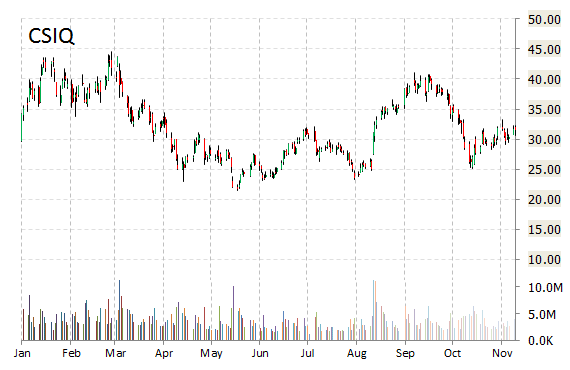

Canadian Solar Inc. (CSIQ) is up $2.34 to $33.81 in pre-market trading today after the West Guelph, Canada-based solar wafers developer said it earned $1.75 per share, on sales of $914 million in the third quarter of 2014. The earnings-per-share and revs beat Wall Street’s expectations, which had forecast $1.14 per share on sales of $803.24 million.

Gross margin was 22.9%, compared to 19.0%, in 2Q’14 and to 3Q guidance in the range of 19% to 21%. Solar module shipments were 770 MW, compared to 646 MW in 2Q’14 and 3Q guidance in the range of 720 MW to 750 MW.

Dr. Shawn Qu, Chairman and Chief Executive Officer of Canadian Solar, remarked: “Our results for the third quarter exceeded our expectations on all financial and operating metrics, led by the strength of our utility-scale solar energy business, combined with a robust performance from our module business, which continues to benefit from our Tier-1 brand, global scale, stable average selling price and broad-based growth in demand.”

On trading-measure, CSIQ has a beta of 3.36 and a short float of 9.26%. In the past 52 weeks, shares of Canadian Solar have traded between a low of $21.38 and a high of $44.50 with the 50-day MA and 200-day MA located at $31.57 and $29.97 levels, respectively. The company has a market cap of $1.72B and a median Wall Street price target of $45.00 with a high target of $56.00.

CSIQ currently prints a one year return of about 6.46%, and a year-to-date return of around 5.53%.

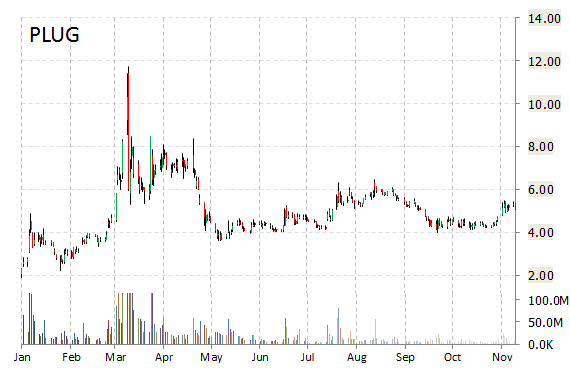

Shares of Plug Power Inc. (PLUG) plunged more than 15% to $4.28 in pre-market trading Wednesday after the maker of fuel-cell systems for forklifts reported third-quarter sales that fell short of analysts’ estimates.

While revs rose 332.6% year-over-year to $19.9 million from $4.6 million a year ago, it was less than the $24.4 million consensus. Plug Power had cash and cash equivalents of $156.5 million and net working capital of $177.6 million at September 30, 2014. This compares to $5.0 million and $11.1 million, respectively, at December 31, 2013.

Plug said its quarterly net loss shrank to $9.4 million, or $0.06 per share on a basic and diluted basis, from $15.9 million, or $0.19 per share y/y. Excluding one-time items, Plug’s loss was $0.01 more than estimates.

Plug Power is an alternative energy technology provider engaged in the commercialization of fuel cell systems for the industrial off-road markets worldwide. Its stock has a median consensus analyst price target of $8.00 and a 52-week trading range of $0.53 to $11.72. The T-12 operating margin at Plug Power is (84.35%). PLUG‘s revenue for the same period is $35.55 million.

Plug Power has market cap of $850.11.

