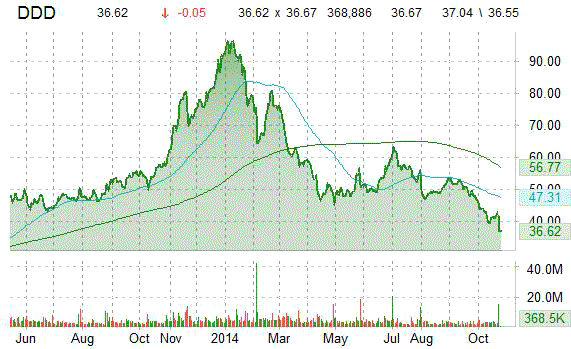

Shares of 3D Systems Corporation (DDD) were downgraded to an ‘Hold’ rating from ‘Buy’ by Brean Capital on Thursday. Separately, 3D Systems had its 12-month base case estimate lowered to $37 from $50 at Piper Jaffray.

3D Systems Corporation shares are currently priced at 106.29x this year’s forecasted earnings compared to the industry’s 10.07x earnings multiple. Ticker has a PEG and forward P/E ratio of 2.16 and 33.34, respectively. Price/Sales for the same period is 6.83 while EPS is 0.35. Currently there are 10 analysts that rate DDD a ‘Buy’, while 12 rate it a ‘Hold’. 1 analyst rates it a ‘Sell’. DDD has a median Wall Street price target of $54.00 with a high target of $84.00.

In the past 52 weeks, shares of Rock Hill, South Carolina-based company have traded between a low of $36.17 and a high of $97.28 and are now at $36.46. Shares are down 35.99% year-over-year and 60.54% year-to-date.

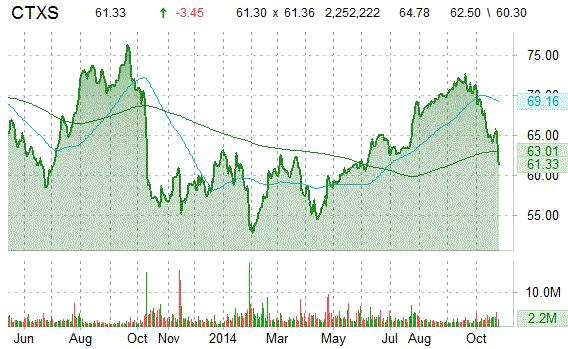

Analysts at Bank of America (BAC) downgraded Citrix Systems, Inc. (CTXS) to ‘Neutral’ from ‘Buy’.

The target price for Citrix is lowered to $70 from $78.

Citrix shares are down 79.74% year-over-year and 82.10% year-to-date. CYTX dropped 6.36% to $60.66 in pre-market trading.

The chart below shows where the equity has traded over the past 52-weeks, with the 50-day and 200-day moving averages includ

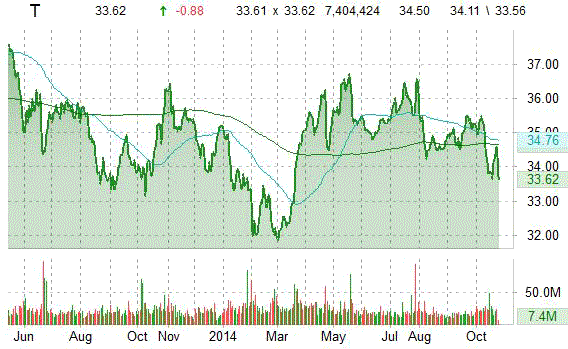

RBC Capital Markets reported on Thursday that they have lowered their price target to $35 from $36 for AT&T, Inc. (T).

Shares of AT&T have a 5.30% dividend yield, based on ticker’s previous closing price-per-share of $34.09. The name trades at 10.01x this year’s forecasted earnings compared to the industry’s 21.00x earnings multiple. Currently there are 8 analysts that rate T a ‘Buy’, while 18 rate it a ‘Hold’. 3 analysts rate it a ‘Sell’. T has a median Wall Street price target of $36.00 with a high target of $42.00.

Shares of AT&T fell 1.30% in recent trading.

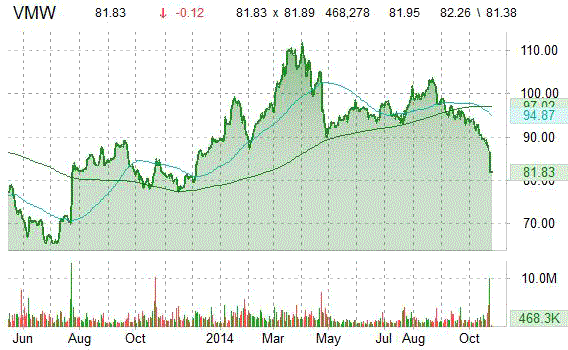

In a report published Thursday, Credit Agricole analysts downgraded their rating on VMware, Inc. (VMW) to ‘Outperform’.

VMware shares, which are currently priced at 37.04x this year’s forecasted earnings compared to the industry’s 8.41x earnings multiple, recently declined fractionally to $81.83. The stock is down more than 8% this year and has fallen roughly 4% over the past 12 months. VMware has a median Wall Street price target of $105.00 with a high target of $130.00.

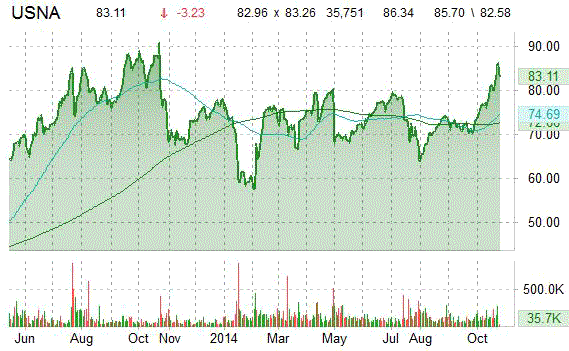

Usana Health Sciences Inc. (USNA), a manufacturer of science-based nutritional and personal care products, was downgraded by Sidoti analysts to ‘Neutral’ from a ‘Buy’ rating Thursday. Usana shares were down 3.39% at $83.41 in early trade, moving within a 52-week range of $55.01 to $88.71.

Leave a Reply