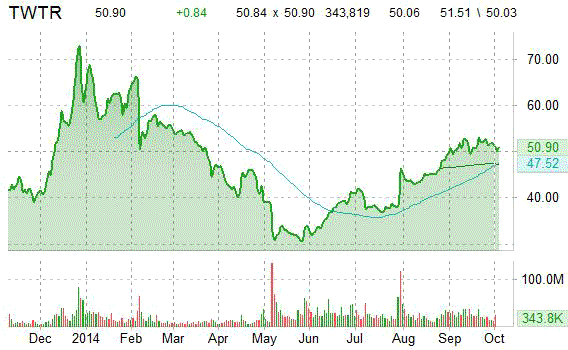

Twitter, Inc. (TWTR) was upgraded by JPMorgan (JPM) from a ‘Neutral’ rating to an ‘Overweight’ rating in a research note issued to clients on Thursday. The firm currently has a $64.00 price target on the stock, up from their previous price target of $54.00. JPMorgan said it has increased confidence in the blogging platform’s mobile monetization and it expects greater margin expansion as monetization improves. JPM’s price objective suggests a potential upside of 25% from the stock’s current price.

On valuation-measures, shares of Twitter have a PEG and forward P/E ratio of 4.58 and 135.30, respectively. Price/Sales for the same period is 32.13 while EPS is ($2.04). Currently there are 17 analysts that rate TWTR a ‘Buy’, 15 rate it a ‘Hold’. 1 analyst rates it a ‘Sell’. TWTR has a median Wall Street price target of $56.50 with a high target of $65.00.

In the past 52 weeks, shares of San Francisco, California-based company have traded between a low of $29.51 and a high of $74.73 and are now at $51.13. Shares are up 11.49% year-over-year ; down 21.35% year-to-date.

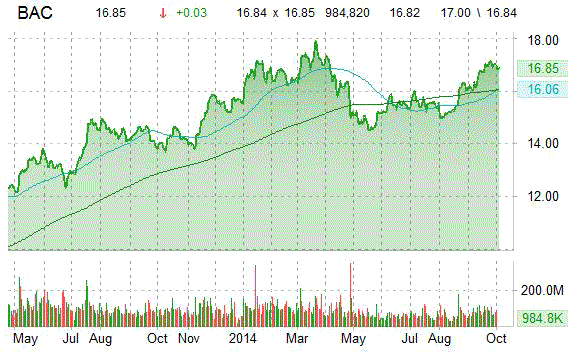

Bank of America Corporation (BAC) was raised to ‘Buy’ from ‘Neutral’ and it was given a $20 price target from $16.80 at UBS on Thursday. The firm said it believes BofA’s deposit profile will benefit from rising interest rates and that the bank will be under less pressure than peers to pass on rate increases to deposit holders.

Bank of America shares are currently priced at 26.36x this year’s forecasted earnings compared to the industry’s 15.82x earnings multiple. Ticker has a PEG and forward P/E ratio of 5.26 and 11.21, respectively. Price/Sales for the same period is 2.07 while EPS is $0.64. Currently there are 12 analysts that rate BAC a ‘Buy’, 14 rate it a ‘Hold’. 3 analysts rates it a ‘Sell’. BAC has a median Wall Street price target of $17.75 with a high target of $22.00.

In the past 52 weeks, shares of Charlotte, North Carolina-based company have traded between a low of $13.68 and a high of $18.03 and are now at $16.91. Shares are up 21.62% year-over-year and 8.52% year-to-date.

The chart below shows where the stock has traded over the last year, with the 50-day and 200-day moving averages included.