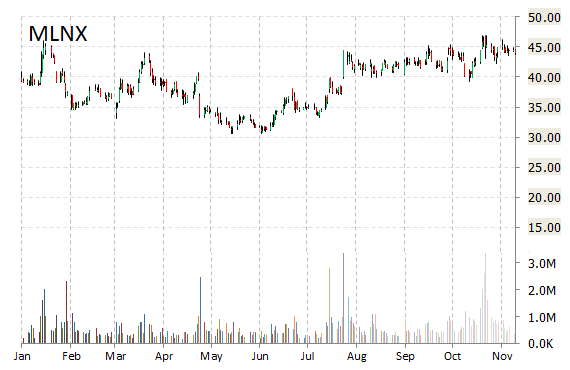

Mellanox Technologies, Ltd. (MLNX) shares are down 6.50% to $41.09 after the company files to delay Form 10-Q. The name, currently valued at $1.98B, has a median Wall Street price target of $53.50 with a high target of $60.00.

In the last 12 months, shares of Yokneam, Israel-based fabless semiconductor company have traded between a low of $30.58 and a high of $46.96 with the 50-day MA and 200-day MA located at $43.46 and $38.95 levels, respectively. Additionally, shares of MLNX trade at a P/E ratio of 1.13 and have a Relative Strength Index (RSI) and MACD indicator of 50.55 and -0.16, respectively.

MLNX currently prints a one year return of about 28.49%, and a year-to-date return of around 10.01%.

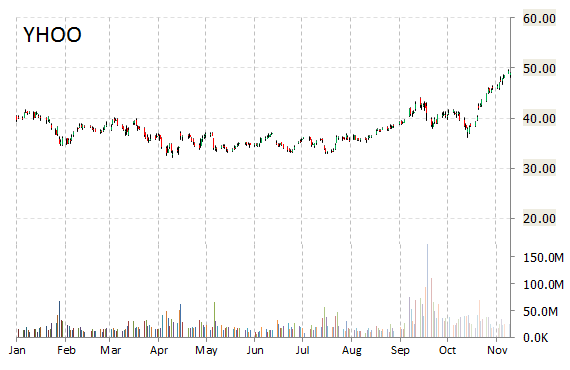

Yahoo! Inc. (YHOO) – The company said it will pay about $640 million in cash for automated ad platform BrightRoll. Separately, Reuters reports that at least two top-10 Yahoo shareholders are unhappy with CEO Marissa Mayer’s turnaround efforts and are appealing to AOL Inc (AOL) CEO Tim Armstrong to consider a merger and run the combined company.

Yahoo! Inc. is up $0.14 to $49.19 in pre-market trading today.

On valuation-measures, the web portal’s shares have a trailing-12 and forward P/E of 6.56 and 43.03, respectively. P/E to growth ratio is 5.02, while t-12 profit margin is 166.35%. EPS registers at $7.48. The company has a market cap of $46.47B and a median Wall Street price target of $49.00 with a high target of $63.00.

On trading-measure, YHOO has a beta of 0.87 and a short float of 5.60%. In the past 52 weeks, shares of the internet giant have traded between a low of $32.15 and a high of $49.63 with the 50-day MA and 200-day MA located at $42.44 and $37.83 levels, respectively.

YHOO currently prints a one year return of about 45.03%, and a year-to-date return of around 21.29%.

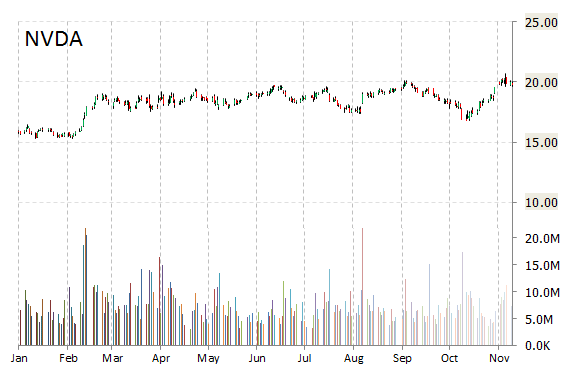

Nvidia Corporation (NVDA) – The chipmaker is being sued by Samsung for allegedly infringing several of its chip-related patents and for making false claims about its products. The South Korean firm said Nvidia was guilty of false advertising in claiming that its “Shield” tablet computer contains the world’s fastest mobile processor, the Tegra.

On valuation measures, Nvidia Corp. shares are currently priced at 21.66x this year’s forecasted earnings, compared to the industry’s 11.15x earnings multiple. Ticker has a PEG and forward P/E ratio of 2.25 and 17.05, respectively. Price/sales for the same period is 2.37 while EPS is $0.91. Currently there are 10 analysts that rate NVDA a ‘Buy’, while 19 rate it a ‘Hold’. 2 analysts rate it a ‘Sell’. NVDA has a median Wall Street price target of $21.00 with a high target of $26.00.

Nvidia Corporation shares have surged 28.44% over the past 52 weeks and 25.19% year-to-date.

Leave a Reply