In a report issued to clients Tuesday, Wunderlich analysts upgraded the rating on Markwest Energy Partners LP (MWE) from ‘Hold’ to ‘Buy’, and raised the price target from $68.00 to $83.00.

Markwest has been the subject of a number of other recent research reports. Analysts at Citigroup (C) maintained their ‘Buy’ rating with a price target of $82.00 on MWE in a report released on Friday, July 25. Separately, analysts at Global Hunter downgraded Markwest Energy shares to an ‘Accumulate’ rating from a ‘Buy’ rating in a research note to clients on July 23. Finally, analysts at US Capital Advisors initiated coverage on MWE in a report released on July 22. The firm set a ‘Buy’ rating on the stock with an $87.00 price target.

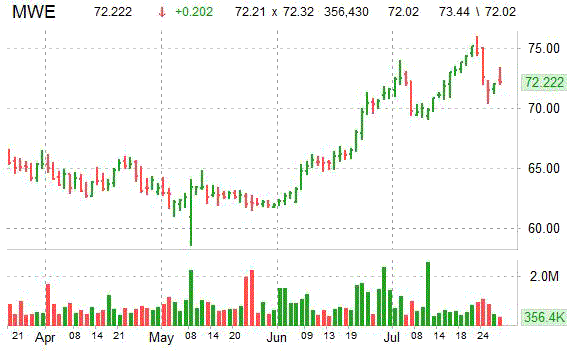

MarkWest Energy shares, which currently have an average 3-month trading volume of less than one million shares, trade at a trailing-12 P/E of 188, a forward P/E of 45.09 and a P/E to growth ratio of 12.40. The median Wall Street price target on the company’s stock is $72.00 with a high target of $87.00.

Profitability-wise, MWE’s t-12 profit margin currently stands at 3.60% while operating ones are at 12.04%. The $11.73 billion market cap company reported $123 million in cash vs. $3.4 billion in debt in its most recent quarter.

Shares of MarkWest Energy gained 0.24% to $72.19 in midday trading Tuesday. MWE is up 7.32% year-over-year, and 9.13% year-to-date.

MarkWest Energy Partners is engaged in the gathering, processing, and transportation of natural gas. The company was founded in 1988 and is headquartered in Denver, Colorado.

Leave a Reply