Atmel Corporation (ATML) is trading at an unusually high volume Thursday with 16.3 million shares changing hands. It is currently at more than three times its 3-month average volume.

ATML dipped a couple of points in early trading after the company reported second-quarter earnings that came in line with Wall Street estimates. Non-GAAP EPS for Q2’14 registered at $0.09 per share, in-line with estimates of $0.09. Revenues rose 2.2% year-over-year to $355.5 million but missed the Street’s $356.36 million prediction. Following the company’s mix results, analysts at Oppenheimer lifted their price target on shares of Atmel Corp to $10 from $9 in a research report issued to clients on Thursday, noting among other things that the tech company has reduced its dependence on mobile handset-related MCU revenues and is benefiting from wider adoption of touch interface outside of mobile handsets.

Speaking from a valuation-measure perspective, shares of Atmel Corporation have a trailing-12 P/E of 122.77, a forward P/E of 12.81 and a P/E to growth ratio of 1.17. Price/sales for the t-12 period is at 2.60 while EPS is at $0.07. The company has a market cap of $3.36 billion and a median Wall Street price target of $9.63 with a high target of $11.00.

Profitability-wise, Atmel’s t-12 profit margin currently stands at 1.99% while operating ones are at 5.98%. The company reported $255 million in cash vs. $0 in debt in its most recent quarter. ATML is currently trading down 61 cents (-7.21%) at $7.98, printing a one year return of about 8% and a year-to-date return of around 1.34%.

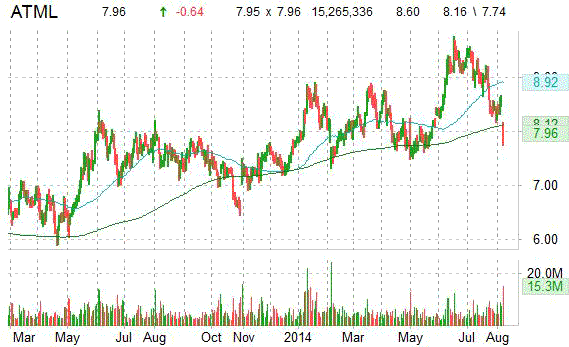

The chart below shows where the equity has traded over the last 52 weeks, with the 50-day and 200-day MAs included.

Atmel Corporation designs, develops, manufactures, and sells semiconductor integrated circuit (IC) products. The company was founded in 1984 and is headquartered in San Jose, California.

Leave a Reply