Cleveland BioLabs, Inc. (CBLI) is one of today’s biggest movers, up almost 50%. The price spike came after the company announced positive results from a July meeting with the U.S. Food and Drug Administration [FDA] regarding a potential pre-Emergency Use Authorization submission for Entolimod for reducing the risk of death following exposure to potentially lethal irradiation occurring as the result of a radiation disaster.

Yakov Kogan, Ph.D, MBA, Chief Executive Officer of Cleveland BioLabs, said in a statement, “The outcome of our FDA meeting is very positive and we are pleased with the agreements we have reached with the agency. Our achievement of animal-to-human dose conversion and the FDA’s acknowledgement of the conceptual soundness of our dose-conversion methods are significant milestones in entolimod’s development under the FDA’s Animal Rule.”

CBLI was last printing the tape at $0.60 on a traded volume of 4,148,182 million shares, compared to the average volume of 188,900. Cleveland BioLabs has a total market capitalization of $33.69 million.

The chart below shows where the equity has traded over the last year, with the 50-day and 200-day moving averages included.

Infinity Pharmaceuticals (INFI) stock rose sharply today following a partnership with big pharma AbbVie Inc. (ABBV) for a joint venture on a cancer treatment. Under the terms of the agreement, Infinity will receive an upfront payment of $275 million and is eligible to receive up to $530 million in milestone payments if duvelisib, Infinity’s investigational blood cancer drug, passes successfully through development, regulatory and commercial approval.

At the time of this writing shares of Infinity are up 47% to $16.30. The stock is trading on heavy volume with more than 15 million shares changing hands, well ahead of its three month daily average of 510,102 shares. Infinity Pharmaceuticals has a total market capitalization of $541 million.

The chart below shows where the equity has traded over the last year, with the 50-day and 200-day moving averages included.

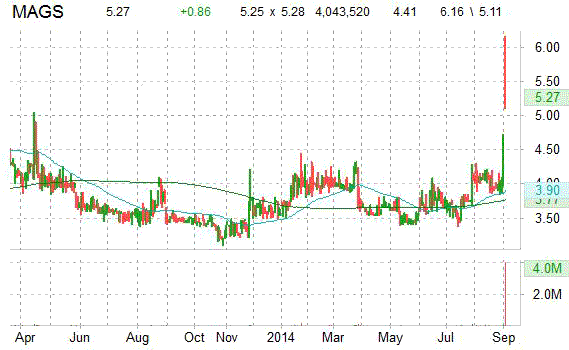

Magal Security Systems Ltd. (MAGS) is trading higher by almost 19% after announcing its new perimeter security surveillance robot called RoboGuard. The RoboGuard is a surveillance machine that can conduct regular inspections of a fence line to maintain the integrity of a perimeter, according to Magal Security Systems.

MAGS was gaining 21.32% to $5.35 Wednesday. The stock, which closed yesterday at $4.41 a share, jumped to an intraday high of $6.14 before settling back to its current price. The stock is trading on heavy volume with more than 4 million shares changing hands, well ahead of its three month daily average of 12,414 shares. MAGS has a market cap $85 million with a float of only 8.99M shares. Ticker’s short-interest stands at 23% of the float, so it could see significant price oscillations.

The chart below shows where the equity has traded over the last year, with the 50-day and 200-day moving averages included.

IRadimed Corporation (IRMD) is one of Wednesday’s notable stocks in decline, down 33% to $6.98. The nosedive came after the company announced that it received a warning letter from the the U.S. Food and Drug Administration relating to an inspection of the company’s facility that took place in April 2014.

IRadimed’s CEO Roger Susi stated, “We take the matters identified in the warning letter seriously and are in the process of evaluating what corrective actions and associated costs may be required to fully address the matters raised in the warning letter.”

More than 588.000 IRMD shares have changed hands, compared to the average volume of 50.279. IRadimed Corp, which has a total market capitalization of $76.53 million, is down more than 29% this year.

The chart below shows where the equity has traded over the last year.

Leave a Reply