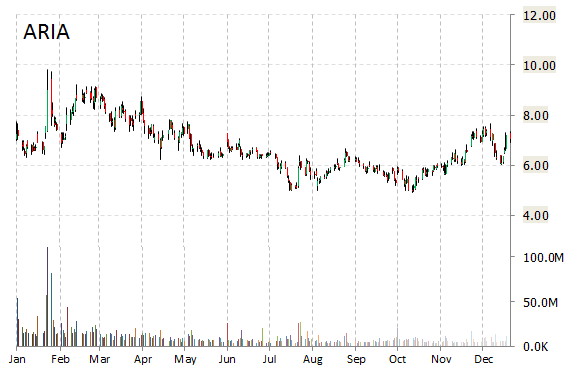

Shares of Ariad Pharmaceuticals Inc. (ARIA) are up nearly 6% to $7.48 in early trading Tuesday, as investors react to news the company has entered into an agreement for Otsuka to commercialize ARIAD’s Iclusig in Japan and nine other Asian countries and to fund future clinical trials in those countries. The agreement allows ARIAD to receive upfront payment of $77.5 million.

Ariad Pharma currently valued at $1.32 billion, has a median Wall Street price target of $8.00 with a high target of $14.00.

In the past 52 weeks, shares of the Cambridge, Massachusetts-based firm have traded between a low of $4.90 and a high of $9.83 with the 50-day MA and 200-day MA located at $6.60 and $6.07 levels, respectively. Additionally, shares of ARIA trade at a P/E ratio of -0.16 and have a Relative Strength Index (RSI) and MACD indicator of 56.97 and +0.13, respectively.

ARIA currently prints a one year return of about 9.80% and a year-to-date return of around 3.52%.

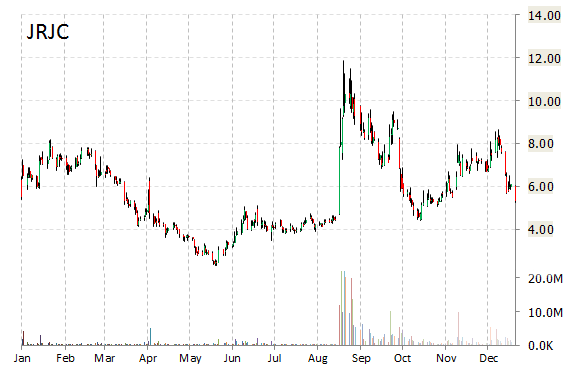

China Finance Online Co. (JRJC) is a big mover this pre-market session, as its shares are up nearly 24% to $6.54. The surge came after the company said Q3 net revenues increased by 61% to $21.1 million, compared with $13.2 million in Q3’13. Gross profit jumped 41% yoy to $16.0 million. JRJC also said non-GAAP net income attributable to the company came in at $1.1 million, compared with a non-GAAP net loss of $1.0 million in the third quarter of 2013.

On valuation measures, China Finance Online shares have a t-12 price/sales ratio of 1.60 and a price/book for the same period of 2.24. EPS is ($0.40). The Beijing-based company has a market cap of $116.20 million and a median Wall Street price target of $8.30.

Fundamentally, JRJC shows the following financial data:

· $20.39 million in cash

· $133.4 million total current assets

· $83.42 million t-12 total revenue

· ($8.10) million quarterly net income

Shares of China-based integrated financial information and services provider are up 20.91% year-over-year ; down 15.42% year-to-date.

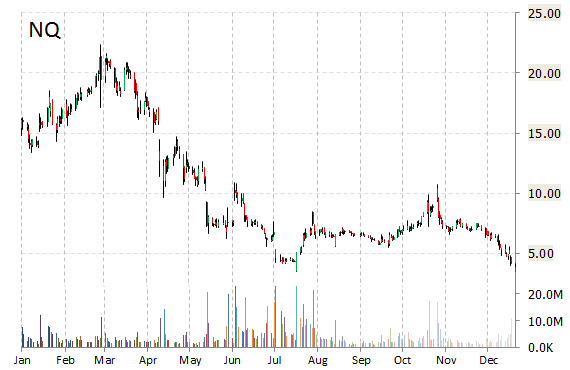

Shares of NQ Mobile Inc. (NQ) are up almost 17% to $4.05 in pre-market trading Tuesday following the co.’s announcement that its board of directors has authorized a share repurchase program under which NQ may repurchase up to $80 million of its shares over the next 12 months. NQ Mobile said it plans to fund repurchases made under this plan from its existing cash balance.

