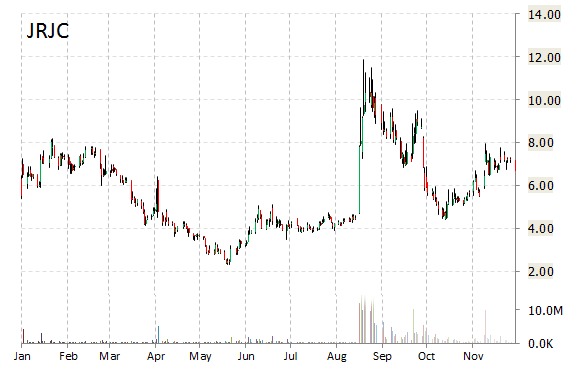

Shares of China Finance Online (JRJC) gained more than 3% to $6.92 in mid-day trading Tuesday. Strength being attributed to a blog reporting the company is building relationships with three security firms to provide fast and updated Hong Kong stock market information services through JRJC’s online product, Zhengquantong.

On valuation measures, China Finance Online shares have a t-12 price/sales ratio of 1.75 and a price/book for the same period of 2.46. EPS is ($0.40). The Beijing-based company has a market cap of $151.15 million and a median Wall Street price target of $8.30.

Fundamentally, JRJC shows the following financial data:

· $20.39 million in cash

· $133.4 million total current assets

· $83.42 million t-12 total revenue

· ($8.10) million quarterly net income

Shares of China-based integrated financial information and services provider are up 66.25% year-over-year and 6.52% year-to-date.

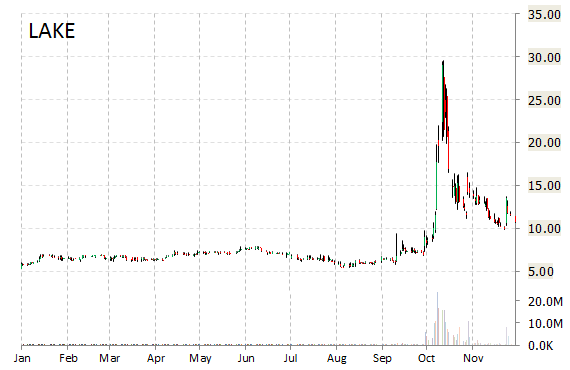

Lakeland Industries Inc. (LAKE), one of beneficiaries of the Ebola outbreak, is up 9.24% to $11.71 in mid-day trading Tuesday following a Reuters report that president Obama will press Congress to approve $6.18 billion in emergency funding to help fight the Ebola epidmic in West Africa and prepare U.S. hospitals to handle future cases.

The publication notes that the package also includes $1.5 billion in contingency funds – money that could become a target if lawmakers decide to trim the bill.

Shares of Lakeland have a consensus analyst price target of $7.35 and a 52-week trading range of $4.75 to $29.55. Shares are up 98.33% year-over-year and 103.61% year-to-date.

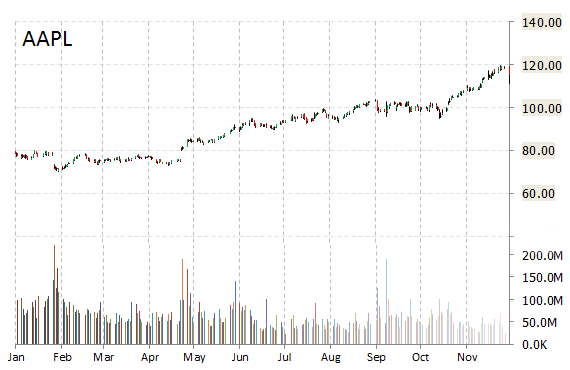

Apple Inc. (AAPL) – Pacific Crest issued a cautious note on the tech giant on Tuesday recommending clients reduce their exposure to AAPL.

“While sales of Apple’s iPhones look to be strong in the current quarter, the company’s stock appears to already reflect that strength”, Pacific Crest analyst Andy Hargreaves wrote in a note to investors this morning. “Although near-term results are likely to be solid, we expect growth to slow substantially in the second half of 2015, which is likely to pressure trading multiples and prevent meaningful stock appreciation from current levels,” the analyst stated. According to Hargreaves, most of the demand for the new iPhones is being driven by current iPhone users, rather than consumers who were using devices from other companies. This trend will likely reduce iPhone demand in future quarters, the analyst warned.

Meanwhile, Deutsche Bank (DB)’s Yasuo Nakane slashed his Q1 iPhone production estimates on Tuesday to a range of 35 million to 38 million units from 49 million, according to reports.