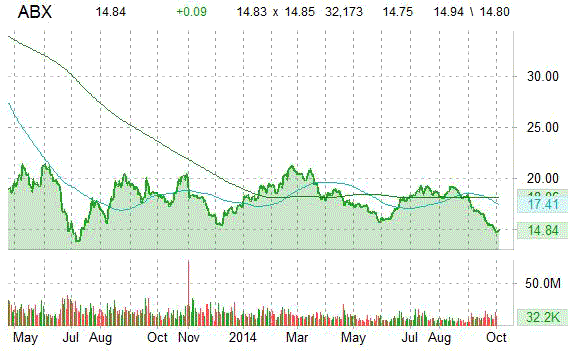

Barrick Gold Corporation (ABX) was raised to ‘Hold’ from ‘Sell’ with a $20 price target, versus a prior $14.75 close, at Canaccord on Thursday.

On valuation-measures, Barrick Gold Corporation has a PEG and forward P/E ratio of -0.61 and 13.17, respectively. Price/Sales for the same period is 1.57 while EPS is ($2.58). Currently there are 6 analysts that rate ABX a ‘Buy’, 22 rate it a ‘Hold’. 2 analysts rate it a ‘Sell’. ABX has a median Wall Street price target of $20.00 with a high target of $25.00.

In the past 52 weeks, shares of the Toronto, Canada-based gold and copper producer have traded between a low of $14.55 and a high of $21.45 and are now at $14.80. Shares are down 17.27% year-over-year and 15.62% year-to-date.

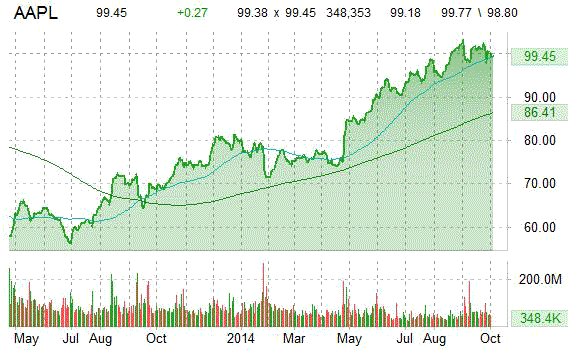

Citigroup (C) on Thursday raised its price target on Apple Inc. (AAPL) to $120 from $110. Citi’s new PT represents expected upside of 20.66% from the stock’s current price-per-share.

Apple Inc. shares are currently priced at 16.00x this year’s forecasted earnings compared to the industry’s 23.23x earnings multiple. Ticker has a PEG and forward P/E ratio of 1.29 and 13.70, respectively. Price/sales for the same period is 3.33 while EPS is $6.20. Currently there are 32 analysts that rate AAPL a ‘Buy’ and 10 that rate it a ‘Hold’. Two analysts rate it a ‘Sell’. AAPL has a median Wall Street price target of $110.00 with a high target of $135.00.

Apple shares are slightly higher in early trade and are up 23.88% on y/y basis, while the S&P 500 has gained 14.89%.

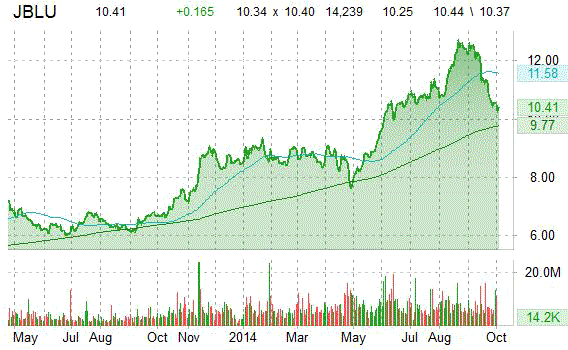

Raymond James is out with a report upgrading shares of JetBlue Airways Corporation (JBLU) with a ‘Market Perform’ from ‘Underperform’ rating in a research note to clients on Thursday. The firm lifts the rating based on valuation and leverage to lower fuel prices.

JBLU shares recently gained 0.26 to $10.50. The stock is up more than 52.53% year-over-year and has gained roughly 20.02% year-to-date. In the past 52 weeks, shares of the Charlotte, North Carolina-company have traded between a low of $6.57 and a high of $12.83.

JetBlue Airways Corporation, which closed Wednesday at $10.25, has a total market cap of $3.06B.

Leave a Reply