On valuation measures, NQ Mobile Inc. shares have a PEG and forward P/E ratio of 0.09 and 2.08, respectively. Price/Sales for the same period is 1.85 while EPS is ($0.05). NQ has a median Wall Street price target of $33.00.

In the past 52 weeks, shares of Beijing, China-based mobile Internet services provider have traded between a low of $3.45 and a high of $22.33. Shares are down 69.91% year-over-year and 76.46% year-to-date.

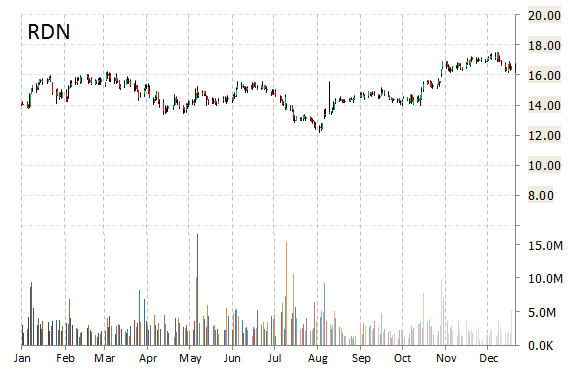

Radian Group Inc. (RDN) shares are currently printing a large uptick, gaining 6% from the previous close following an announcement that said the co. has entered into a stock purchase agreement to sell 100% of the issued and outstanding shares of Radian Asset Assurance to Assured Guaranty for a purchase price of $810 million. The purchase price is payable in cash and allows for a complete transfer of Radian Asset’s $19.4 billion in net par outstanding to Assured Guaranty Corp. as of Sept. 30, 2014. The company expects to complete the sale of Radian Asset in the first half of 2015.

Radian Group shares are currently priced at 6.05x this year’s forecasted earnings compared to the industry’s x earnings multiple. Ticker has a PEG and forward P/E ratio of 0.40 and 10.50, respectively. Price/Sales for the same period is 2.44 while EPS is $2.69. Currently there are 8 analysts that rate RDN a ‘Buy’, 2 rate it a ‘Hold’. No analysts rates it a ‘Sell’. RDN has a median Wall Street price target of $19.00 with a high target of $26.00.

In the past 52 weeks, shares of Philadelphia, Pennsylvania-based credit enhancement firm have traded between a low of $12.18 and a high of $17.50 and are now at $17.25. Shares are up 16.95% year-over-year and 15.38% year-to-date.

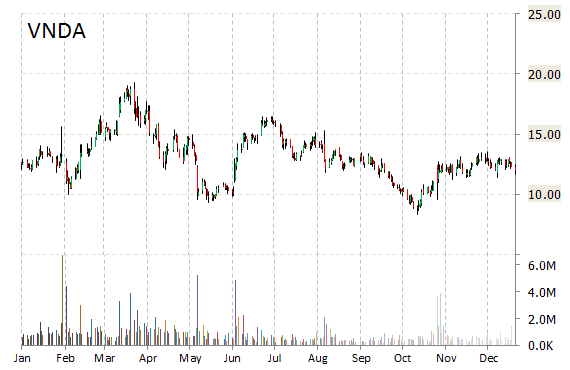

Vanda Pharmaceuticals, Inc. (VNDA) is seeing a big move Tuesday, as the company’s shares are up by over 20% on news the drugmaker struck a settlement with Novartis in which Vanda regained the rights to the schizophrenia treatment Fanapt in the U.S. and Canada.

Shares of Washington, DC-based biopharmaceutical company have risen 7.59% year-over-year ; down 4.03% year-to-date. The name has a median Wall Street price target of $27.50 with a high target of $30.

Shares of Vanda Pharmaceuticals gained $2.48 to $14.39 in recent trading.

Leave a Reply