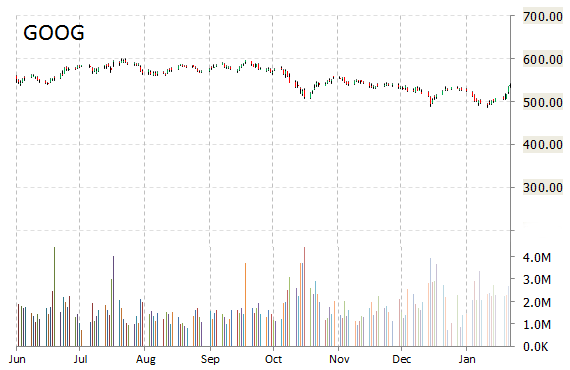

Google Inc. (GOOG) — The search giant has signed a deal to distribute NFL video, according to a Re/code report. The publication said that starting this week, official NFL highlight clips will show up in Google’s YouTube, as well as in Google search results themselves. Google will also sell ads against the league’s information and clips and share revenue with the NFL, and will promote the NFL on YouTube and in other places.

Google shares were flat at $539.88 in premarket trading and are down 3.81% year-over-year, while the S&P 500 has gained 15.17%.

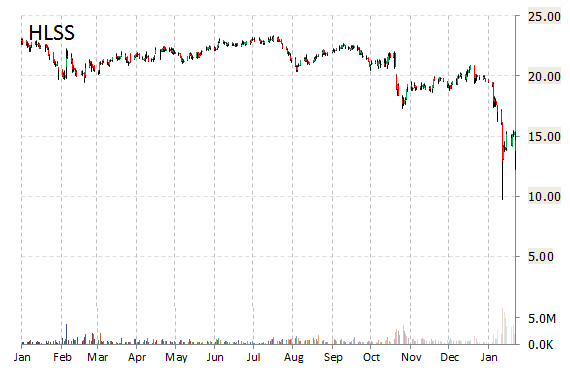

Home Loan Servicing Solutions, Ltd. (HLSS) spiked over 8% in pre-market trading in sympathy with peer company Ocwen Financial (OCN).

Residential and commercial mortgage provider Ocwen Financial has agreed to pay a $2.5 million penalty and hire outside accountants to settle a mortgage servicing dispute with the state of California over the firm’s failure for more than a year to provide loan information needed by the the California Department of Business Oversight to assess Ocwen’s compliance with state mortgage lending laws.

Shares of HLSS gained $1.14 to $14.90, giving it a market capitalization of roughly $1 billion. The stock traded as high as $23.38 in July 18, 2014. OCN is up $1.63, or 25.67%, to $7.98. Ticker traded as high as $47.44 in January 27, 2014. In the past 52-weeks it has plunged nearly 87%.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply