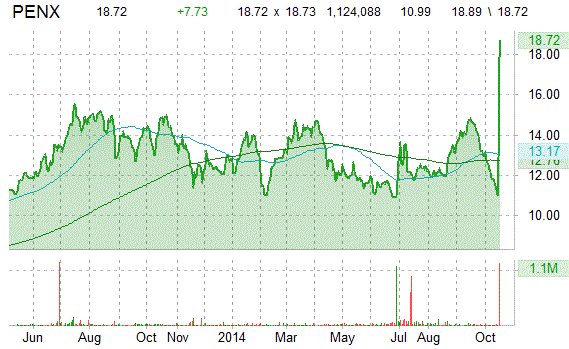

Shares of Penford Corporation (PENX) surged 70.88% to $18.78 this morning after Ingredion (INGR), a maker of high-fructose corn syrup, announced its plans to acquire Penford for about $340M, or $19.00/share in cash.

“After a thorough process and careful consideration, the Penford Board and management team believe this transaction will maximize value for Penford shareholders,” Paul Hatfield, Chairman of the Penford Board of Directors said in a statement.

SEACOR Holdings Inc., the owner of approximately 9.34% of Penford’s outstanding common stock, has indicated that it supports the transaction.

Penford Corporation gained $7.75 to $18.74 in mid-day trading today. Approximately 1,038,080 shares have already changed hands, compared to the stock’s average daily volume of 44,894 shares.

On valuation-measures, shares of Penford have a trailing-12 and forward P/E of 61.85 and 20.82, respectively. P/E to growth ratio is 5.34, while T-twelve profit margin is 0.85%. EPS registers at $0.30. The company has a market cap of $238.09M and a median Wall Street price target of $14.00 with a high target of $14.00.

On trading-measure, PENX has a beta of 0.69 and a short float of 0.58%. In the past 52 weeks, shares of Centennial, Colorado-based company have traded between a low of $10.71 and a high of $18.89 with the 50-day MA and 200-day MA located at $13.34 and $12.52 levels, respectively.

PENX currently prints a one year gain of about 26% and a year-to-date gain of around 45.76%.

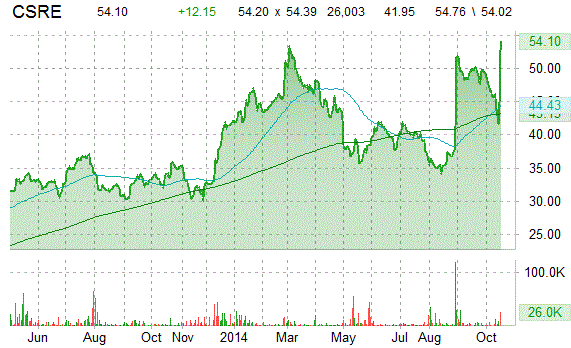

CSR plc (CSRE) shares are up almost 30% to $54.29 on Wednesday following Qualcomm (QCOM)’s announcement that it plans to acquire CSR for $2.5 billion. Under the terms of the agreement, Qualcomm has agreed to pay 900 pence a share in cash for the British Bluetooth specialist, a 56.5% premium on CSR’s pps before the start of the offer period in August.

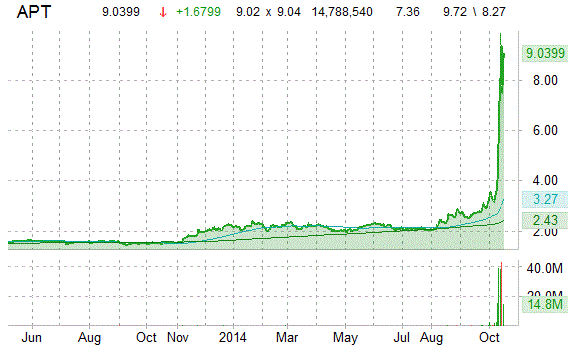

Alpha Pro Tech (APT) shares spiked 24% to $9.12 after tanking nearly 27% on Tuesday. Approximately 14,446,408 shares have already changed hands, compared to the stock’s average daily volume of 2,325,080 shares. APT’s today strength is attributed to Ebola concerns. The deadly virus has killed more than 4,400 people in West Africa since the start of the year. The Markham, Canada-based company manufactures and markets a line of disposable protective apparel and infection control products in the US and internationally.

Alpha Pro currently prints a one year return of about 503% and a year-to-date return of around 318.14%.

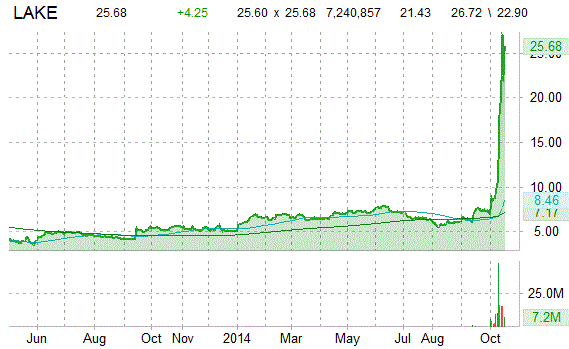

Lakeland Industries Inc. (LAKE) gained $4.25 to $25.68 in mid-day trading today. Ticker is currently printing a higher than average trading volume with the issue trading 7.3M shares, compared to the average volume of 2,417,160. The stock began trading this morning at $24.86 to currently trade up 20% from the prior days close of $21.43. On an intraday basis it has gotten as low as $22.92 and as high as $26.72.

In the past 52 weeks, shares of the manufacturer of safety garments for the industrial protective clothing market worldwide have traded between a low of $4.75 and a high of $29.55 with the 50-day MA and 200-day MA located at $9.00 and $7.36 levels, respectively.

LAKE currently prints a one year return of about 319.37% and a year-to-date return of around 307.41%.

The chart below shows where the equity has traded over the past 52-weeks, with the 50-day and 200-day moving averages included.

Leave a Reply