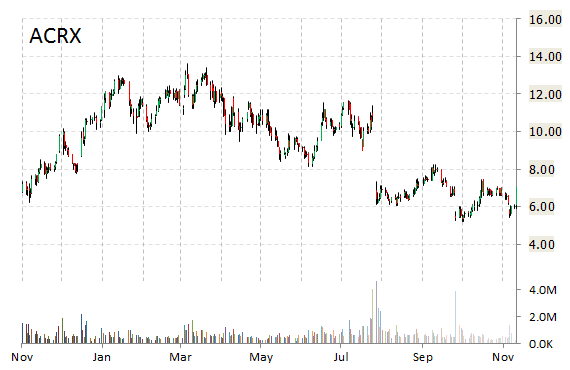

AcelRx Pharmaceuticals, Inc. (ACRX) has been a solid gainer in mid-day trading, up more than 12% to $6.77 from Monday’s close of $6.03. The gains have been aided by the company’s narrower net loss in its 3Q 2014 results, and positive Guggenheim comments. AcelRx posted a loss of $0.13 per diluted share, compared to an expected a loss of $0.22 per diluted share. Revenue came in at $4.8 million versus $548,000 in prior year. AcelRx also announced that it still plans to resubmit its New Drug Application for its experimental pain management treatment device Zalviso for FDA approval in the first quarter of 2015. However, the company notes that depending on feedback from the FDA, including their review of the materials submitted, the timing of the filing of the NDA could be later than the first quarter of 2015.

On valuation measures, AcelRx Pharmaceuticals, currently valued at $297.13M, has a median Wall Street price target of $12.00 with a high target of $15.00. Approximately 1.96M shares have already changed hands, compared to the stock’s average daily volume of 653.75K.

In the past 12 months, shares of the development stage specialty pharmaceutical firm have traded between a low of $5.22 and a high of $13.64 with the 50-day MA and 200-day MA located at $6.34 and $8.17 levels, respectively. Additionally, shares of ACRX have a Relative Strength Index (RSI) and MACD indicator of 53.10 and -0.26, respectively.

ACRX currently prints a one year loss of about 19%, and a year-to-date loss of around 47%.

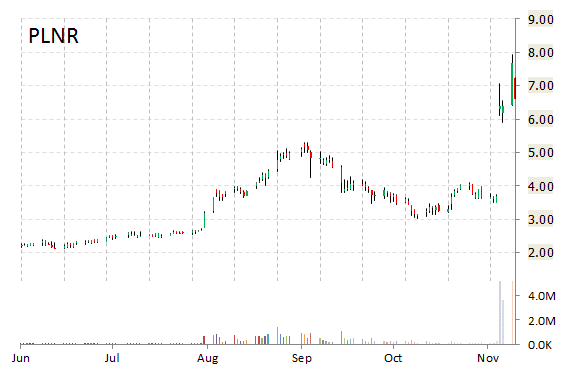

Shares of Planar Systems Inc. (PLNR) were downgraded to ‘Neutral’ from ‘Buy’ by Roth Capital on Tuesday. The firm also set its 12-month base case estimate to $7 implying 3% expected return. The firm believes shares have reached full valuation, in their view, and they have lowered their rating.

PLNR shares recently lost $0.85, or 12%, to $6.75. Approximately 3.11M shares have already changed hands, compared to the stock’s average daily volume of 784.19K.

In the last 12 months shares of Beaverton, Oregon-based company have traded between a low of $1.93 and a high of $7.51. Shares are down 13.80% year-over-year, and 44.15% year-to-date. The name has a median Wall Street price target of $6.50 with a high target of $7.00.

Planar Systems is currently valued at $150.40M.

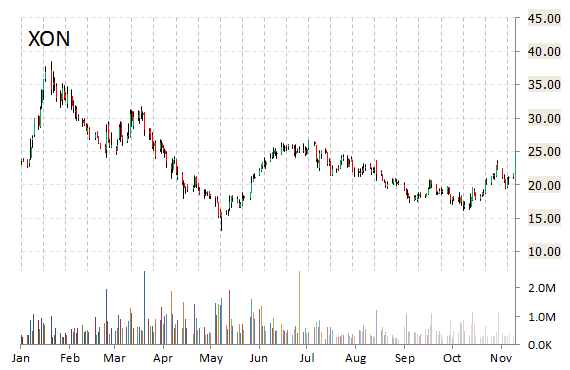

Intrexon Corporation (XON) shares are ticking higher following a positive mention by Herb Greenberg on CNBC.

