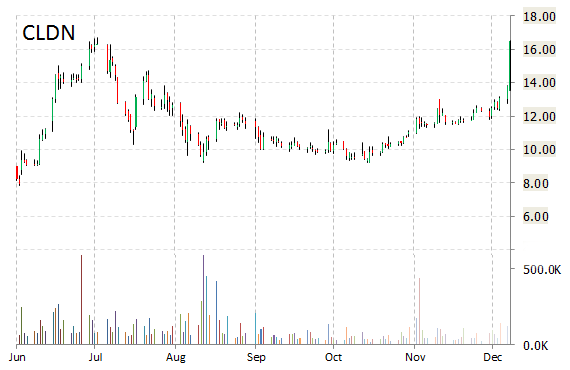

Celladon Corporation (CLDN) shares are up close to 18% to about $16.25 in mid-day trading Tuesday. The move comes on a big volume too with the issue currently trading more than 773K shares, compared to the normal trading volume of 64,636K shares a day. The gene therapy firm is up in sympathy with bluebird bio, Inc (BLUE) following positve data at the 56th Annual Meeting of the American Society of Hematology (ASH) in San Francisco.

Fundamentally, CLDN shows the following financial data:

· $95.12 million cash

· $18,550 total current assets

· $9.91 million total debt

· ($29.55) million quarterly net income

On valuation measures, Celladon Corp. shares have a current ratio of 19.55 and a price-to-book ratio of 3.92. EPS is ($2.28). CLDN has a market cap of $377M and a median Wall Street price target of $17.

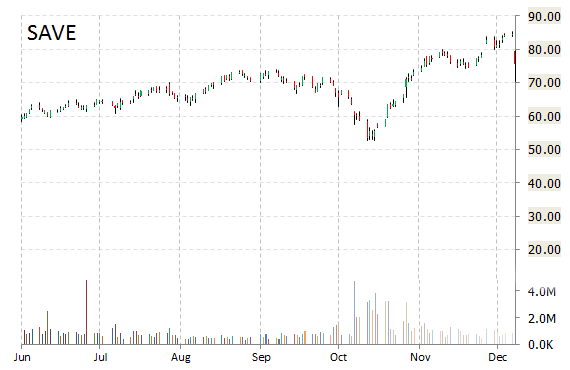

Spirit Airlines, Inc. (SAVE) fell around 11% to $75.28 in mid-day trading after the discount airline gave disappointing guidance last night, citing pricing pressure from competitors as oil prices have fallen. Following earnings report, analysts at Raymond James downgraded the name to ‘Market perform’ from ‘Outperform’ and removed their $85 price target. The equity research firm said it based its downgrade on added competition from Southwest airlines and others.

Spirit Airlines, Inc., currently valued at $5.48B, has a median Wall Street price target of $90.00 with a high target of $114.00. Approximately 4.97M shares have already changed hands, compared to the stock’s average daily volume of 1.26M.

In the past 52 weeks, shares of Miramar, Florida-based low fare airline have traded between a low of $42.25 and a high of $85.35 with the 50-day MA and 200-day MA located at $75.01 and $68.03 levels, respectively. Additionally, shares of SAVE trade at a P/E ratio of 0.75 and have a Relative Strength Index (RSI) and MACD indicator of 47.09 and +2.01, respectively.

SAVE currently prints a one year return of about 66% and a year-to-date return of around 65%.

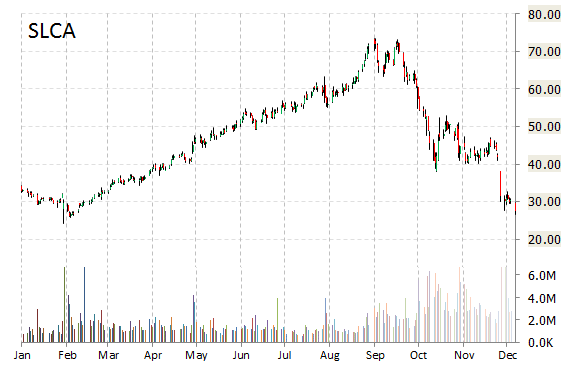

Investment analysts at Ladenburg Thalmann initiated coverage on shares of U.S. Silica Holdings, Inc. (SLCA) in a note issued to investors on Tuesday. The firm set a ‘Buy’ rating and a $67.00 price target on the stock. Ladenburg ’s price target would suggest a potential upside of more than 135% from the stock’s current price.

SLCA shares recently gained $0.77, or 2.82%, to $28.42. The pop may also be attributed to a recommendation from Ariel Investment’s John Rodgers on CNBC.

Shares of SLCA are down 20.69% year-over-year and have lost roughly 18.38% year-to-date. In the past 52 weeks, shares of Frederick, Maryland-based commercial silica producer have traded between a low of $24.28 and a high of $73.43.

U.S. Silica Holdings, Inc. closed Monday at $27.63. The name has a total market cap of $1.53B.

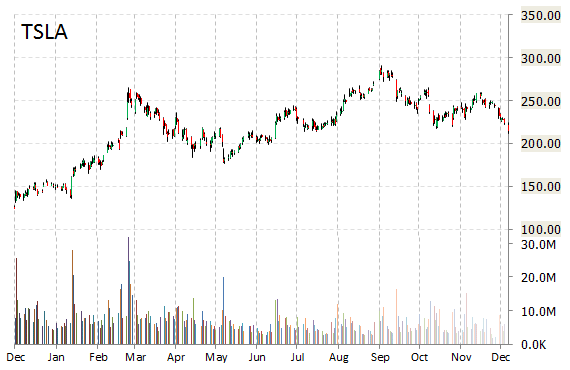

Tesla Motors (TSLA) stock plunge continued Tuesday after Orips Research’s Zev Spiro warned that the electric car maker is heading for $165. Reading the technical levels in Monday’s Nas trading, Spiro said [via Barron’s], “A negative signal developed yesterday as a high volume break occurred below the slightly upward slanted neckline of the topping pattern, in the $219.20 area. The break below the neckline signaled a trigger of the bearish pattern and indicated a downtrend with a minimum expected price objective in the $165 area. In addition, yesterday’s bearish trigger may result in downward momentum in the near term. Indicators are generally negative, adding to the overall bearish tone.”

Tesla traded recently at $211.65 a share, down $2.65.The stock currently prints a one year return of about 56.06% and a year-to-date return of around 42%.

Leave a Reply