AXT Inc. (AXTI) shares are up sharply on Friday, after the company reported another solid quarter. Following AXT Inc’s earnings, analysts at B. Riley upgraded the name to ‘Buy’ from ‘Neutral’, setting a 12-month base case estimate to $3.10. The firm’s price objective suggests a potential upside of 27% from the stock’s current pps. Separately, AXTI was also upgraded to ‘Outperform’ from ‘Market Perform’ at Northland.

AXT shares recently gained $0.26, or 11.93%, to $2.44. The stock is down more than 0.91% year-over-year and has lost roughly 16.48% year-to-date. In the past 52 weeks, shares of Fremont, California-based company have traded between a low of $2.04 and a high of $3.04.

AXT Inc., which closed Thursday at $2.18, has a total market cap of $79.05M.

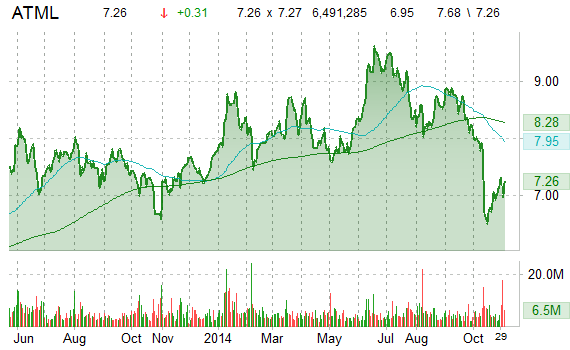

Analysts at FBR Capital upgraded their rating on the shares of Atmel Corporation (ATML) to ‘Outperform’ from ‘Market Perform’.

ATML shares recently gained $0.39 to $7.34. In the past 52 weeks, shares of San Jose, California-based firm have traded between a low of $6.32 and a high of $9.76. Shares are up 5.62% in the last 12 months ; down 11.24% year-to-date.

The chart below shows where the equity has traded over the last 52 weeks, with the 50-day and 200-day MAs included.

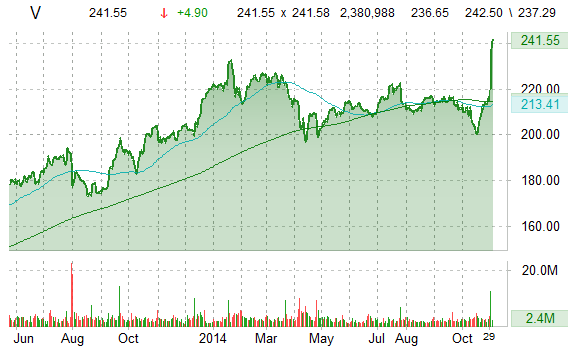

Visa Inc. (V) was raised to ‘Buy’ from ‘Hold’ and it was given a $260 price target at Argus on Friday. The stock began trading this morning at $237.85 to currently trade up $4.74, or 2%, from the prior days close of $236.65. On an intraday basis it gotten as low as $237.54 and as high as $241.59.

Visa shares are currently priced at 27.63x this year’s forecasted earnings, compared to the industry’s 14.74x earnings multiple. The company’s current year and next year EPS growth estimates are 18.40% and 15.60%, compared to the industry growth rates of 63.60% and 9.90%, respectively. V has a t-12 price/sales ratio of 11.71. EPS for the same period registers at $8.74.

Visa shares have advanced 12.69% in the last 4 weeks and 11.94% in the past three months. Over the past 5 trading sessions the stock has gained 10.44%.

The San Francisco, California-based payments company, which is currently valued at $151.73B, has a median Wall Street price target of $251.00 with a high target of $280.00. V is up 17.00% year-over-year, and up 6.87% this year.

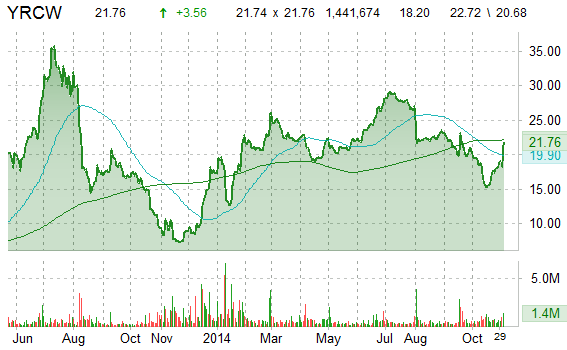

Analysts at Deutsche Bank (DB) upgraded their YRC Worldwide Inc. (YRCW) rating to ‘Buy’ from ‘Hold’ and set a price target of $24.00 per share in a research report issued to clients on Friday. DB said it believes Q3 marked the start of an LTL turnaround.

YRCW shares are up almost 19% to $21.64. On valuation measures, ticker has a forward P/E of 31.69 and t-12 price-to-sales ratio of 0.11. EPS for the same period is ($7.50).

YRC Worldwide currently prints a one year return of about 96%, and a year-to-date return of around 5%.In the past 52 weeks, shares of Overland Park, Kansas-based company have traded between a low of $7.06 and a high of $29.21.

Leave a Reply