Intrexon Corporation gained $1.54, or 7%, to $23.14 in mid-day trading today. Approximately 1.81M shares have already changed hands, compared to the stock’s average daily volume of 463.17K shares.

On trading-measure, XON has a beta of -13.18 and a massive short float of 72.36%. The company has a market cap of $2.33B and a median Wall Street price target of $30.00.

In the past 52 weeks, shares of the West Palm Beach, Florida-based company have traded between a low of $13.13 and a high of $38.50 with the 50-day MA and 200-day MA located at $19.32 and $20.83 levels, respectively.

XON currently prints a one year return of about 18.74%, and a year-to-date loss of around 2.24%.

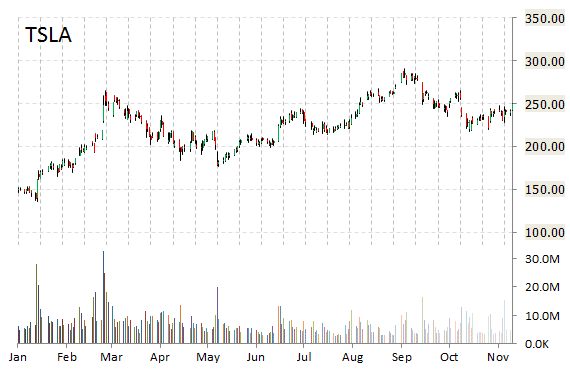

Tesla Motors, Inc. (TSLA) is higher by 3% intraday. Not seeing any news or rumors to account for the move.

Tesla is currently printing a lower than average trading volume with the issue trading 5.9M shares, compared to the average volume of 6.10M. The stock began trading this morning at $242.55 to trade up seven points as of 2:12 pm EST from the prior days close of $241.93. On an intraday basis it gotten as low as $242.00 and as high as $250.90.

TSLA’s current year and next year EPS growth estimates stand at -11.50% and 340.60% compared to the industry growth rates of 12.60% and -9.20%, respectively. The name has a t-12 price/sales ratio of 12.38. EPS for the same period registers at ($1.35).

Tesla shares have advanced 2.12% in the last 4 weeks and declined 6.94% in the past three months. Over the past 5 trading sessions the stock has lost 0.27%.

The Palo Alto, Calif.-based electric car maker, which is currently valued at $31.03B, has a median Wall Street price target of $300.00 with a high target of $400.00. TSLA is up 75.38% year-over-year, and 60.83% year-to-date.

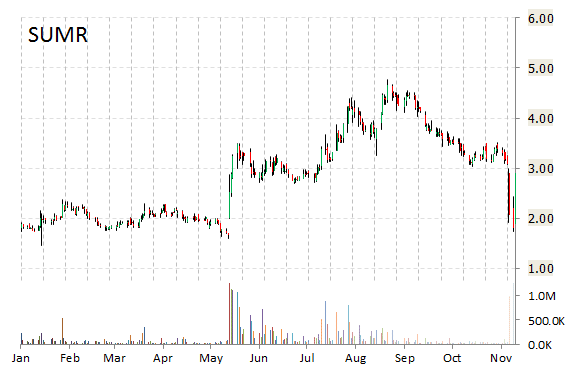

Summer Infant, Inc. (SUMR) shares are up 44% to $2.59 in mid-day trading. The move comes on a big volume too with the issue currently trading more than 1.3M shares, compared to the average volume of 111,303 shares. Not seeing any news or rumors to account for the move.

Summer Infant is a distributor of branded juvenile health, safety, and wellness products in North America and the UK. Its stock has a median consensus analyst price target of $5.00 with a high target of $6.00, and a 52-week trading range of $1.45 to $4.77.

The T-12 profit margin at Summer Infant is (1.23%). SUMR‘s revenue for the same period is $198.65 million.

Summer Infant has market cap of $45.23M.

Leave a Reply