Shares of Yahoo! Inc. (YHOO) are up 0.85% at $42.44 as of 6:51 a.m. ET in anticipation of Alibaba Group’s (BABA) upcoming public offering which will take place on Friday. Also ahead of Alibaba’s IPO, the web portal was upgraded with an ‘Overweight’ rating and a $48 from $44 price target by analysts at Piper Jaffray.

In other Yahoo news ; Re/code reports the company is closing its Carlsbad, California office and laying off 59 San Diego-area employees.

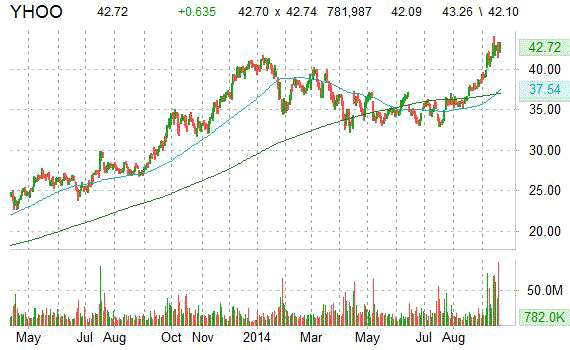

YHOO shares are up more than 43% year-over-year and 4.06% year-to-date. In the past 52 weeks, shares of Sunnyvale, California-based company have traded between a low of $30.02 and a high of $44.01.

Yahoo! closed Thursday at $42.08. It currently has a total market cap of $41.86B.

The chart below shows where the equity has traded over the last year, with the 50-day and 200-day moving averages included

Shares of Netflix (NFLX) are up 0.76% in pre-market trading Friday following the company’s official launches in France, Germany, Austria, Switzerland, Belgium And Luxembourg.

More than 63 million broadband households in these six European countries can now subscribe to Netflix and, for one low monthly price.

“We’ve received a very warm welcome throughout Europe,” Reed Hastings, Netflix co-founder and CEO said in a statement…”We are delighted people are embracing Netflix in our newest territories and, particularly, the incredible viewer enthusiasm for our original series.”

Netflix, Inc. shares are currently priced at 172.50x this year’s forecasted earnings compared to the industry’s 17.58x earnings multiple. Ticker has a PEG and forward P/E ratio of 3.73 and 69.44, respectively. Price/Sales for the same period is 5.58 while EPS is $2.66. Currently, NFLX has a median Wall Street price target of $500.00 with a high target of $600.00.

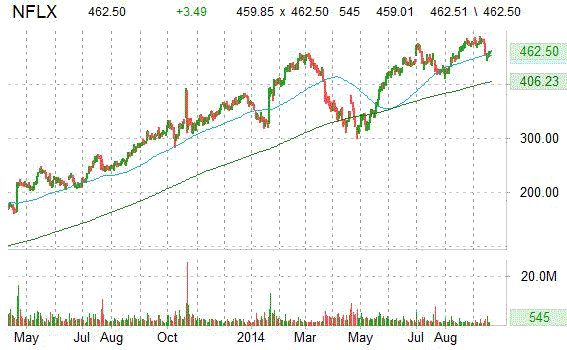

In the past 52 weeks, shares of Los Gatos, California-based company have traded between a low of $282.80 and a high of $489.29 and are now at $459.01. Shares are up 50.18% year-over-year and 25.07% year-to-date.

The chart below shows where the equity has traded over the last year, with the 50-day and 200-day moving averages included.

Bloomberg reports that Europe’s largest engineering company, Siemens AG (SIEGY), is preparing to offer at a Sept. 24 board meeting more than $6.5B, or at least $85 per share, for Dresser-Rand Group Inc (DRC), a US-based manufacturer of compressors and turbines for the oil and gas industry.

Dresser-Rand Group Inc. shares are currently priced at 36.90x this year’s forecasted earnings compared to the industry’s 15.15x earnings multiple. Ticker has a PEG and forward P/E ratio of 1.81 and 23.41, respectively. Price/Sales for the same period is 2.00 while EPS is $1.98. Currently, DRC has a median Wall Street price target of $67.00 with a high target of $100.00.

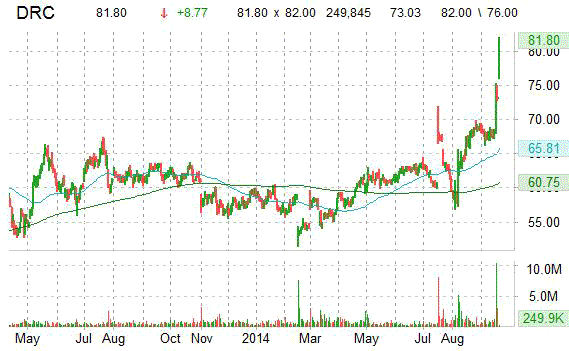

In the past 52 weeks, shares of Houston, Texas-based company have traded between a low of $51.46 and a high of $75.32 and are now at $73.03. Shares are up 15.96% year-over-year and 22.47% year-to-date.

The chart below shows where the equity has traded over the last year, with the 50-day and 200-day moving averages included.

Shares of U.S. expenses software maker Concur Technologies, Inc (CNQR) were downgraded to a ‘Sector Perform’ rating from ‘Outperform’ by RBC Capital Markets on Friday. The firm also cut its 12-month base case estimate to $129 from $130 following Germany’s SAP SE (SAP) offer for $129 a share, a 20% premium over the Sept. 17 closing pss and just short of the $130.39 record high Concur shares set in Jan.30.

Concur Technologies was also downgraded to ‘Neutral’ from ‘Outperform’, and to ‘Market Perform’ from ‘Outperform’ at Credit Suisse (CS) and William Blair, respectively.

Concur Tech shares are currently priced at 111.13x next year’s forecasted earnings compared to the industry’s 6.91x earnings multiple. Ticker has a PEG of 10.10. Price/Sales for the same period is 9.18 while EPS is ($1.51). Currently, CNQR has a median Wall Street price target of $115.00 with a high target of $130.00.

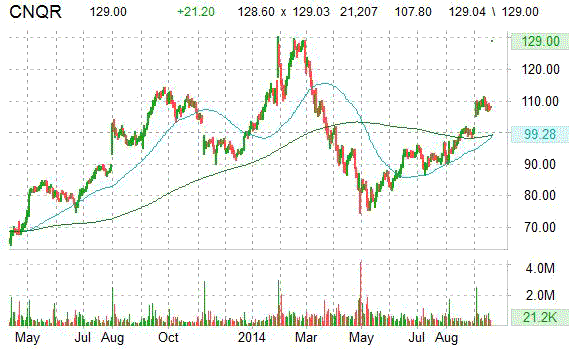

In the past 52 weeks, shares of Bellevue, Washington-based company have traded between a low of $74.43 and a high of $130.39 and are now at $107.80. Shares are up less than 1% year-over-year and 5.98% year-to-date.

The chart below shows where the equity has traded over the last year, with the 50-day and 200-day moving averages included.

Leave a Reply