Not all analysts are sold on a slowdown.

Canaccord Genuity analyst Michael Walkley on Tuesday increased his 12-month base case estimate on Apple to $135 from $120 and reiterated its ‘Buy’ rating, saying the company is benefiting from “very strong demand” for both the iPhone 6 and iPhone 6 Plus. Also upbeat on Apple was BofA’s (BAC) Wamsi Mohan who increased his estimates for FY’15 iPhone shipments by 5 million, citing stronger than expected demand for the new iPhones and improved availability of the devices. The analyst also kept a ‘Buy’ rating on the name.

Apple Inc., currently valued at $675.63B, has a median Wall Street price target of $120.00 with a high target of $150.00. Approximately 41.86M shares have already changed hands, compared to the stock’s average daily volume of 59.25M.

In the past 52 weeks, shares of Cupertino, Calif.-based tech giant have traded between a low of $70.51 and a high of $119.75 with the 50-day MA and 200-day MA located at $108.77 and $99.26 levels, respectively. Additionally, shares of AAPL trade at a P/E ratio of 1.30 and have a Relative Strength Index (RSI) and MACD indicator of 60.94 and +0.69, respectively.

Apple shares are currently changing hands at $115.18, up 11 cents. The stock prints a one year return of about 47.90% and a year-to-date return of around 46.60%.

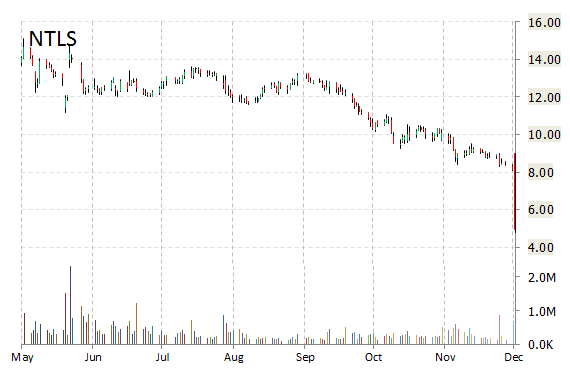

Shares of Ntelos Holdings Corp. (NTLS) are down nearly 40% in Tuesday afternoon trading following the company’s announcement of several strategic initiatives to refocus on its Western Markets. Ntelos said it will wind down retail operations in eastern markets over 12 month period and sell all associated wireless spectrum.

“In an effort to strengthen our retail sales performance and leverage our strategic relationship with Sprint, we are right-sizing our business and redirecting our resources on our Western Markets, which provide us the greatest opportunity for sustained, profitable growth. At the same time, we are exiting markets that have become increasingly competitive and where we have been unable to achieve acceptable financial returns,” Michael A. Huber, Chairman of the Board of NTELOS Holdings Corp. said in a statement.

NTLS shares recently lost $3.23 to $4.89. The stock is down more than 58.72% year-over-year and has lost roughly 57.22% year-to-date. In the past 12 months, shares of Waynesboro, Virginia-based wireless firm have traded between a low of $4.80 and a high of $21.40.

Ntelos Holdings Corp. closed Monday at $8.12. The name has a total market cap of $104.39M.

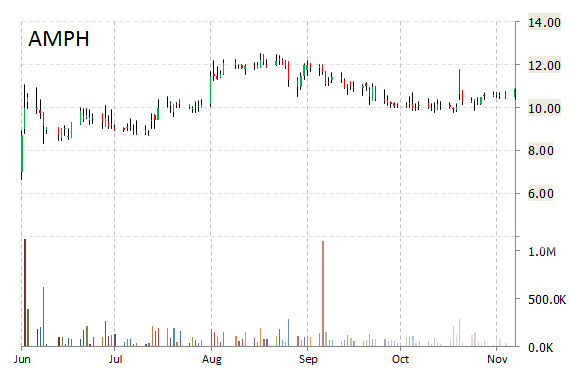

Shares of Amphastar Pharmaceuticals, Inc. (AMPH) are up 3% to $11.22. Strength being attributed to a $232 million dollar contract awarded to the company by the U.S. Government. Amphastar Pharmaceuticals has a t-12 revenue of $209.46M.

AMPH shares recently gained $0.37 to $11.25. The stock is up 28.57% year-to-date. In the past 52 weeks, shares of the Charlotte, North Carolina-company have traded between a low of $6.67 and a high of $12.52.

Amphastar Pharmaceuticals, Inc. has a total market cap of $502.29M.

Leave a Reply