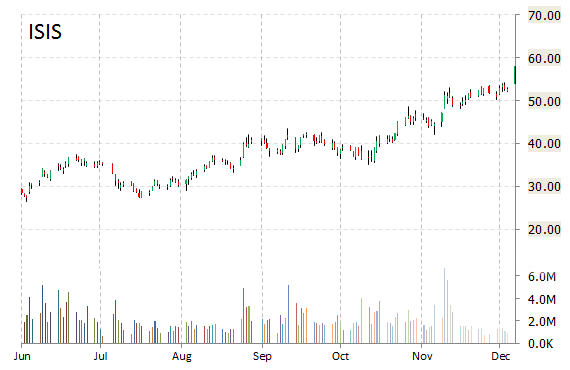

Analysts at Piper Jaffray lifted their price target on shares of Isis Pharmaceuticals, Inc. (ISIS) to $81 from $62 in a research report issued to clients on Monday. Isis’ shares closed at $52.76 Friday. The firm’s target price suggests a potential upside of about 7.26% from the company’s current price.

In other ISIS news this morning, the company reported positive phase 2 data for ISIS-FXI Rx for the prevention of Venous Thrombosis in patients undergoing total knee replacement surgery.

Isis Pharmaceuticals gained $4.77 to $57.53 in mid-day trading today. Approximately 1.80M shares have already changed hands, compared to the stock’s average daily volume of 2.21M shares.

On valuation-measures, shares of Isis Pharmaceuticals, Inc. have a P/E to growth ratio is -3.52, while t-12 profit margin is (54.98%). EPS registers at ($0.81). The company has a market cap of $6.80B and a median Wall Street price target of $57.50 with a high target of $70.00.

On trading-measure, ISIS has a beta of 1.63 and a short float of 12.75%. In the past 52 weeks, shares of Carlsbad, California-based company have traded between a low of $22.25 and a high of $62.66 with the 50-day MA and 200-day MA located at $47.92 and $38.00 levels, respectively.

ISIS currently prints a one year return of about 34.42% and a year-to-date return of around 32.43%.

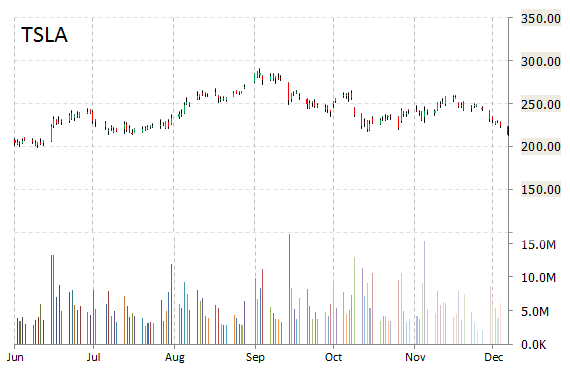

Tesla Motors, Inc. (TSLA) are trading down nearly 5% to $214.51 in Monday mid-day trading after InsideEVs reports November U.S. “Models S” sales came in flat year-over-year.

“If there was ever a month to be ignored for Model S sales, it would probably be November”, the publication said, adding Tesla delivered 1,200 “Model S” sedans during the month in the U.S.

Tesla Motors, currently valued at $26.98B, has a median Wall Street price target of $300.00 with a high target of $400.00. Approximately 6.3M shares have already changed hands, compared to the stock’s average daily volume of 6.03M.

In the past 12 months, shares of the electric car maker have traded between a low of $134.21 and a high of $291.42. Additionally, shares of TSLA trade at a P/E ratio of 4.54 and have a Relative Strength Index (RSI) and MACD indicator of 29.42 and -15.76, respectively. TSLA has come under pressure recently, as lower oil prices have hurt sentiment. The name is currently trading near a 2 & 5 month low.

TSLA currently prints a one year return of about 59.25% and a year-to-date return of around 48.71%.

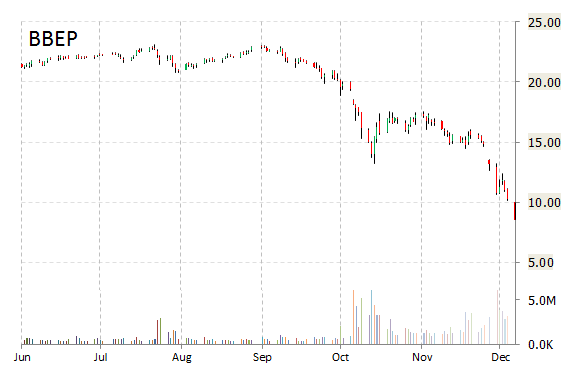

Breitburn Energy Partners L.P. (BBEP) shares are falling sharply, down more 16% to $8.62 on Monday, after analysts at Wells Fargo (WFC) downgraded the stock to ‘Market perform’ from ‘Outperform.’ The move comes on a big volume too with the issue currently trading more than 5 million shares, which dwarfs the average volume of 1.75 million.

