Dendreon Corp. (DNDN), the maker of prostate-cancer drug Provenge, filed for Chapter 11 bankruptcy protection on Monday and said it has reached agreements on the terms of a financial restructuring with investors holding about 84% of the company’s $620 million of convertible notes.

The Seattle-based drugmaker also said the restructuring may involve a recapitalization, or a sale of the company or its assets.

“Whether the restructuring takes the form of a stand-alone recapitalization or a sale of the company or its assets, we are confident that this process will allow Provenge to remain commercially available to the patients and providers,” Thomas Amick, Dendreon’s CEO, said in a statement.

Dendreon said it has significant liquidity to support all of its operations during the restructuring process. It said it has about $100 million of cash, cash equivalents and investments on hand as of Friday.

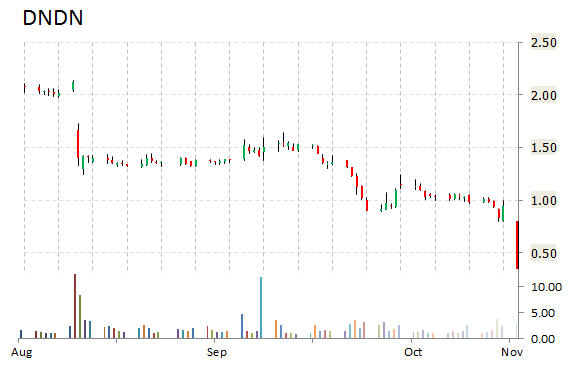

Shares of Dendreon, whose market value once topped $7B, nosedived 66% to 33 cents in pre-market trading today, giving the company a market cap of $151M.

Leave a Reply