Shares of Tesla Motors (TSLA) fell more than 3% to $250.90 in premarket trade Wednesday, after Morgan Stanley (MS) slashed its forecasts for Model X deliveries forecast to 5,000 units from 15,000 units. The firm said the reduction was made “to reflect reasonable execution risk and a slower ramp to ensure quality”. MS also cut its fiscal 2014 TSLA EPS estimate to $0.73 from $1.13, and its fiscal 2015 forecast to $2.45 from $4.39. Meanwhile, the investment bank, and Tesla’s ‘axe’, reiterated its ‘Overweight’ rating and $320 price target on the name, saying it would view any hiccups or delays in Model x deliveries “as an opportunity to increase exposure to what we believe is the most important manufacturer in global autos.”

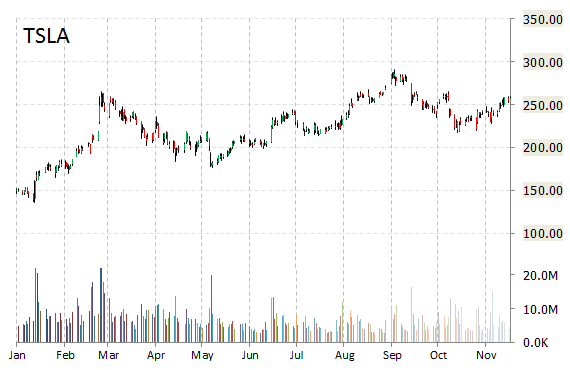

Tesla Motors, currently valued at $32.31B, has a median Wall Street price target of $300.00 with a high target of $400.00. In the past 52 weeks, shares of Palo Alto, California-based company have traded between a low of $116.10 and a high of $291.42 with the 50-day MA and 200-day MA located at $241.85 and $235.20 levels, respectively. Additionally, shares of TSLA trade at a P/E ratio of 5.23 and have a Relative Strength Index (RSI) and MACD indicator of 60.68 and +11.18, respectively.

TSLA currently prints a year-to-date return of around 71.31%, compared with an 11% gain in the S&P 500.

Leave a Reply