Breitburn Energy is a Los Angeles, Calif.-based independent oil and gas company. Its stock has a median consensus analyst price target of $20.50 with a high target of $25.00, and a 52-week trading range of $11.22 to $23.15.

The T-12 profit margin at Breitburn Energy Partners is (4.97%). BBEP‘s revenue for the same period is $857.08 million.

Breitburn Energy Partners L.P. has market cap of $1.20 billion.

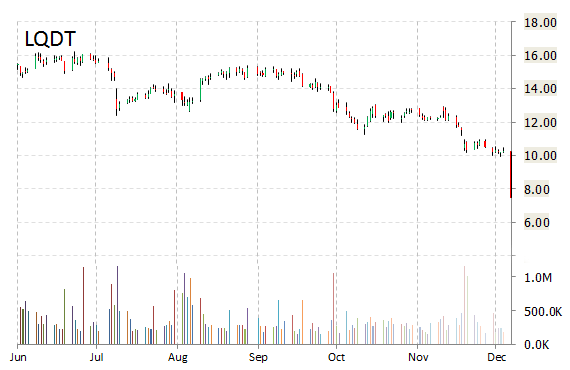

Liquidity Services, Inc. (LQDT) stock is getting crushed, down 26%, shaving $2.76 off its stock price after the company disclosed in a regulatory filing that Wal-Mart (WMT) had terminated a deal to provide it with merchandise. Wal-Mart accounted for 11% of Liquidity Services’ gross merchandise volume in fiscal 2014, according to Janney Capital.

Following the news, Robert W. Baird’s Colin Sebastian predicted [via TheStreet] that the loss of the contract would have a significant impact on Liquidity Services’ results starting in 2015. However, he believes that the extent of the impact on the company’s EBITDA will depend on its ability to manage its expenses. Sebastian cut his price target on the name to $9 from $12 and kept a ‘Neutral’ rating on the shares.

Liquidity Services, Inc. lost $2.71 to $7.55 in mid-day trading today. Approximately 1.4M shares have already changed hands, which dwarfs the average volume of 337.734K.

On valuation-measures, shares of Liquidity Services, Inc. have a trailing-12 and forward P/E of 7.78 and 9.00, respectively. P/E to growth ratio is -1.84, while t-12 profit margin is 6.13%. EPS registers at $0.97. The company has a market cap of $225.93M and a median Wall Street price target of $12.00 with a high target of $12.00.

LQDT currently prints a one year loss of about 55% and a year-to-date loss of around 54.72%.

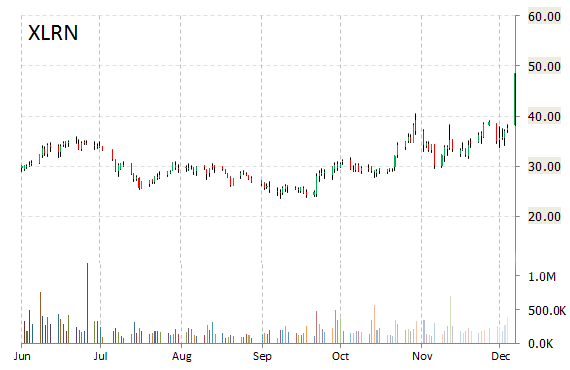

Acceleron Pharma (XLRN) is seeing a big move Monday, as the company’s shares surged by over 21% on the day on news of positive preliminary data from the firm’s luspatercept phase 2 clinical trial.

“These results in beta-thalassemia are extremely exciting,” Professor Antonio Piga, a principal investigator of the study said in a statement. “A therapy that could potentially treat both the anemia and complications of beta-thalassemia, such as iron overload, is unprecedented in this disease and could potentially benefit most patients, regardless of the genetic background.”

XLRN shares recently gained $7.47 to $45.04. The stock is up more than 55.79% year-over-year and has lost roughly 5.15% year-to-date. In the past 52 weeks, shares of Cambridge, Massachusetts-based company have traded between a low of $23.61 and a high of $57.89.

Acceleron Pharma, Inc. has a total market cap of $1.45B.

Leave a Reply