Shares of Abiomed, Inc. (ABMD) are up $4.46, or 17.59%, at $29.81, in late trading, after the company today reported fiscal Q2 revenue and earnings that beat Wall Street’s expectations, and forecast full year revenue higher as well. Revenue in Q2 rose 17.2%, year-over-year, to $51.9 million versus $49.99 million forecasts, yielding EPS of $0.09 versus $0.02 Zacks Investment Research estimate. Abiomed said it expects FY15 revenue in the range of $209 million to $212 million versus $207.84 million estimate.

ABMD shares are currently priced at 168.36x this year’s forecasted earnings, which makes them expensive compared to the industry’s 9.14x earnings multiple. The company’s current year and next year EPS growth estimates are 33.30% and 300.00%, compared to the industry growth rates of 5.70% and 19.40%, respectively. ABMD has a t-12 price/sales ratio of 5.35. EPS for the same period registers at $0.18.

ABMD’s shares have advanced 2.09% in the last 4 weeks and declined 0.98% in the past three months. Over the past 5 trading sessions the stock has gained 7.23%.

The Danvers, Massachusetts-based maker of heart devices, which is currently valued at $1.19B, has a median Wall Street price target of $30.50 with a high target of $35.00. ABMD is up 16.55% year-over-year ; down 5.20% year-to-date.

Myos Corporation (MYOS) is a big mover this session with its shares spiking nearly 25% on the day. The move comes after the company today announced new statistically significant top-line clinical data demonstrating Fortetropin’s(TM) anti-inflammatory bioTherapeutic properties.

Earlier this year Myos reported positive data confirming that the use of Fortetropin significantly increases muscle size and lean body mass in recreationally-exercised male subjects. Further analysis of serum biomarkers from subjects in the clinical trial revealed that daily use of Fortetropin significantly decreases inflammatory cytokine levels which demonstrates Fortetropin’s promising anti-inflammatory biotherapeutic properties.

In the past 52 weeks, shares of Myos Corporation, which are currently valued at $36.36M, have traded between a low of $6.00 and a high of $16.85 with the 50-day MA and 200-day MA located at $12.84 and $13.23 levels, respectively. Additionally, shares of MYOS have a Relative Strength Index (RSI) and MACD indicator of 50.57 and -0.08, respectively.

MYOS currently prints a one year return of about 54.15%, and a year-to-date return of around 33.60%.

Changyou.com Limited (CYOU) spiked $3.35, or 18%, to $23.39 in mid-day trading today. Approximately 493,135 shares have already changed hands, compared to the stock’s average daily volume of 134,611 shares. We are not seeing any news or rumors to account for the move.

On valuation-measures, shares of Changyou.com have a trailing-12 and forward P/E of 12.64 and 16.10, respectively. P/E to growth ratio is 4.08, while t-12 profit margin is 13.34%. EPS registers at $1.85. The company has a market cap of $1.24B and a median Wall Street price target of $22.40 with a high target of $26.00.

On trading-measure, CYOU has a beta of 1.25 and a short float of 5.28%. In the past 52 weeks, shares of Beijing-based online games operator have traded between a low of $17.13 and a high of $34.32 with the 50-day MA and 200-day MA located at $21.49 and $24.51 levels, respectively.

CYOU currently prints a one year loss of about 30.73% and a year-to-date loss of around 37.47%.

TrovaGene, Inc. (TROV) shares are currently printing a large uptick, gaining 17% from the previous close. Trovagene, a developer of cell-free molecular diagnostics, will report Q3 financial results today at 4:00 p.m. ET.

TROV shares recently gained $0.72 to $5.11. The stock is down more than 32.87% year-over-year and has lost roughly 23.52% year-to-date. In the past 52 weeks, shares of San Diego, California-based company have traded between a low of $2.97 and a high of $7.10.

TrovaGene, Inc. closed Wednesday at $4.39. The name has a total market cap of $96.59M.

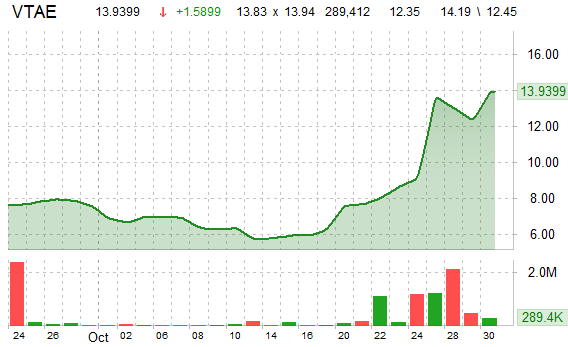

Vitae Pharmaceuticals, Inc. (VTAE) gained nearly 10% to $13.55 late trading today. Approximately 300K shares have changed hands, compared to the stock’s average daily volume of 395,027 shares. We are not seeing any news to account for the upside.

Vitae Pharmaceuticals is currently valued at $240M. The name has a median Wall Street price target of $14.50 with a high target of $21.00.

Leave a Reply